Machine learning sniffs out corruption

“Bribery and corruption are by-products of risk culture,” said Aparna Gupta, Associate Professor at Lally School of Management at Rensselaer Polytechnic Institute. “We can take a step back and devise methods to detect it using textual data and machine learning.” Gupta was the second of two speakers at the one-hour webinar “Corruption and Corporate Governance” sponsored by the Global Association of Risk Professionals (GARP) on October 30, 2019. Since culture is intangible, empirical work on the relation between risk culture and risk management is limited. Traditional approaches for assessing risk culture have many drawbacks such as bias and lack of comparability. Nonetheless, […]

Earthquakes kill, and so does bribery

“Bribery and corruption are not victimless crimes,” said Hilary Rosenberg, Managing Director and Global Head of Anti-Bribery & Corruption at Standard Chartered Bank. To drive home the point, she showed a brief video in which the pile of rubble from an earthquake is compared to a house collapsing because corruption allowed an unsafe building to be approved. Furthermore, corruption “can hinder economic progress and destroy people’s trust in their government,” Rosenberg said. She was the first of two speakers at the one-hour webinar “Corruption and Corporate Governance” sponsored by the Global Association of Risk Professionals (GARP) on October 30, 2019. Anti-corruption policy […]

Finding a New Balance

How can monetary policy achieve price stability and full employment objectives in the midst of a changing economic environment? Lately, the US Federal Reserve Bank (FRB) has been thinking hard about new ways to control inflation, given the new economic headwinds. “Persistently low inflation presents a new problem for monetary policymakers,” said Mary C. Daly, president and CEO of the Federal Reserve Bank of San Francisco (FRBSF). On August 29, 2019, she gave a speech to a conference of economists and policymakers in Wellington, NZ. This was a significant venue, because inflation targeting was pioneered in New Zealand in 1990, […]

Shadow Banking in China

Shadow banking has enjoyed extraordinary growth over the past decade, especially in the emerging markets of China. The implications were discussed in the webinar “Shadow Banking: Standing at the Precipice?” sponsored by the Global Association of Risk Professionals (GARP) on August 6, 2019. Cindy Li, a Greater China analyst of the Federal Reserve Bank of San Francisco, was the second of two speakers at the one-hour GARP webinar. She said the shadow banking system in China has evolved to a fairly large group of powerful competitors, but that has led to “a build-up of risk” as China’s economic growth slows down. First, […]

Standing at the Precipice?

What is shadow banking, and are the associated risks being properly mitigated? A summary of issues can be found in the webinar “Shadow Banking: Standing at the Precipice?” sponsored by the Global Association of Risk Professionals (GARP) on August 6, 2019. Fabio Natalucci, Deputy Director, Monetary and Capital Markets Department of the International Monetary Fund (IMF), was the first of two speakers at the one-hour webinar. He began by explaining that the shadow banking system prefers to be thought of in “less sinister” terms as “non-bank financial intermediaries” that provide services similar to, but outside of, the regular banking system. He described […]

Winds of Change

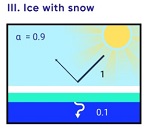

“Will the greater intensity of climate change expected in Canada produce a greater impact on Canadian financial institutions, and firms that hold a greater proportion of exposure to Canada in its portfolio?” This was the question posed by Robert Thomas, risk consultant to the non-profit organization Ontario Conservation Now as part of a round table held at the Toronto Public Library on April 18, 2019. A report[1] tabled earlier this month by Environment Canada says that climate change will have a greater effect on Canada than on most countries. The report, Canada’s Changing Climate Report 2019 (CCCR2019), looked at observed […]

Barcodes of Finance 4

7. Will blockchain technology affect the drive toward barcodes? It most definitely should—and in a positive way. The maintenance of a distributed database of identifiers, both for participants and products traded throughout the global financial supply chain is the easiest global blockchain infrastructure application to be developed. A global database of all the world’s participant and product identifiers, maybe a half billion records, is limited in scale, both as to data recorded in its distributed ledger and in its limits of processing speed—seconds required, at the most. Both parameters of speed and scale are well within the boundaries of current […]

Barcodes of Finance 3

5. Great, the G20 set up the Financial Stability Board to set things straight. So, what’s the problem? It was thought by all that “regulatory compulsion” at such a global level, overseen by the world’s most prominent collection of leaders of the largest economies, would finally solve the collective action problem that stymied the industry from doing this on their own. Industry members could not justify stepping aside from each firm’s own self-interest in maintaining the status quo. It would be costly to re-engineer legacy systems built in convoluted increments over the previous six decades. Everyone without exception wanted to […]

Barcodes of Finance 2

3. What allowed non-standard transaction date to persist and what was your response? I had spent my whole career in various sectors of finance and as an advisor to many financial institutions as a consulting Partner with PwC, responsible for the Financial Services sector. I saw the same sets of transaction data described differently in each firm, even though they would need to match perfectly between firms in order to confirm the transaction with the counterparty and either receive payment or pay for it. This disorder was managed by delaying the payment until all the details were reconciled, first by […]

Barcodes of Finance 1

After the holidays, Morty was bragging he’d been out to a new, very swanky seafood restaurant. “The maître d’ said they’re planning to bring in seafood barcodes.” I immediately pictured a slab of fish on Styrofoam with the price barcode sticker on it—straight from my local supermarket. “And this is at a high-end place?” I said skeptically. “Yeah, but it’s an identifier code, not a price sticker. It’s so the customer can verify they’re getting what they’re paying for,” he said. “Apparently there’s a big push to identify species, and make the information available.” Talking about fish barcodes reminded me […]