Basel, the Big Picture: Tackling Risk Aggregation & Reporting. Part 1

“It’s a quality piece of work that lays out the road ahead,” said Donna Howe, professor of finance at Brandeis International Business School. She was the first of two speakers at a webinar to discuss the 2013 Basel paper, Principles for Effective Aggregation and Reporting of Risk Data. The webinar was sponsored by the Global Association of Risk Professionals. Besides governance, Howe noted the 14 principles described in the paper expressed four main themes: completeness, accuracy, timeliness, and adaptability. Completeness of risk reporting is necessary, but “it becomes very easy to lose the nuance” when the data are too numerous […]

Eye on Credit Markets. Part 2: Spreads Hit Floor

“The central bank stimulus has been significant—what will happen as it’s withdrawn?” asked Seth Rooder, Global Credit Derivatives Product Manager at Bloomberg. He was the second of two speakers to consider the effects of tapering in a GARP webinar presentation on November 21, 2013. A key question is: “when will the Fed taper?” Rooder said not soon, because with unemployment still above 6.5 percent, Vice-Chair of the Fed Janet Yellen will have unwillingness to taper. Currently, the Fed is pumping money into the system by buying $40 billion in mortgage-backed securities and $45 billion in Treasury bills per month. He […]

Eye on Credit Markets. Part 1: Little Beta, Lots of Alpha

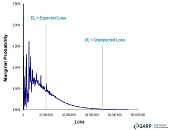

“How will the credit markets perform if the Federal Reserve Board chooses to taper over the next year or so?” asked Sivan Mahadevan, Head of U.S. Credit Strategy and Global Credit Derivatives Strategy at Morgan Stanley. He posed this question to members of the Global Association of Risk Professionals on November 21, 2013. Here, “tapering” refers to a gradual lessening of asset purchases. As the first of two speakers in a webinar presentation, Mahadevan summarized the credit markets to date: “little beta, lots of alpha.” Investment grade assets have had a good rally this year. “The higher yields go, the […]

China: Global Leader, Threat, or Both? Part 2.

“The likelihood of conflict is low but non-negligible” when it comes to China’s perspective on Japan’s re-militarization, said Daniel Wagner, CEO of Country Risk Solutions, during the second half of his Global Association of Risk Professionals webinar on October 22, 2013. After surveying Sino-American relations in Part 1, Wagner guided the audience through an in-depth look at China’s evolving geopolitical position in Asia and Africa. Japanese Prime Minister Shinzo Abe has raised military spending, loosened constitutional constraints on military action, and given a high profile to the Senkaku Islands dispute. Sabre-rattling occurs, but Wagner doubts that China and Japan would […]

China: Global Leader, Threat, or Both? Part 1. China and US

“Hide one’s brilliance, bide one’s time” seems the most fitting aphorism for China’s global strategy, said Daniel Wagner, CEO of Country Risk Solutions. During an hour-long webinar on October 22, 2013 organized by the Global Association of Risk Professionals, Wagner guided the audience through China’s evolving geopolitical position generally, as well as its relationships with US, Asia, and Africa. China is in the ascendant mode, said Wagner, citing the increasing use of the yuan as a reserve currency, as well as its rising military power. Regaining global dominance would be “like picking up where they left off,” he said, reminding […]

Credit Workflow Optimization: A Practical Approach

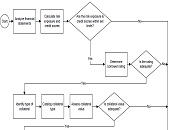

“How can an institution practically approach credit workflow when it might not be streamlined? How can we optimize existing processes?” These questions were posed by Justin Huhn, Credit Assessment & Origination Practice Leader at Moody’s Analytics Enterprise during a webinar arranged by the Global Association of Risk Professionals on September 24, 2013. Huhn noted that, as of Q1 2013, there were over seven thousand insured commercial banks and savings institutions in the US excluding foreign branches. These financial institutions tend to develop silos of expertise. Workflow optimization is of pressing concern to many. In 2008 the American Bankers Association estimated […]

Risk Data Aggregation & Risk Reporting. Part 2

“Not everything that can be counted counts,” said Mike Donovan, VP, Strategic Risk Analytics & Credit Portfolio Management at Canadian Imperial Bank of Commerce (CIBC). He was the second speaker to address the September 19, 2013 evening meeting of the Toronto chapter of GARP regarding the set of Principles for Effective Risk Data Aggregation & Risk Reporting released by the Basel Committee in January 2013. CIBC, like other Canadian banks, is adapting to the heightened risk management data requirements and building the foundation for future sustainable growth. Donovan used the opening quote by Einstein to remind the audience that big […]

Risk Data Aggregation & Risk Reporting. Part 1

During the throes of the last financial crisis, banks and regulators alike “struggled” to get good quality information. “The infrastructure was not there,” said James Dennison, CFA, Managing Director, Operational Risk Division, Office of the Superintendent of Financial Institutions (OSFI). To enhance banks’ risk management infrastructure, the Basel Committee on Banking Supervision (BCBS) released a set of Principles for Effective Risk Data Aggregation & Risk Reporting in January 2013. Dennison was first to speak on the evening of September 19, 2013 at the Toronto chapter meeting of the Global Association of Risk Professionals (GARP). It was convened at First Canadian Place to allow […]

Leveraging Risk Analytics. Part 2

“To drive competitive value, a business must build situational context,” said Tom Kimner, Head of Americas Risk Practice & Global Risk Products at SAS. “And it’s extremely important to take the holistic view.” He was the second of two speakers at a GARP webinar on September 17, 2013 on leveraging risk analytics to drive competitive advantage. To build situational context, Kimner noted the analytics system must provide prediction and data mining, alternative sourcing, and optimization. “Build context for the data as it is used.” The different types of return metrics will help determine what is “best” in relative terms. Kimner […]

Leveraging Risk Analytics. Part 1

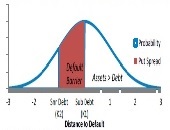

“The new risk management role has a dual responsibility: to the organization, and to achieve business goals. When they contradict each other, the business profitability must come first,” said Boaz Galinson, VP and Head of Credit Risk Modeling and Measurement at Bank Leumi. He was the first of two speakers at a GARP webinar on leveraging risk analytics to drive competitive advantage held September 17, 2013. Galinson referred to the Accenture 2011 Global Risk Management Survey of the 400 biggest corporations (including the 40 biggest banks). Of the respondents, 93 percent said that “sustainability of future profitability” was important or […]