Pain of Payment for … the First Date

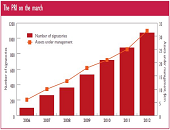

This concludes the interview with Professor Avni Shah regarding consumer behaviour and the connection we feel to the stuff we buy. And, possibly, to the people we buy it for. Click here to read the first half of the interview. Q: Did you look at other aspects of the connection? I said, let’s see how long this effect persists. I got data for the years 2004 to 2013 from an alumni association. What I was interested in is how alums make donations: by cheque versus card. Cheque feels more painful because you have to write out that amount. I wondered […]

Pain of Payment for … Coffee

“Me? Why do I have to pay for the falafels? I barely have two dollars to rub together,” said Morty. Tuesday is the two-for-one special at our local take-out Mediterranean shop. “Take it from me—you’ll enjoy them more!” I said, tapping the article I had just been reading in the New York Times. In a nutshell, it reported on new research in the Journal of Consumer Research that said having some difficulty in payment increased the consumer’s connection with the item purchased. He grabbed the section to read while we wolfed down our falafels. “You’ve gotta interview these people,” he […]

“Well Worth The Trouble”

How well positioned are you for the job market in a softening economic environment? Possessing the chartered financial analyst designation, known as the CFA charter, sends a strong signal to potential employers, said Chris Polson, President of the CFA Society Toronto, which is part of the global CFA Institute. He was speaking at the webinar “Capital Markets Compensation Trends” on August 11, 2015, sponsored by CFA Society Toronto. The goals of the webinar were twofold: to recap the value underlying the charterholder designation, and whether this was reflected in the remuneration of Canadian charterholders, as shown by the results of […]

8 Things About a Winning Team

“Our firm is kind of like a teaching hospital,” said Kim Shannon, President, Founder and CIO of Sionna Investment Managers. The second part of her presentation to the CFA Society Toronto at the National Club on March 5, 2014, described what she looks for in her employees, and how the team works. Below are eight insights on selecting and retaining top talent. Grow their own – Shannon noticed early on that the most successful investment firms grew their own talent, namely, they hired junior employees and trained them over a period of years for senior positions. Greed is not good – […]

The Value Proposition

“I believe financial statements are as much marketing documents as statements of fact,” said Kim Shannon, President, Founder and Chief Investment Officer of Sionna Investment Managers. She was addressing a crowd of analysts and financial managers at a breakfast meeting organized by the CFA Society Toronto on March 5, 2014, in the historic National Club. The first part of Shannon’s presentation tied in directly with her new book, The Value Proposition. Shannon wrote 80 pages of the first draft, and then stopped while she established the company and guided it through the next decade (which included the 2008 financial crisis). Years […]

Spotting Signs of Poor Corporate Governance. Part 2: ESG Management

Corporate governance is only one part of an overall phenomenon known as “ESG management,” or how a company handles environmental, social, and corporate governance (ESG) issues. “Research shows that companies that disclose more ESG information are more likely to enjoy a lower cost of capital,” said Max Zehrt, Senior Manager at Sustainalytics. He was addressing a noon-hour seminar of financial analysts and portfolio managers on the subject of corporate governance on May 8, 2013 at the offices of the CFA Society Toronto. His talk was the second part of a two-speaker panel moderated by Toby Heaps of Corporate Knights. Zehrt was […]

Spotting Signs of Poor Corporate Governance. Part 1: “Ask the Tough Questions”

“Good governance practices are important for the sound financial growth of a corporation—the board directs and protects,” said Stephen Kibsey, VP Equity Risk Management at Caisse de dépôt et placement du Québec. On May 8, 2013 he addressed a noon-hour seminar of financial analysts and portfolio managers through remote link on the subject of corporate governance at the offices of the CFA Society Toronto. His talk was the first part of a two-speaker panel moderated by Toby Heaps, co-founder and president of Corporate Knights. Kibsey pointed out that concern over matters like environment, social and governance (ESG) issues within a […]

Executive Compensation: Insights for Investors

If you pick the right people and give them the opportunity to spread their wings and put compensation as a carrier behind it you almost don’t have to manage them. – Jack Welch Catherine McCall and Damian Yu, both principals at Hugessen Consulting , provided a lively overview of issues in executive compensation to an afternoon audience at the CFA Society Toronto offices on August 20, 2012. The duo first outlined the current governance and market environment of compensation, then gave helpful pointers for deciphering management information, and concluded with “hot topics” in the area. Executive compensation deserves the attention […]

Reality vs Expectations: What Risk Managers Can Learn from the NFL

Arriving a little late at the CFA Society Toronto luncheon on June 4, 2012 at the National Club on Bay Street, I had a lucky choice of seat at the “hodge podge” table near the back. My two nearest neighbours at the table had driven from Simcoe to Toronto that morning (a minimum two-hour trip) for the express purpose of meeting the featured speaker, Roger Martin, Dean of Rotman School of Management. One said he had not only read and enjoyed Martin’s latest book, Fixing the Game: Bubbles, Crashes, and What Capitalism Can Learn from the NFL, he had also […]