Risk Ratings 2. “Hundreds of Spreadsheets”

“There were hundreds of different spreadsheet templates floating around,” said Christopher Hansert, Product Manager at Bosch Software Innovations, and the second of two presenters at a GARP webinar on the impact of new capital rules on risk ratings, held June 24, 2014. He presented a case study of an unnamed US commercial bank. Due to an acquisition during the period of regulatory change, he said that the bank had a “heterogeneous set of platforms, models, and inconsistent ratings. They wanted one robust and centralized” risk rating system. Inconsistencies in the risk rating process increased the likelihood of error, Hansert pointed […]

Risk Ratings 1. The Big Choke Points

“The inter-connectedness of the regulatory landscape has increased dramatically,” said Balachander Lakshmanan, Director at Deloitte & Touche LLP. He was the first of two presenters at the June 24, 2014, webinar sponsored by the Global Association of Risk Professionals to discuss the impact of capital rules on risk rating systems. In the wake of the financial crisis, new regulations—Basel, Volcker rule, Comprehensive Capital Analysis and Review (CCAR)—have proliferated. Due to changes in capital rules, new operating models are starting to emerge at banks, said Lakshmanan. There are requests for “spot calculations” or snapshots of a bank at any given time. […]

Fama-French 2. Three is Now Five?

Fama and French, originators of the three-factor model for asset pricing, are working to understand the fourth factor –and a fifth factor, too, said Marlena Lee, PhD, VP of Dimensional Fund Advisors. She should know; she has worked closely with Nobel laureate Gene Fama and was his former teaching assistant at the University of Chicago Booth School of Business. Lee spoke at the CFA Society Toronto on June 19, 2014, about the evolution of asset pricing. Part 1 summarizes her comments on the dimension of profitability. Could there be another component? As early as 1993 Jegadeesh and Titman had proposed […]

Fama-French Model 1. Three is Now Four

Does the Fama-French three-factor model adequately capture all information available in describing stock returns? According to Marlena Lee, PhD, VP of Dimensional Fund Advisors, the three-factor model is lacking one or two important components. Lee visited the Toronto offices of the CFA Society Toronto on the afternoon of June 19, 2014, to speak to over twenty financial experts about the evolution of asset pricing. Lee was a funny and forthcoming lecturer. After her flight from the States up to Toronto, she said the suspicious Canada Border Services officer asked: “This CFA Society… what does ‘CFA’ stand for?” She momentarily blanked: […]

Counterparty Credit Risk 3. Modelling

“Counterparty credit risk is particularly difficult” to model due to its “bilateral nature” and the fact it often covers more than one year, said Rajan Singenellore, Global Head of the Default Risk and Valuation Group at Bloomberg. He was the third of three presenters at a GARP webinar on counterparty risk held on May 20, 2014. Singenellore divided the challenges to modelling counterparty risk into three categories. The first, the counterparty’s probability of default (PD), depends on multiple factors and requires estimates of recovery. The second category is how to estimate the future value of securities, which depends on the […]

Model Risk 2. Look Beyond the Numbers

What does the near-disaster on London’s Millennium Bridge have to teach us about model risk? “The bridge, inaugurated with great fanfare by the Queen in 2000, filled with people and began to sway so strongly it had to be immediately shut down,” said Ravi Chari, Manager, Americas Risk Practice at the SAS Institute. “When the bridge was modelled during development, the developers did pose the question ‘what is the probability of 10,000 people walking in unison on the bridge?’ And the answer was ‘practically zero’—but that’s exactly what happened on Day One!” Chari was the second of two speakers on […]

Model Risk 1. After the Crisis

The potential sources of error in constructing a model “is the key point in determining how to handle model risk,” said Suresh Gopalakrishnan, Principal, Business Information Management, at Capgemini Financial Services. He was the first of two speakers on the topic of model risk management (MRM) in the post-financial crisis regulatory regime, and was speaking at a webinar organized by the Global Association of Risk Professionals on April 24, 2014. Model risk is very wide-ranging. “What about inadequacies in models?” he asked. “Do they cover black swan events? What about aggregate risk? Is model risk in fact part of operational […]

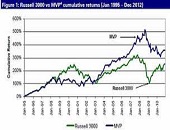

A Low Volatility Equity Strategy

Despite conventional wisdom, “the returns on more volatile equities have not exceeded the historical returns on less volatile equities,” said Grant Wang, Senior Vice-President and Head of Research at Highstreet Asset Management in London, Canada. He was the first of two speakers at the GARP Toronto Chapter meeting held at First Canadian Place at King & Bay, Toronto on the evening of January 30, 2014. Wang began with a brief survey of the increased volatility in equity markets over the past several years: the 2001 tech bubble, the 2008 housing crash, and the 2011 European debt crisis. “VIX has posed […]

Monetary Policy and Treasury Risk Premia: Part 2

After giving an overview (see Part 1), Paul Whelan, of the Imperial College London and formerly the European Central Bank, walked the audience through the mechanics of an award-winning paper on monetary policy at a webinar on January 16, 2014 sponsored by GARP. A shock, by its very nature, is non-routine. Therefore, “a good measure of monetary policy shocks should exclude systematic components,” Whelan said. Another challenge was to “distinguish between quantity of risk versus price of risk channels.” Use of the Taylor rule allowed the researchers to isolate the exogenous dynamics of monetary policy. The trio was able to […]

Monetary Policy and Treasury Risk Premia: Part 1

“Monetary policy makers want to control the long end of the yield curve,” said Paul Whelan at a webinar on January 16, 2014 sponsored by the Global Association of Risk Professionals. Whelan co-authored an article that won the 2013 GARP Award for best paper in financial risk management. “Monetary Policy and Treasury Risk Premia”, by Andrea Buraschi, Andrea Carnelli, and Paul Whelan, provides a quantitative analysis of the effect of monetary policy shocks on future bond returns. Buraschi is at the University of Chicago Booth School of Business and Imperial College London; Carnelli is at Imperial College London; and Paul […]