Hedge Fund Fallacy

“If all the money that’s ever been invested in hedge funds had been put in treasury bills instead, the results would have been twice as good,” said Simon Lack, founder of SL Advisors, LLC, and author of The Hedge Fund Mirage: The Illusion of Big Money and Why It’s Too Good to Be True. This statement was his opening volley in a webinar titled “The Hedge Fund Fallacy” on May 5, 2014, sponsored by the CFA Institute. Lack began with a “typical portrayal” of hedge fund returns: a 6 percent return over the period 1998 to 2013. Over the same […]

A Successful Operational Risk Program 2. Purpose

“The purpose of the framework is to provide business value,” said Philippa Girling, Commercial Business Chief Risk Officer at Capital One and author of Operational Risk Management: A Complete Guide to a Successful Operational Risk Framework. She was the second of two presenters at a GARP-sponsored webinar on April 8, 2014 that attracted about 2,000 registrants. “Good governance drives good behaviour,” said Girling, noting that the standards of Basel II have now become the de facto standard. Operational risk is “about anything that can go wrong” that’s not market or credit risk. “People make mistakes, systems fail, policies fail” plus […]

A Successful Operational Risk Program 1. Framework

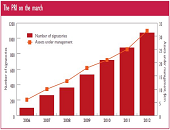

“A clear strategic direction of your company should help formulate clear business objectives, understood by all stakeholders, including employees,” said Brenda Boultwood, SVP, Industry Solutions at MetricStream. An operational risk may be seen as something, together with credit or market risks, which impedes “achieving those business objectives” and includes IT risk, HR risk, and reputation risk. MetricStream is a provider of Governance, Risk, Compliance (GRC) management software and consulting. Boultwood was the first of two presenters at a GARP-sponsored webinar on April 8, 2014 that attracted about 2,000 registrants. Operational risk has evolved from conceptual to strategic, and is now […]

Risk Data Aggregation & Risk Reporting. Part 2

“Not everything that can be counted counts,” said Mike Donovan, VP, Strategic Risk Analytics & Credit Portfolio Management at Canadian Imperial Bank of Commerce (CIBC). He was the second speaker to address the September 19, 2013 evening meeting of the Toronto chapter of GARP regarding the set of Principles for Effective Risk Data Aggregation & Risk Reporting released by the Basel Committee in January 2013. CIBC, like other Canadian banks, is adapting to the heightened risk management data requirements and building the foundation for future sustainable growth. Donovan used the opening quote by Einstein to remind the audience that big […]

Interview with Philippe Jorion: “Is There a Cost to Transparency?”

In early 2013 the CFA Institute announced Philippe Jorion and Rajesh K. Aggarwal won the Graham and Dodd scroll award from Financial Analysts Journal for their paper, “Is There a Cost to Transparency?” An in-depth interview with Professor Jorion appears in the June 2013 issue of The Analyst, the member bulletin of the CFA Society Toronto. Below are a few of the statements from the course of the interview. Q: What is your principal area of research? PJ: Ever since I discovered the field of finance, I have had long-standing interests in topics such as portfolio construction and risk management. […]

Ain’t Misbehavin’. Part 2: What Makes a Good Committee?

“Good committees make good decisions,” said Arnold Wood, guest speaker at the CFA Society Toronto on June 3, 2013. On the TV show Who Wants to Be a Millionaire, whenever the contestant turns to the crowd for help with an answer, the crowd is right 91 percent of the time, said Wood, who is president and CEO of Martingale Investments and a specialist in behavioural finance. The first part of his talk described common errors in individual thinking. But what makes a good committee? The composition of committees can be tricky. Too often, there is an appearance of diversity but […]

Ain’t Misbehavin’. Part 1: Overconfidence and Illusion

“It’s not our ability that makes us, it’s our choices.” With this quotation from Harry Potter, Arnold Wood, President and CEO of Martingale Investments proceeded to show how, in case after case, a good grasp of behavioural finance could explain the workings of the typical investment committee. Wood was speaking to a few dozen charterholders at a luncheon sponsored by the CFA Society Toronto at the historic National Club in Toronto on June 3, 2013. Wood wove his commentary around three themes: key habitual errors of decision-making, the composition of committees, and the behaviour of the chair of the investment […]

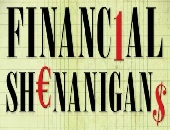

Financial Shenanigans: Forensic Accounting in Practice

There are ample opportunities for financial shenanigans in North American companies, according to Howard Schilit, founder of Schilit Forensics LLC and author of the classic Financial Shenanigans: How to Detect Accounting Gimmicks & Fraud in Financial Reports, first published in 1993 and now in its third edition. He led a mid-day seminar on characteristics of poor accounting practices at the CFA Society Toronto downtown offices on May 30, 2013. “Financial shenanigans are not necessarily illegal,” explained Schilit, but they are practices that “are not nice to perpetrate on someone” and could, if unchecked, slip into criminality. Given the extensive subject […]

Spotting Signs of Poor Corporate Governance. Part 2: ESG Management

Corporate governance is only one part of an overall phenomenon known as “ESG management,” or how a company handles environmental, social, and corporate governance (ESG) issues. “Research shows that companies that disclose more ESG information are more likely to enjoy a lower cost of capital,” said Max Zehrt, Senior Manager at Sustainalytics. He was addressing a noon-hour seminar of financial analysts and portfolio managers on the subject of corporate governance on May 8, 2013 at the offices of the CFA Society Toronto. His talk was the second part of a two-speaker panel moderated by Toby Heaps of Corporate Knights. Zehrt was […]

Spotting Signs of Poor Corporate Governance. Part 1: “Ask the Tough Questions”

“Good governance practices are important for the sound financial growth of a corporation—the board directs and protects,” said Stephen Kibsey, VP Equity Risk Management at Caisse de dépôt et placement du Québec. On May 8, 2013 he addressed a noon-hour seminar of financial analysts and portfolio managers through remote link on the subject of corporate governance at the offices of the CFA Society Toronto. His talk was the first part of a two-speaker panel moderated by Toby Heaps, co-founder and president of Corporate Knights. Kibsey pointed out that concern over matters like environment, social and governance (ESG) issues within a […]