Commercial Credit Analytics 2: A Missed Opportunity

Many banks are wasting the loans data they capture, according to David O’Connell, Senior Analyst, Aite Group, a financial services consulting group. This posting summarizes the second half of his webinar organized by the Global Association of Risk Professionals on February 20, 2014. O’Connell contrasted marketing teams with underwriting teams. Marketing teams use predictive analytics to decide which customers are most likely to respond to certain campaigns. They are very forward-thinking in devising the “customer next best action,” he said. O’Connell encouraged the credit and underwriting teams to have a similar outlook—to also make use of predictive analytics to determine “borrower […]

Commercial Credit Analytics 1: Under-utilized Tools

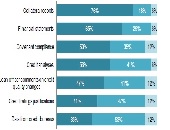

“There is a surprising under-utilization of common tools,” said David O’Connell, Senior Analyst, Aite Group, a financial services consulting group, during a webinar organized by the Global Association of Risk Professionals on February 20, 2014. He was referring to a survey by Aite Group of about twenty North American commercial loan underwriting professionals (responses as at quarter end Q3 2012). O’Connell characterized the under-utilization as “surprising” because loan underwriting is such an important part of banking. O’Connell was formerly a loan underwriting and loans officer, and was clearly familiar with the details of commercial lending and its role in “Banking […]

Eye on Credit Markets. Part 2: Spreads Hit Floor

“The central bank stimulus has been significant—what will happen as it’s withdrawn?” asked Seth Rooder, Global Credit Derivatives Product Manager at Bloomberg. He was the second of two speakers to consider the effects of tapering in a GARP webinar presentation on November 21, 2013. A key question is: “when will the Fed taper?” Rooder said not soon, because with unemployment still above 6.5 percent, Vice-Chair of the Fed Janet Yellen will have unwillingness to taper. Currently, the Fed is pumping money into the system by buying $40 billion in mortgage-backed securities and $45 billion in Treasury bills per month. He […]

Eye on Credit Markets. Part 1: Little Beta, Lots of Alpha

“How will the credit markets perform if the Federal Reserve Board chooses to taper over the next year or so?” asked Sivan Mahadevan, Head of U.S. Credit Strategy and Global Credit Derivatives Strategy at Morgan Stanley. He posed this question to members of the Global Association of Risk Professionals on November 21, 2013. Here, “tapering” refers to a gradual lessening of asset purchases. As the first of two speakers in a webinar presentation, Mahadevan summarized the credit markets to date: “little beta, lots of alpha.” Investment grade assets have had a good rally this year. “The higher yields go, the […]

Credit Workflow Optimization: A Practical Approach

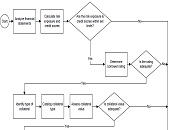

“How can an institution practically approach credit workflow when it might not be streamlined? How can we optimize existing processes?” These questions were posed by Justin Huhn, Credit Assessment & Origination Practice Leader at Moody’s Analytics Enterprise during a webinar arranged by the Global Association of Risk Professionals on September 24, 2013. Huhn noted that, as of Q1 2013, there were over seven thousand insured commercial banks and savings institutions in the US excluding foreign branches. These financial institutions tend to develop silos of expertise. Workflow optimization is of pressing concern to many. In 2008 the American Bankers Association estimated […]

Risk Data Aggregation & Risk Reporting. Part 2

“Not everything that can be counted counts,” said Mike Donovan, VP, Strategic Risk Analytics & Credit Portfolio Management at Canadian Imperial Bank of Commerce (CIBC). He was the second speaker to address the September 19, 2013 evening meeting of the Toronto chapter of GARP regarding the set of Principles for Effective Risk Data Aggregation & Risk Reporting released by the Basel Committee in January 2013. CIBC, like other Canadian banks, is adapting to the heightened risk management data requirements and building the foundation for future sustainable growth. Donovan used the opening quote by Einstein to remind the audience that big […]

Risk Data Aggregation & Risk Reporting. Part 1

During the throes of the last financial crisis, banks and regulators alike “struggled” to get good quality information. “The infrastructure was not there,” said James Dennison, CFA, Managing Director, Operational Risk Division, Office of the Superintendent of Financial Institutions (OSFI). To enhance banks’ risk management infrastructure, the Basel Committee on Banking Supervision (BCBS) released a set of Principles for Effective Risk Data Aggregation & Risk Reporting in January 2013. Dennison was first to speak on the evening of September 19, 2013 at the Toronto chapter meeting of the Global Association of Risk Professionals (GARP). It was convened at First Canadian Place to allow […]

Leveraging Risk Analytics. Part 1

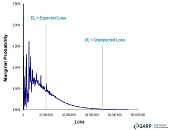

“The new risk management role has a dual responsibility: to the organization, and to achieve business goals. When they contradict each other, the business profitability must come first,” said Boaz Galinson, VP and Head of Credit Risk Modeling and Measurement at Bank Leumi. He was the first of two speakers at a GARP webinar on leveraging risk analytics to drive competitive advantage held September 17, 2013. Galinson referred to the Accenture 2011 Global Risk Management Survey of the 400 biggest corporations (including the 40 biggest banks). Of the respondents, 93 percent said that “sustainability of future profitability” was important or […]

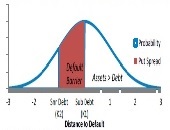

Modeling Sovereign Risk. Part 2: Quantification

“The Bloomberg sovereign risk model starts by dividing countries into two types,” said Rajan Singenellore, “reserve-currency countries and non-reserve currency countries. Everything else depends on that distinction.” Singenellore is Product Manager, Risk & Valuations at Bloomberg and was the second of two speakers to address a GARP webinar audience on September 12, 2013. A reserve-currency country is one whose currency is held in significant quantities by other governments as part of their foreign exchange reserves, such as the US and the Japan. There is a pressing need for quantification in the area of sovereign credit risk, he said, citing as […]

Modeling Sovereign Risk. Part 1: Emerging Markets

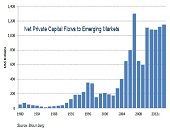

“Country-specific factors such as government debt and the sovereign credit rating change slowly but global aggregates such as the risk appetite change quickly, thus leading to confusion the part of observers,” said Michael Rosenberg, Foreign Exchange Consultant, Bloomberg and author of Currency Forecasting: A Guide to Fundamental and Technical Models of Exchange Rate Determination. He was the first of two speakers to address a GARP webinar audience on September 12, 2013. Much of Rosenberg’s talk focused on the sovereign credit risk of emerging markets (EM), because the accelerating flow of net private capital into EM from 1980-2014 has been unprecedented. […]