Standing at the Precipice?

What is shadow banking, and are the associated risks being properly mitigated? A summary of issues can be found in the webinar “Shadow Banking: Standing at the Precipice?” sponsored by the Global Association of Risk Professionals (GARP) on August 6, 2019. Fabio Natalucci, Deputy Director, Monetary and Capital Markets Department of the International Monetary Fund (IMF), was the first of two speakers at the one-hour webinar. He began by explaining that the shadow banking system prefers to be thought of in “less sinister” terms as “non-bank financial intermediaries” that provide services similar to, but outside of, the regular banking system. He described […]

A Good Start…

Financial risks due to climate change are receiving more attention of late, particularly for investors and regulators, but how far along are firms in addressing the issues? A report on climate risk management at financial firms tabled on June 28, 2019, sponsored by the Global Association of Risk Professionals (GARP), answers the question with its subtitle: “A Good Start, But More Work to Do.” The report is co-authored by Jo Paisley, Co-President, and Maxine Nelson, Senior Vice President at GARP. “Our sample covered 20 banks and seven other financial institutions … from across the globe. These firms have a global […]

Wanted: Business Expertise

Artificial intelligence can be expensive and tricky to implement. Is it worth the trouble? Two organizations recently decided to pose the question to those who were working in financial institutions. “Due to budget constraints, a company might not always be able to apply artificial intelligence. But, to those who can, the benefits have become clear,” said Mahdi Amri, Partner and National AI Services Leader, Canada at Omnia, which is the artificial intelligence practice at Deloitte. On January 24, 2019, Amri was the second of two panellists who discussed early results of a joint survey by SAS and the Global Association […]

Operationalizing A.I.

How pervasive is the use of artificial intelligence in the field of financial risk management? What are the key challenges in AI implementation over the next two to three years? These issues were examined in early 2019 via the webinar, Operationalizing AI and Risk in Banking, sponsored by the Global Association of Risk Professionals (GARP). “We found exceptionally high rates of AI usage among survey respondents,” said Katherine Taylor, Senior Data Scientist at the software company SAS. On January 24, 2019, Taylor was the first of two panellists who presented a “sneak peek” at a joint survey by SAS and […]

Managing Artificial Intelligence Risk

“The potential consequences of artificial intelligence are profound,” said Daniel Wagner, founder and CEO, Country Risk Solutions. “We’re just at the beginning of the runway. How resources are utilized will change significantly.” AI will affect all areas of life, and it is possible new forms of digital authoritarianism may arise. Wagner was one of two speakers at a webinar titled “Artificial Intelligence: Running the Race and Managing the Risks,” sponsored by the Global Association of Risk Professionals (GARP) on October 16, 2018. Wagner and Keith Furst co-authored the new book AI Supremacy: Winning in the Era of Machine Learning. His presentation summarized […]

AI Supremacy?

“There is definitely a race for AI going on,” said Keith Furst, Managing Director, Data Derivatives. “You might wonder, is there any hope of catching up if you are not already in the race?” He was one of two speakers at a webinar titled “Artificial Intelligence: Running the Race and Managing the Risks,” sponsored by the Global Association of Risk Professionals (GARP) on October 16, 2018. Furst and Daniel Wagner co-authored the new book AI Supremacy: Winning in the Era of Machine Learning. At the outset, Furst described the process of “cognification” that has been transforming our world. “As everything becomes digitized, […]

Not Just the Modelling

The estimation and reporting of credit impairment at banks has led to a brand-new set of guidelines around the current expected credit loss (CECL). What’s a beleaguered banker to do? “For an effective CECL transition, preparation is key,” said Samrah Kazmi, Advisory Industry Consultant for Risk Solutions at SAS. She was the third and final speaker at a webinar titled “CECL: Managing Through the Implementation Headwinds” sponsored by the Global Association of Risk Professionals (GARP) on September 12, 2018. “Most banks think CECL is just about the modelling,” she said, “but it’s also data, systems, and processes.” Begin by identifying the stakeholders, she advised, […]

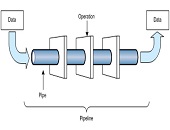

The Data Pipeline

The new guidelines on credit impairment at U.S. banks regulate the estimation and reporting of the current expected credit loss (CECL). But what are they really about? “CECL is all about setting up a data pipeline,” said Krish Ray, CECL Implementation Lead at SAS. He was the second of three speakers at a webinar panel titled “CECL: Managing Through the Implementation Headwinds” sponsored by the Global Association of Risk Professionals (GARP) on September 12, 2018. Ray categorized the key challenges of CECL implementation as: models, data, business, governance, and sustainability. Smaller banks might lack modelling expertise and “may have to turn to vendor models.” […]

CECL Headwinds

The time for banks to implement the new guidelines on credit impairment is at hand. How prepared is your team? A summary of issues around the current expected credit loss (CECL) can be found in the webinar titled “CECL: Managing Through the Implementation Headwinds” sponsored by the Global Association of Risk Professionals (GARP) on September 12, 2018. “The life of loan loss expectation is a big factor in CECL,” said Michael Gullette, senior vice-president, Tax and Accounting, at the American Bankers Association. He was the first of three speakers at the GARP webinar. Loan loss expectation (LOL) includes loan prepayments and troubled debt restructuring […]

Shifting Energy Markets

How are strategic priorities in energy markets shifting? What are the risk management implications? “Geopolitical risks have worsened and technological innovation is causing more disruption,” said Medy Agami, senior partner and vice-chairman at Ben-Roz and Associates and co-founder of the consulting firm Opimas. He was the sole presenter of the webinar “Energy Market Strategy and Risk Playbook: How to prosper amid a wave of disruptive innovation, geopolitical uncertainty, market volatility & exponentially growing risk landscape in 2018 & beyond” sponsored by the Global Association of Risk Professionals (GARP) on August 7, 2018. “There are five main forces acting on fundamentally shifting markets,” […]