The Latest & Greatest

Although the next round of changes to accounting standards will not come into effect until 2018, alert financial analysts should already be asking companies about how they plan to address them, according to Canada’s top accountant. “Pay attention now, because companies do have the option to adopt” and some, such as Canadian banks, are adopting IFRS 9 early, said Linda Mezon, Chair of the Accounting Standards Board (AcSB). She was speaking at a webinar on January 21, 2016, to members of CFA Society Toronto and CPA Canada on the recent developments in accounting standards and emerging trends impacting financial statements. […]

“Feedback Difficult to Obtain”

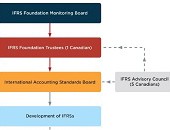

In the financial world, change is a constant. Regulators can barely keep up. Who decides what regulatory changes need to be made? And who can apply the brakes, if a certain type of change is having unintended consequences? Canada’s top accountant briefed the members of the CFA Society Toronto jointly with CPA Canada at a webinar on January 21, 2016. “Feedback is important but difficult to obtain,” said Linda Mezon, FCPA, FCA, who is the Chair of the Accounting Standards Board (AcSB). She summarized how Canadians and the AcSB influence the development of International Financial Reporting Standards. “The Accounting Standards […]

Risk Units & Risk Accounting

“In the absence of a standardized and universally accepted method of calculating exposure to risk, are accuracy, integrity and timeliness achievable?” asked Peter Hughes, Managing Director, Financial InterGroup (UK). He was the fourth of four panellists to present at the GARP webinar on risk data aggregation held July 22, 2014. Hughes was speaking with reference to the Basel Committee on Banking Supervision (BCBS) article 239, which spells out principles of accuracy, integrity, and timeliness for risk data. There’s a mixed bag of methods used to identify and quantify exposure to risk, Hughes noted. Quantitative modelling, accounting methods, key risk indicators, […]

Basel III and Beyond: Part 1. Optimization with On-Demand Risk Insights

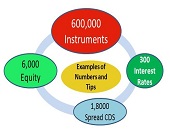

“The capital consumption of credit counterparty risk has become an issue for banks,” said Rita Gnutti, Head of Internal Model Market and Counterparty Risk at Intesa Sanpaolo. She was the first of two speakers addressing the impact of regulatory developments on counterparty risk assessment. She spoke to a webinar audience arranged by the Global Association of Risk Professionals on June 27, 2013. Gnutti first outlined the new Basel III regulatory framework of credit counterparty risk (CCR), then she described its calculation using internal model methodology (IMM), and third she described the computing and back-testing of CCR carried out by her […]

Basel III and Beyond: Capital Management and Funding Strategies

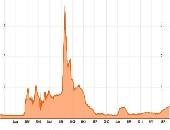

“Banking profitability will remain below pre-financial crisis levels for the near term,” said Mario Onorato, Senior Director, Balance Sheet and Capital Management at IBM and Visiting Professor at Cass Business School in London, UK. He was addressing a June 25, 2013 webinar organized by the Global Association of Risk Professionals (GARP) on the effects of Basel III. Banks have potential funding problems due to mismatched maturity periods, among other challenges. Onorato cited a Goldman Sachs report that forecasts a 1 percent decline year-over-year in revenue for banks in North America. There were comparable dismal reports by Citi and UBS about […]

Financial Shenanigans: Forensic Accounting in Practice

There are ample opportunities for financial shenanigans in North American companies, according to Howard Schilit, founder of Schilit Forensics LLC and author of the classic Financial Shenanigans: How to Detect Accounting Gimmicks & Fraud in Financial Reports, first published in 1993 and now in its third edition. He led a mid-day seminar on characteristics of poor accounting practices at the CFA Society Toronto downtown offices on May 30, 2013. “Financial shenanigans are not necessarily illegal,” explained Schilit, but they are practices that “are not nice to perpetrate on someone” and could, if unchecked, slip into criminality. Given the extensive subject […]

Al Rosen: Latest Trends in Financial Deception

“Canada is changing. There’s a return to yield games” and manipulation of operating cash flow, said Al Rosen on October 25, 2012. He was addressing about 40 people at a CFA Society Toronto luncheon seminar on the topic “Latest Trends in Financial Deception.” Rosen is co-founder of Accountability Research Corporation (ARC), the investment research arm of Rosen & Associates Limited, a forensic accounting firm, and co-author of Swindlers: Cons & Cheats and How To Protect Your Investments From Them published by Madison Commerce Press in 2010. Rosen does not like the loose guidelines of the International Financial Reporting Standards (IFRS) in Canada. He paraphrased it thus: […]

Impact of Basel III on Capital Instruments. Part 2: Football vs. Soccer

On August 16, 2012, speaking at a webinar hosted by the Global Association of Risk Professionals (GARP), three panellists gave a perspective on the changes Basel III would wreak on capital instruments. Click here for Part 1. The second speaker, April Frazer, Director of Client Solutions Group at Wells Fargo, gave an overview of the impact of the US Basel III proposal on market dynamics. Due to regulatory limitations that she is subject to as a member of a financial institution, her talk is not reported on here. Steve Sahara, Global Head of DCM Solutions and Hybrid Capital, Crédit Agricole […]

US Implementation of Basel III. Part 2: The GPS for the Journey

On July 24, 2012, Peter Went, VP Banking Risk Management Programs at GARP, summarized the changing landscape of Basel III from a US perspective. First he outlined the deadlines and proposed changes; Part 1 of this posting covers these for the standardized approach. Financial institutions adhering to the advanced approach, Went said, must follow the Basel III counterparty credit risk rules. In some cases, correlations between asset values must be increased. A distinction will be made between securitization and resecuritization. [Ed. Note: To this, we say, “high time.” See, for example, Hull & White’s award-winning article in Financial Analysts Journal, […]