Eye on Credit Markets. Part 1: Little Beta, Lots of Alpha

“How will the credit markets perform if the Federal Reserve Board chooses to taper over the next year or so?” asked Sivan Mahadevan, Head of U.S. Credit Strategy and Global Credit Derivatives Strategy at Morgan Stanley. He posed this question to members of the Global Association of Risk Professionals on November 21, 2013. Here, “tapering” refers to a gradual lessening of asset purchases. As the first of two speakers in a webinar presentation, Mahadevan summarized the credit markets to date: “little beta, lots of alpha.” Investment grade assets have had a good rally this year. “The higher yields go, the […]

How New Regulations Are Breaking Down Silos. Part 3: Interconnection Needed

The biggest hurdle to breaking down silos “is organizational in nature,” according to Amit Gupta, Partner in Risk Management Practice at the consulting firm Accenture. “The heads of Risk, Finance, Operations are all different people and this introduces a level of complexity.” However, “organizational interconnection at high levels is starting to happen.” Gupta was the third panellist to weigh in at the GARP webinar on May 21, 2013 on how new financial regulations (Dodd-Frank and Basel III) are breaking down silos in risk management. Regulators are pushing for greater consistency in reporting. As an example, Gupta pointed to new requirements […]

How New Regulations Are Breaking Down Silos. Part 2: Look at Economics

An institution “needs to have a strong cross-risk function which coordinates all parties in order to influence the recovery plan,” said Dr. Andrea Burgtorf, Head of Stress Testing, Risk Analytics and Instruments at Deutsche Bank. She was speaking at the GARP webinar on May 21, 2013 about the effect of new regulations on risk management. As part of the Basel III mandate to develop a Recovery and Resolution Plan, a bank must include analysis of all critical economic functions, and this, said Burgtorf, “forces a bank to examine what are its core and non-core businesses, and to decide which governance […]

How New Regulations Are Breaking Down Silos. Part 1: Stress Testing

“Financial regulators have introduced stress testing as a means to cut across silos,” said Dan Travers, VP of Product Management, Adaptiv at SunGard and the opening speaker at a GARP webinar on May 21, 2013. Historically, he noted, financial risk has been treated as a set of separate units (or silos) across the main types of risk: credit, market, operational, and liquidity risk, the latter connected to asset-liability management (ALM). The new reporting demands of Basel III and Dodd-Frank serve to break down silos, Travers said, with such things as incremental risk charge being reported as capital percentage for the […]

Evolution of the OTC Swaps Markets. Part 2: Lessons Learned

The scramble to meet the Phase 1 deadline of new regulations on swaps “was a significant learning experience,” said Bis Chatterjee, Global Head of E-Trading, Credit Markets at Citi. He was the second speaker in a webinar panel organized by the Global Association of Risk Professionals (GARP) on May 14, 2013. The deadline that came into effect March 11, 2013 pertained to the Dodd-Frank Act governing over-the-counter (OTC) swaps. (Two more phases will follow; see Part 1 for details.) There were challenges first of all, Chatterjee said, in the self-identification of market participants in Phase 1. Second, even if you […]

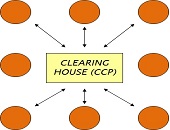

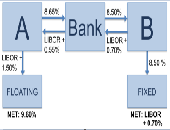

Evolution of the OTC Swaps Markets. Part 1: “Futurization” of Swaps

Recent reforms to the swaps market can be thought of as “the futurization of swaps,” said Nathan Jenner, COO Fixed Income E-Trading at Bloomberg. He was addressing a webinar audience on May 14, 2013 as the first speaker in a panel organized by the Global Association of Risk Professionals (GARP) on the evolution of the market for over-the-counter (OTC) swaps. Five years ago, “derivatives were perceived as a catalyst in precipitating” the financial crisis of 2007-08, said Jenner. For example, it wasn’t immediately apparent who were all the counterparties to the AIG swaps. Pricing was “murky,” he said, and risk […]

The Fed, Foreign Banks and Basel III: Part 1. A Long Hard Look

Foreign banking operations (FBOs) in the United States are about to face a whole new set of regulations that may dampen their enthusiasm for US-based operations, according to a February 14, 2013 webinar organized by the Global Association of Risk Professionals (GARP). “The Fed observed over time that US branches were increasingly used to fund the home office operations,” said Charles Horn, partner at Morrison Foerster, who was the first speaker at the panel. Other concerns of the Federal Reserve Board are the increased complexity of FBOs, and “the availability of home country financial resources for branch offices.” The goal, […]

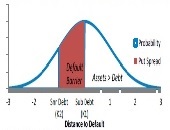

US Implementation of Basel III. Part 2: The GPS for the Journey

On July 24, 2012, Peter Went, VP Banking Risk Management Programs at GARP, summarized the changing landscape of Basel III from a US perspective. First he outlined the deadlines and proposed changes; Part 1 of this posting covers these for the standardized approach. Financial institutions adhering to the advanced approach, Went said, must follow the Basel III counterparty credit risk rules. In some cases, correlations between asset values must be increased. A distinction will be made between securitization and resecuritization. [Ed. Note: To this, we say, “high time.” See, for example, Hull & White’s award-winning article in Financial Analysts Journal, […]

US Implementation of Basel III. Part 1: A Long and Winding Journey

The long and winding US route to Basel implementation has been more difficult and circuitous than the route for European banks. Peter Went, VP Banking Risk Management Programs at GARP, delivered a webinar update on the Basel III leg of the journey on July 24, 2012. First, Went summarized the deadlines. Several sequential proposals have been issued by the US prudential agencies: the OCC, FRB, and the FDIC, with an expected implementation date beginning January 1, 2013, and a series of milestones thereafter. [Note: by mid-December 2012, the implementation dates for most of the Basel III proposals have been delayed […]