What is Key to Integrating Op Risk?

“It’s critical to unite multiple perspectives on risk,” said Brenda Boultwood, Senior Vice President at MetricStream, “even though approaches to risk and compliance can be very different” throughout an organization. Boultwood was the second of two speakers at a webinar on operational risk held on August 27, 2015, sponsored by the Global Association of Risk Professionals. A common framework will require standard taxonomies, common definitions, and consistent risk assessment across a company, said Boultwood. She sketched out an integrated enterprise risk management (ERM) framework, in which all types of risk share a common hierarchy, common business processes, and a common […]

Is it OpRisk? or Business Risk?

Operational risk has figured prominently in the business news this summer: a lightning storm destroyed cloud data stored by Google, and a cyber-hack of dating website Ashley Madison breached confidentiality of 33 million accounts. Are companies addressing operational risk the best way possible? What is called operational risk may in fact have its roots in business risk, according to Mike Finlay, Chief Executive of RiskBusiness International. He was the first of two speakers at a webinar on operational risk held on August 27, 2015, sponsored by the Global Association of Risk Professionals. For example, the 2011 Fukushima Daiichi disaster in […]

Liquidity: A Change in Governance

Have you noticed that financial risk managers talk and think differently about liquidity risk, compared to pre-crisis days? The 2007-08 financial crisis was a watershed in the evolution of liquidity management, according to Nicolas Kunghehian, Director Solutions Specialist at Moody’s Analytics. He was the second of three presenters on liquidity risk compliance at a webinar on June 25, 2015, sponsored by the Global Association of Risk Professionals. “Before the crisis, there was only one team dedicated to monitoring and managing liquidity,” Kunghehian said. Liquidity risk was assumed to be small, and the Treasury department was chiefly fine-tuning the profit and […]

Effective Risk Reporting

Effective risk reporting means “having the intelligence at your fingertips but exercising the judgment to report only what your company needs,” said Elizabeth Abraham, Director of Professional Services at MetricStream, and the second of two presenters at the June 16, 2015, webinar on Effective Risk Reporting sponsored by the Global Association of Risk Professionals. “Lack of clarity about the reporting objective” is a common barrier to effective enterprise risk management reporting, she said. Make sure you understand what level of information the audience wants. “Data model inconsistencies can lead to an inability to aggregate” the risk estimates, and that’s another […]

One Size Does Not Fit All

When it comes to risk reporting, do you ever feel that you are trying to push a square peg into a round hole? According to Gordon Goodman, that may happen rather often for companies that are not in the finance industry. Goodman, Director of Governance and Enterprise Risk Management at NRG Energy, was the first of two presenters at the June 16, 2015, webinar on Effective Risk Reporting sponsored by the Global Association of Risk Professionals. According to Goodman, there has been a push by banks to “bring their metrics to the marketplace, but this has created problems” for non-financial […]

Alternative Mutual Funds 1

Alternative mutual funds have been experiencing a growth “nothing short of phenomenal,” said Amy Poster, Director of Financial Services Advisory at Berdon LLP, “and this has not escaped the notice of the Office of Compliance Inspections and Examinations (OCIE).” She was the first of three speakers in a webinar about alternative mutual funds held on February 17, 2015, and sponsored by the Global Association of Risk Professionals (GARP). She pointed to a 2014 Barclays study, Developments and Opportunities for Hedge Fund Managers in the ’40 Act Space , that estimated assets controlled by liquid alternative funds would reach between $USD […]

Cyber Risks: 5 Core Capabilities

Integration of cybersecurity into an organization’s risk management framework is “still in the hunter-gatherer state,” said Yo Delmar, VP, Governance Risk & Compliance (GRC) at MetricStream. She was the second of two presenters at the December 16, 2014, webinar on cybersecurity organized by the Global Association of Risk Professionals. Cyber risks are currently incorporated into existing risk management and governance processes in an ad hoc fashion that is “unorganized and fragmented,” Delmar said. “There is quite a bit of work to do to get to a rationalized state” that would permit management of such risks. “Most companies have the vision […]

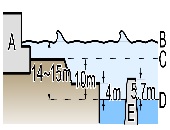

Tracking the Elusive Black Swan

Enterprise risk management (ERM) requires a “robust framework design and collaborative approach to capture a black swan event before its occurrence,” said Brenda Boultwood, Senior Vice President of Industry Solutions at MetricStream. She was the second of two speakers at the GARP-sponsored webinar on Black Swans and Reputational Risk held on August 26, 2014. Black swan events are “close to impossible to estimate impact and likelihood,” such as the Japan 2011 tsunami, or Hurricane Katrina. The complexity of these types of risk “requires that we focus on what is most important” in strategic risk management, said Boultwood, naming four principal areas: […]

“They Kill Things!”

Enterprise risk management (ERM) should aim to fill the strategic advisor role, which is the most valuable role, said Jim Fitzmaurice, Executive Advisor at Corporate Executive Board (CEB), because “the strategic advisor focuses on improving risk-informed strategic decisions.” Fitzmaurice, who advises both CEB Audit Leadership Council and CEB Risk Management Leadership Council, was the first of two speakers at the August 26, 2014 webinar on Black Swans and Reputational Risk sponsored by the Global Association of Risk Professionals. Fitzmaurice began by showing how the evolution of ERM has been a progression in the prominence of its role and a concomitant […]