Not Just the Modelling

The estimation and reporting of credit impairment at banks has led to a brand-new set of guidelines around the current expected credit loss (CECL). What’s a beleaguered banker to do? “For an effective CECL transition, preparation is key,” said Samrah Kazmi, Advisory Industry Consultant for Risk Solutions at SAS. She was the third and final speaker at a webinar titled “CECL: Managing Through the Implementation Headwinds” sponsored by the Global Association of Risk Professionals (GARP) on September 12, 2018. “Most banks think CECL is just about the modelling,” she said, “but it’s also data, systems, and processes.” Begin by identifying the stakeholders, she advised, […]

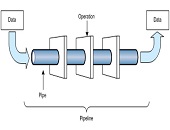

The Data Pipeline

The new guidelines on credit impairment at U.S. banks regulate the estimation and reporting of the current expected credit loss (CECL). But what are they really about? “CECL is all about setting up a data pipeline,” said Krish Ray, CECL Implementation Lead at SAS. He was the second of three speakers at a webinar panel titled “CECL: Managing Through the Implementation Headwinds” sponsored by the Global Association of Risk Professionals (GARP) on September 12, 2018. Ray categorized the key challenges of CECL implementation as: models, data, business, governance, and sustainability. Smaller banks might lack modelling expertise and “may have to turn to vendor models.” […]

CECL Headwinds

The time for banks to implement the new guidelines on credit impairment is at hand. How prepared is your team? A summary of issues around the current expected credit loss (CECL) can be found in the webinar titled “CECL: Managing Through the Implementation Headwinds” sponsored by the Global Association of Risk Professionals (GARP) on September 12, 2018. “The life of loan loss expectation is a big factor in CECL,” said Michael Gullette, senior vice-president, Tax and Accounting, at the American Bankers Association. He was the first of three speakers at the GARP webinar. Loan loss expectation (LOL) includes loan prepayments and troubled debt restructuring […]

Shifting Energy Markets

How are strategic priorities in energy markets shifting? What are the risk management implications? “Geopolitical risks have worsened and technological innovation is causing more disruption,” said Medy Agami, senior partner and vice-chairman at Ben-Roz and Associates and co-founder of the consulting firm Opimas. He was the sole presenter of the webinar “Energy Market Strategy and Risk Playbook: How to prosper amid a wave of disruptive innovation, geopolitical uncertainty, market volatility & exponentially growing risk landscape in 2018 & beyond” sponsored by the Global Association of Risk Professionals (GARP) on August 7, 2018. “There are five main forces acting on fundamentally shifting markets,” […]

Recent SEC Enforcement

Given the trends that are emerging for enforcement by the U.S. Securities and Exchange Commission (SEC), what’s a risk manager to do? “Risk managers should use data and data analytics to identify patterns,” said Steven Hilfer, Managing Director in the Disputes & Investigations practice, Capital Markets at Navigant. He was the fourth and final speaker in a four-part webinar panel titled “SEC 2018 Enforcement Trends” sponsored by the Global Association of Risk Professionals (GARP) on July 25, 2018. He argued that the SEC is plunging ahead in the area of data analytics, and it expects companies “to identify patterns prior to being […]

Supreme Court’s Impact

The U.S. Supreme Court will have a significant effect on the interpretation and enforcement of rules at the U.S. Securities and Exchange Commission (SEC) , according to Thomas Zaccaro, Partner, Litigation Department, Paul Hastings LLP. He was the third speaker in a four-part webinar panel titled “SEC 2018 Enforcement Trends” sponsored by the Global Association of Risk Professionals (GARP) on July 25, 2018. “The disgorgement remedies are now limited to five years,” Zaccaro said. This is as a result of the Kokesh vs. SEC case. Disgorgement refers to the act of giving up something (such as profits illegally obtained). Previously the time […]

An Insider’s View

“Quite frankly, I think some have underestimated Clayton,” said Ken Joseph, Managing Director, Disputes and Investigations practice, at Duff & Phelps. “There is a de-emphasis on some areas and re-prioritization of other areas—but he is still focused on wrongdoing.” Joseph was referring to Jay Clayton, the recently appointed chair of the U.S. Securities and Exchange Commission (SEC). Ken Joseph was the second speaker in a four-part webinar panel titled “SEC 2018 Enforcement Trends” sponsored by the Global Association of Risk Professionals (GARP) on July 25, 2018. He is also former Head of the Securities and Exchange Commission’s New York Regional Office Investment […]

A New Landscape

Jay Clayton, the recently appointed chair of the U.S. Securities and Exchange Commission (SEC) under President Trump, has signaled new directions in the enforcement of securities laws. What are the implications for financial risk managers? “There is shift away from ‘broken windows’—trying the smallest cases—and there is no longer a requirement for companies to admit wrongdoing,” said Amy Poster, Managing Principal at Alpha Pacific Strategies. She was the moderator and opening speaker in a four-part webinar panel titled “SEC 2018 Enforcement Trends” sponsored by the Global Association of Risk Professionals (GARP) on July 25, 2018. The SEC appears to be changing its […]

A Tale of Two Funds

There are helpful and unhelpful models for determining risk-based profit attribution, according to Michael B. Miller, founder and CEO, Northstar Risk. This is part 2 of his explanation about how to attribute financial performance, given at a webinar sponsored by the Global Association of Risk Professionals on June 20, 2018. Miller gave an example of two funds. Fund A contains both long and short assets, is market neutral and generates positive alpha. Fund B is a macro fund that is market dependent and whose manager is correct 54 percent of the time. The returns of Funds A and B look very […]

Risk-Based Profit Attribution

“Even the best portfolio managers have bad years due to macroeconomic factors beyond their control,” said Michael B. Miller, founder and CEO, Northstar Risk, to an audience of financial risk professionals. This is Part 1 of his talk about how to attribute performance for financial management at a webinar sponsored by the Global Association of Risk Professionals on June 20, 2018. “We tend to view measurement of risk and performance as separate tasks, but performance can only be fully understood by taking risk into account,” Miller said. Performance is always evaluated relative to something else, such as “the market”—which commonly taken […]