Barcodes of Finance 1

After the holidays, Morty was bragging he’d been out to a new, very swanky seafood restaurant. “The maître d’ said they’re planning to bring in seafood barcodes.” I immediately pictured a slab of fish on Styrofoam with the price barcode sticker on it—straight from my local supermarket. “And this is at a high-end place?” I said skeptically. “Yeah, but it’s an identifier code, not a price sticker. It’s so the customer can verify they’re getting what they’re paying for,” he said. “Apparently there’s a big push to identify species, and make the information available.” Talking about fish barcodes reminded me […]

Wanted: Business Expertise

Artificial intelligence can be expensive and tricky to implement. Is it worth the trouble? Two organizations recently decided to pose the question to those who were working in financial institutions. “Due to budget constraints, a company might not always be able to apply artificial intelligence. But, to those who can, the benefits have become clear,” said Mahdi Amri, Partner and National AI Services Leader, Canada at Omnia, which is the artificial intelligence practice at Deloitte. On January 24, 2019, Amri was the second of two panellists who discussed early results of a joint survey by SAS and the Global Association […]

Operationalizing A.I.

How pervasive is the use of artificial intelligence in the field of financial risk management? What are the key challenges in AI implementation over the next two to three years? These issues were examined in early 2019 via the webinar, Operationalizing AI and Risk in Banking, sponsored by the Global Association of Risk Professionals (GARP). “We found exceptionally high rates of AI usage among survey respondents,” said Katherine Taylor, Senior Data Scientist at the software company SAS. On January 24, 2019, Taylor was the first of two panellists who presented a “sneak peek” at a joint survey by SAS and […]

Not Just the Modelling

The estimation and reporting of credit impairment at banks has led to a brand-new set of guidelines around the current expected credit loss (CECL). What’s a beleaguered banker to do? “For an effective CECL transition, preparation is key,” said Samrah Kazmi, Advisory Industry Consultant for Risk Solutions at SAS. She was the third and final speaker at a webinar titled “CECL: Managing Through the Implementation Headwinds” sponsored by the Global Association of Risk Professionals (GARP) on September 12, 2018. “Most banks think CECL is just about the modelling,” she said, “but it’s also data, systems, and processes.” Begin by identifying the stakeholders, she advised, […]

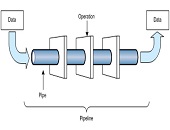

The Data Pipeline

The new guidelines on credit impairment at U.S. banks regulate the estimation and reporting of the current expected credit loss (CECL). But what are they really about? “CECL is all about setting up a data pipeline,” said Krish Ray, CECL Implementation Lead at SAS. He was the second of three speakers at a webinar panel titled “CECL: Managing Through the Implementation Headwinds” sponsored by the Global Association of Risk Professionals (GARP) on September 12, 2018. Ray categorized the key challenges of CECL implementation as: models, data, business, governance, and sustainability. Smaller banks might lack modelling expertise and “may have to turn to vendor models.” […]

CECL Headwinds

The time for banks to implement the new guidelines on credit impairment is at hand. How prepared is your team? A summary of issues around the current expected credit loss (CECL) can be found in the webinar titled “CECL: Managing Through the Implementation Headwinds” sponsored by the Global Association of Risk Professionals (GARP) on September 12, 2018. “The life of loan loss expectation is a big factor in CECL,” said Michael Gullette, senior vice-president, Tax and Accounting, at the American Bankers Association. He was the first of three speakers at the GARP webinar. Loan loss expectation (LOL) includes loan prepayments and troubled debt restructuring […]

Origins of Canadian Banking

The financial crisis of 2007-2008 triggered a worldwide recession. The American and European banking systems experienced massive losses, takeovers, and taxpayer-funded bailouts. Lehman Brothers, Northern Rock, European debt crisis, … and the after-effects are still being felt. Canada’s banking system did have some shaky moments, as a recently published analysis of its asset-backed commercial paper (ABCP) predicament showed. On the whole, however, Canada’s banks withstood the financial crisis relatively well and the financial system maintained its liquidity, solvency, and profitability. The history of the divergence in the Canadian and American banking systems is recounted in a new book. From […]

Myths of CECL

The time for proper accounting of credit impairment is running out. How prepared is your team? Do you even know what the biggest concern of the auditors will be? This was the call to action voiced by Tom Caragher, Senior Product Manager of Risk and Performance at Fiserv, a US provider of financial services technology on October 26, 2017. He spoke about implementation of current expected credit losses (CECL) at a webinar sponsored by the Global Association of Risk Professionals. (Note that CECL is the impairment standard under Financial Accounting Standards Board (FASB).) “When it comes to CECL, there are many […]

A Moving Target

When it comes to changing the Dodd-Frank Act (DFA), the new Trump administration “may find repeal and replace is not really a good strategy,” said Tim McTaggart, partner at Stinson Leonard Street, LLP. He was the second of two presenters during the webinar on planned changes to the Dodd-Frank Act, April 27, 2017, timed to coincide with the 100th day since Donald Trump became U.S. president. The webinar was sponsored by the Global Association of Risk Professionals. The changes could involve a reconfiguration or readjustment of the regulatory process, coupled with “some really interesting personnel appointments,” McTaggart said. It’s a […]

The First 100 Days

In the first 100 days of the Trump presidency, has financial risk increased, decreased, or stayed the same? “One of the key platforms of the Trump administration was a promise to dismantle the Dodd-Frank Act,” said Candice Nonas, managing consultant at Resources Global Professionals. “What will be the impact of repeal on consumer protection?” She was one of two presenters during the one-hour webinar sponsored by the Global Association of Risk Professionals on April 27, 2017, which is the 100th day since Donald Trump became U.S. president. Nonas noted that the Dodd-Frank Act is actually an amalgam of several pieces […]