Evolution of the OTC Swaps Markets. Part 2: Lessons Learned

The scramble to meet the Phase 1 deadline of new regulations on swaps “was a significant learning experience,” said Bis Chatterjee, Global Head of E-Trading, Credit Markets at Citi. He was the second speaker in a webinar panel organized by the Global Association of Risk Professionals (GARP) on May 14, 2013. The deadline that came into effect March 11, 2013 pertained to the Dodd-Frank Act governing over-the-counter (OTC) swaps. (Two more phases will follow; see Part 1 for details.) There were challenges first of all, Chatterjee said, in the self-identification of market participants in Phase 1. Second, even if you […]

Evolution of the OTC Swaps Markets. Part 1: “Futurization” of Swaps

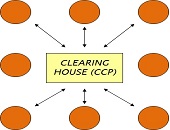

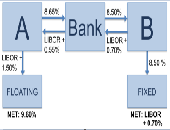

Recent reforms to the swaps market can be thought of as “the futurization of swaps,” said Nathan Jenner, COO Fixed Income E-Trading at Bloomberg. He was addressing a webinar audience on May 14, 2013 as the first speaker in a panel organized by the Global Association of Risk Professionals (GARP) on the evolution of the market for over-the-counter (OTC) swaps. Five years ago, “derivatives were perceived as a catalyst in precipitating” the financial crisis of 2007-08, said Jenner. For example, it wasn’t immediately apparent who were all the counterparties to the AIG swaps. Pricing was “murky,” he said, and risk […]

Stress Testing: Part 2. The Next Generation

There are five key considerations for the “next generation” of financial stress testing, said Tom Kimner, Head of Americas Risk Practice & Global Risk Products at SAS. He was addressing a webinar audience on May 7, 2013 as the second speaker in a panel organized by the Global Association of Risk Professionals (GARP). Modern stress testing must be measured against the key considerations of performance, efficiency, completeness, transparency, and compliance. The goal of turning stress testing into an “early warning system seemed futuristic only a few years ago,” admitted Kimner at the outset of his talk. He contrasted the world […]

Stress Testing: Part 1. Balance Numbers and Narrative

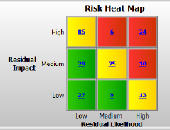

“Uncertainty is a fundamental part of business. Major shifts occur without warning, triggered by a single event, or combination of unrelated, contemporaneous events,” said Sanjiv Talwar, Managing Director, Risk Capital & Stress Testing at Bank of Montreal. He was addressing a webinar audience on May 7, 2013 as the first speaker in a panel organized by the Global Association of Risk Professionals (GARP). He summarized the categorization of uncertainty by Courtney et al. in “Strategy Under Uncertainty”, Harvard Business Review. There is a variety of tools available to help manage the uncertainty, Talwar noted: option evaluation, game theory, pattern recognition, […]

Measuring the ROI of GRC. Part 2: Solutions to “Absorb Regulatory Demands”

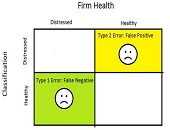

An unprecedented amount of new regulations “has led to risk assessment fatigue,” said John Kelly, Market Segment Manager in Business Analytics at IBM. He was the second of two speakers who addressed a GARP webinar audience on March 28, 2013 on the topic of the return on investment (ROI) on governance, risk assessment, and compliance (GRC). Most of the presentation referred to the study “Guidebook: Understanding the Financial Value of GRC Management” released in October 2012 by Nucleus Research that was talked about by Hyoun Park in the first part of the presentation. When it comes to regulation, there is […]

Measuring the ROI of GRC. Part 1: “Your Mileage May Vary”

When looking at the return on investment (ROI), “it’s not about getting the highest number—it’s what is most defensible,” said Hyoun Park, Principal Analyst at Nucleus Research. Park was speaking on March 28, 2013 to a webinar audience on the topic of how to quantitatively measure the ROI on governance, risk assessment, and compliance (GRC). The two-speaker panel, convened by the Global Association of Risk Professionals (GARP), based their remarks on a study released in October 2012 by Nucleus Research (cover shown here). The report states “this research was conducted in context of the usage of IBM OpenPages, a software […]

The Fed, Foreign Banks and Basel III: Part 3. Necessary Complexity?

As the US moves to adopt Basel III, there are regulatory initiatives that are expected to be implemented, said Peter Went, VP, Banking Risk Management Programs, GARP, on February 14, 2013. The Basel Committee has several proposals that are issued for consultation and discussion, including ones that affect liquidity rules, the securitization framework, trading book review, and consistency of risk-weighted assets. Went was the second speaker at a webinar organized by the Global Association of Risk Professionals (GARP) regarding regulatory reform of foreign banking operations (FBOs) in the United States and the implementation of the Basel III framework. (This continues […]

The Fed, Foreign Banks and Basel III: Part 2. Capital Concerns

“Some of the rules are in direct conflict,” said Peter Went, VP, Banking Risk Management Programs, GARP. He was the second speaker at a webinar presented on February 14, 2013 organized by the Global Association of Risk Professionals (GARP) regarding regulatory reform of foreign banking operations (FBOs) in the United States and the implementation of the Basel III framework. The “conflict” refers to rules in the Dodd-Frank Act versus the globally agreed Basel III Accord’s guidelines. Both regulatory attempts apply the G-20 principles on financial regulation (Pittsburgh 2009 summit). The US implementation of the Basel III framework differs from the […]

The Fed, Foreign Banks and Basel III: Part 1. A Long Hard Look

Foreign banking operations (FBOs) in the United States are about to face a whole new set of regulations that may dampen their enthusiasm for US-based operations, according to a February 14, 2013 webinar organized by the Global Association of Risk Professionals (GARP). “The Fed observed over time that US branches were increasingly used to fund the home office operations,” said Charles Horn, partner at Morrison Foerster, who was the first speaker at the panel. Other concerns of the Federal Reserve Board are the increased complexity of FBOs, and “the availability of home country financial resources for branch offices.” The goal, […]