Quant Chalkboard: A New Way to Aggregate

The Gumbel copula is the best way to aggregate losses in economic capital, says Yimin Yang, Director of Model Risk and Capital Management Practice at Protiviti, a global consulting firm. “This copula has asymmetrical behaviour and can model fat tails the best” of the numerous copulas he has tried recently. He was speaking at a GARP webinar on August 20, 2013. Yang began by explaining that a copula was a broad class of mathematical function that could be used to describe the joint distribution function between two or more other functions. Such a joint cumulative distribution function (CDF) must determine […]

Basel III and Beyond: Part 1. Optimization with On-Demand Risk Insights

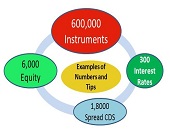

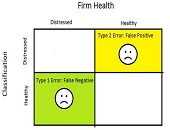

“The capital consumption of credit counterparty risk has become an issue for banks,” said Rita Gnutti, Head of Internal Model Market and Counterparty Risk at Intesa Sanpaolo. She was the first of two speakers addressing the impact of regulatory developments on counterparty risk assessment. She spoke to a webinar audience arranged by the Global Association of Risk Professionals on June 27, 2013. Gnutti first outlined the new Basel III regulatory framework of credit counterparty risk (CCR), then she described its calculation using internal model methodology (IMM), and third she described the computing and back-testing of CCR carried out by her […]

How New Regulations Are Breaking Down Silos. Part 3: Interconnection Needed

The biggest hurdle to breaking down silos “is organizational in nature,” according to Amit Gupta, Partner in Risk Management Practice at the consulting firm Accenture. “The heads of Risk, Finance, Operations are all different people and this introduces a level of complexity.” However, “organizational interconnection at high levels is starting to happen.” Gupta was the third panellist to weigh in at the GARP webinar on May 21, 2013 on how new financial regulations (Dodd-Frank and Basel III) are breaking down silos in risk management. Regulators are pushing for greater consistency in reporting. As an example, Gupta pointed to new requirements […]

How New Regulations Are Breaking Down Silos. Part 2: Look at Economics

An institution “needs to have a strong cross-risk function which coordinates all parties in order to influence the recovery plan,” said Dr. Andrea Burgtorf, Head of Stress Testing, Risk Analytics and Instruments at Deutsche Bank. She was speaking at the GARP webinar on May 21, 2013 about the effect of new regulations on risk management. As part of the Basel III mandate to develop a Recovery and Resolution Plan, a bank must include analysis of all critical economic functions, and this, said Burgtorf, “forces a bank to examine what are its core and non-core businesses, and to decide which governance […]

The Fed, Foreign Banks and Basel III: Part 1. A Long Hard Look

Foreign banking operations (FBOs) in the United States are about to face a whole new set of regulations that may dampen their enthusiasm for US-based operations, according to a February 14, 2013 webinar organized by the Global Association of Risk Professionals (GARP). “The Fed observed over time that US branches were increasingly used to fund the home office operations,” said Charles Horn, partner at Morrison Foerster, who was the first speaker at the panel. Other concerns of the Federal Reserve Board are the increased complexity of FBOs, and “the availability of home country financial resources for branch offices.” The goal, […]

The State of the Credit Markets: Part 2. Global Trends

“Political uncertainty creates a bimodal distribution of risk, which is very difficult for the markets to price,” said Seth Rooder, Global Credit Derivatives Product Manager for Bloomberg, and the second of two speakers at the Global Association of Risk Professionals (GARP) webinar on November 15, 2012. (Click here to view Part 1.) Rooder was referring to the first of five main themes in global risk trends, as he sees them. They are: (1) Economic and political uncertainty (2) Slowing global growth (3) Central Bank (CB) intervention (4) Continuing low yields (5) Increased regulation Ever since the financial crisis of 2008, […]