Barcodes of Finance 3

5. Great, the G20 set up the Financial Stability Board to set things straight. So, what’s the problem? It was thought by all that “regulatory compulsion” at such a global level, overseen by the world’s most prominent collection of leaders of the largest economies, would finally solve the collective action problem that stymied the industry from doing this on their own. Industry members could not justify stepping aside from each firm’s own self-interest in maintaining the status quo. It would be costly to re-engineer legacy systems built in convoluted increments over the previous six decades. Everyone without exception wanted to […]

Barcodes of Finance 2

3. What allowed non-standard transaction date to persist and what was your response? I had spent my whole career in various sectors of finance and as an advisor to many financial institutions as a consulting Partner with PwC, responsible for the Financial Services sector. I saw the same sets of transaction data described differently in each firm, even though they would need to match perfectly between firms in order to confirm the transaction with the counterparty and either receive payment or pay for it. This disorder was managed by delaying the payment until all the details were reconciled, first by […]

Barcodes of Finance 1

After the holidays, Morty was bragging he’d been out to a new, very swanky seafood restaurant. “The maître d’ said they’re planning to bring in seafood barcodes.” I immediately pictured a slab of fish on Styrofoam with the price barcode sticker on it—straight from my local supermarket. “And this is at a high-end place?” I said skeptically. “Yeah, but it’s an identifier code, not a price sticker. It’s so the customer can verify they’re getting what they’re paying for,” he said. “Apparently there’s a big push to identify species, and make the information available.” Talking about fish barcodes reminded me […]

AI Supremacy?

“There is definitely a race for AI going on,” said Keith Furst, Managing Director, Data Derivatives. “You might wonder, is there any hope of catching up if you are not already in the race?” He was one of two speakers at a webinar titled “Artificial Intelligence: Running the Race and Managing the Risks,” sponsored by the Global Association of Risk Professionals (GARP) on October 16, 2018. Furst and Daniel Wagner co-authored the new book AI Supremacy: Winning in the Era of Machine Learning. At the outset, Furst described the process of “cognification” that has been transforming our world. “As everything becomes digitized, […]

A New Landscape

Jay Clayton, the recently appointed chair of the U.S. Securities and Exchange Commission (SEC) under President Trump, has signaled new directions in the enforcement of securities laws. What are the implications for financial risk managers? “There is shift away from ‘broken windows’—trying the smallest cases—and there is no longer a requirement for companies to admit wrongdoing,” said Amy Poster, Managing Principal at Alpha Pacific Strategies. She was the moderator and opening speaker in a four-part webinar panel titled “SEC 2018 Enforcement Trends” sponsored by the Global Association of Risk Professionals (GARP) on July 25, 2018. The SEC appears to be changing its […]

Geopolitical Risk

What’s with Russia and cyber-hacking? How did it happen, and why? Geopolitical risk threatens the very fundamentals of market stability and the world order. The Global Association of Risk Professionals treated its members to a “big picture” risk topic during the webinar on November 1, 2017. Former senior US intelligence officer Jack Thomas Tomarchio, who is now a principal with the Agoge Group, LLC, described the current geopolitical risk due to Russian cyber-attacks. “Russia was declared to be responsible for leaks at the Democratic National Convention in 2016,” Tomarchio said. “The DNC is supposed to be neutral, but the leaks […]

The Dawn of the Mega-Platform

Disruption of the financial sector is just on the horizon, says Haydn Shaughnessy, author and innovation specialist. He presented a webinar on “The Rise of Mega-Platforms and the Risks to Banking” to the Global Association of Risk Professionals (GARP) on May 25, 2016. His books include The Elastic Enterprise, Shift, and (most recently) Platform Disruption Wave. “What are the consequences of the disintegration of industry structures?” Shaughnessy asked. Most people see innovation as trying to get more of something that’s desirable, he said, but they might not understand clearly where they are headed. In short, what is the “big picture” […]

Platform of the Future

What will be the ideal modelling platform of future bankers? It will need to contain key functionalities in model execution, scenario management, and a “risk engine” that will deliver answers for multiple horizons at the loan level. Furthermore, it should implement the most advanced modelling suites, reduce the quants’ time to develop models, and contain simulation capabilities for stress testing and beyond. This bold vision of the future was presented by Martim Rocha, Advisory Business Solution Manager at SAS. He was the second of two presenters at the February 25, 2016, webinar offered by the Global Association of Risk Professionals […]

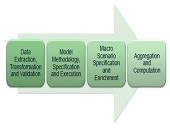

Integrated Data and Modelling

How can today’s bankers prepare for tomorrow’s challenges? Consider the financial models built using available data. Data collection and financial modelling used to be conducted in each different silos of the bank, with credit separate from market, which was separate from treasury and other groups). Then data became “managed” and modelling was moved to “platforms” which did not mix well between the various silos. A few brave souls began to integrate the data management for different groups of the bank. Other brave souls tried to integrate the modelling. This was the phase of integration achieved through batch calculations. Now, the […]

“Not Only The What But The How”

When it comes to financial data for stress testing, there’s a good news-bad news aspect. The good news may be that a bank did not suffer severe financial stress but the bad news is that it will be harder for the bank to model “bad events” if it does not have such data. And banks “will get written up if [the regulators] don’t believe their bad events,” said Tara Heusé Skinner, Manager at SAS Risk Research & Quantitative Solutions, and co-author of The Bank Executive’s Guide to Enterprise Risk Management. She was the first presenter of two at the May […]