China: Global Leader, Threat, or Both? Part 1. China and US

“Hide one’s brilliance, bide one’s time” seems the most fitting aphorism for China’s global strategy, said Daniel Wagner, CEO of Country Risk Solutions. During an hour-long webinar on October 22, 2013 organized by the Global Association of Risk Professionals, Wagner guided the audience through China’s evolving geopolitical position generally, as well as its relationships with US, Asia, and Africa. China is in the ascendant mode, said Wagner, citing the increasing use of the yuan as a reserve currency, as well as its rising military power. Regaining global dominance would be “like picking up where they left off,” he said, reminding […]

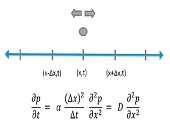

Quant Chalkboard: Data, Models & Concepts

“People are more likely to believe something that comes as data,” said Joe Pimbley, Principal, Maxwell Consulting, “but you shouldn’t necessarily believe the data.” Pimbley, a lead investigator for the examiner appointed by the Lehman Brothers bankruptcy court, addressed financial risk management professionals at a GARP webinar on August 6, 2013. [Ed. Note Click here to read Joe Pimbley – “Why Lehman Brothers Failed When It Did” on Stories.Finance.] Pimbley said that model builders must always look at data with the eyes of a skeptic. With a PhD in physics he is conversant with models devised to predict the “real world” and […]

The State of the Credit Markets: Part 2. Global Trends

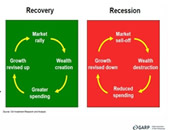

“Political uncertainty creates a bimodal distribution of risk, which is very difficult for the markets to price,” said Seth Rooder, Global Credit Derivatives Product Manager for Bloomberg, and the second of two speakers at the Global Association of Risk Professionals (GARP) webinar on November 15, 2012. (Click here to view Part 1.) Rooder was referring to the first of five main themes in global risk trends, as he sees them. They are: (1) Economic and political uncertainty (2) Slowing global growth (3) Central Bank (CB) intervention (4) Continuing low yields (5) Increased regulation Ever since the financial crisis of 2008, […]

Global Outlook for Crude Oil: FUD = Fear, Uncertainty, Doubt

In July 2008, Brent crude oil prices reached $148 per barrel “and we saw a lot of pushback from the market but nowadays when I mention $150, there is no pushback,” said Christian O’Neill, senior analyst at Bloomberg Industries during a GARP webinar October 11, 2012. He proceeded to walk the audience through the key factors affecting current supply and demand of this vital commodity. O’Neill’s presentation showed that oil leveraged energy and petroleum (E&P) stocks have strongly outperformed the S&P 500 in the period since March 2009. “Energy has been the beta sector of the market,” said O’Neill, because […]

Implications of the Euro Zone Crisis

When it comes to financial debt in the Euro Zone, “deleveraging has barely begun,” said Daniel Wagner, author and risk consultant. “It’s a long and winding road.” On August 7, 2012, Daniel Wagner, CEO of Country Risk Solutions, a US-based cross-border risk management consulting firm, addressed a Global Association of Risk Professionals (GARP) audience about the Eurozone crisis. Wagner, author of Political Risk Insurance Guide, and Managing Country Risk, published in 2012, spoke on a range of related topics. Wagner’s talk was far-ranging and comprehensive (78 slides in 45 minutes). He spoke about the impact of debt: in particular, the effect […]