“Disasters Everywhere”

What is the cost of a disaster? What is the cost of the business cycle? Economically speaking, how do business cycles compare with disasters? The cost of business cycles and the gain to be had from stabilization policy is a highly controversial topic in macroeconomics. Some believe the welfare gains from stabilizing the business cycle are extremely low and therefore not worth the effort. “Depression prevention and stabilization policies are central to the discipline of macroeconomics,” conclude the authors of recent research published by the Federal Reserve Bank of San Francisco. “Extreme and costly events are not the only reason […]

The Value of Data

What is the value of data? Who benefits from data? Can you construct a decent predictive model to manage risk if you have lousy data? Some enterprising souls have tried to sell their data back to the tech giants that collect and use big datasets. There are even some small companies such as CitizenMe and Datum that pay a user for taking a quiz or sending location data. “Data are far from becoming a standardized commodity whose value can readily be established through trades,” writes Diane Coyle, professor at University of Cambridge, in a report she tabled February 26, 2020, […]

Top 5 Trends in Risk Management

The champagne has been drunk, and the New Year has been rung in. What trends are predicted in risk management as we welcome the new decade? “In 2020, we’ll likely see significant changes in risk models, processes and functions,” predicts Brenda Boultwood, Risk Advisory Partner at Deloitte. As a senior expert in risk culture and corporate governance, she published an article online January 10, 2020, for the Global Association of Risk Professionals (GARP). We present the highlights and a link to the full article below. The three lines of defense business model, as we know it, will end This is actually […]

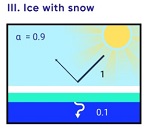

From brown energy to green

How will climate change affect the financial sector and the broader economy? What policy responses will mitigate climate change risks? Recently, the US Federal Reserve Bank (FRB) sponsored the first conference dedicated to exploring the economic and financial risks associated with climate change. “Climate change will have sweeping effects on our economy and financial system,” says the report summarizing the main themes of the conference. The report, released on December 16, 2019, was co-authored by Galina B. Hale, Òscar Jordà, and Glenn D. Rudebusch. Hale is a research advisor and Jordà and Rudebusch are both senior policy advisors at the Federal […]

Machine learning sniffs out corruption

“Bribery and corruption are by-products of risk culture,” said Aparna Gupta, Associate Professor at Lally School of Management at Rensselaer Polytechnic Institute. “We can take a step back and devise methods to detect it using textual data and machine learning.” Gupta was the second of two speakers at the one-hour webinar “Corruption and Corporate Governance” sponsored by the Global Association of Risk Professionals (GARP) on October 30, 2019. Since culture is intangible, empirical work on the relation between risk culture and risk management is limited. Traditional approaches for assessing risk culture have many drawbacks such as bias and lack of comparability. Nonetheless, […]

Winds of Change

“Will the greater intensity of climate change expected in Canada produce a greater impact on Canadian financial institutions, and firms that hold a greater proportion of exposure to Canada in its portfolio?” This was the question posed by Robert Thomas, risk consultant to the non-profit organization Ontario Conservation Now as part of a round table held at the Toronto Public Library on April 18, 2019. A report[1] tabled earlier this month by Environment Canada says that climate change will have a greater effect on Canada than on most countries. The report, Canada’s Changing Climate Report 2019 (CCCR2019), looked at observed […]

Missing the Mark

“In the spring a young man’s fancy lightly turns to thoughts of buying a house,” Morty said, as he put the latest issue of the Financial Analysts Journal on my desk. We don’t often paraphrase Tennyson in the office, so this caught my attention. “You’re not thinking of moving again, are you?” I said. “No, but I always keep my eye on the market,” he said. “You should check out what these economists are saying.” So I did. First I read the FHFA working paper, by the team of Alexander Bogin, William Doerner, and William Larson. “Missing the Mark: Mortgage […]

Wanted: Business Expertise

Artificial intelligence can be expensive and tricky to implement. Is it worth the trouble? Two organizations recently decided to pose the question to those who were working in financial institutions. “Due to budget constraints, a company might not always be able to apply artificial intelligence. But, to those who can, the benefits have become clear,” said Mahdi Amri, Partner and National AI Services Leader, Canada at Omnia, which is the artificial intelligence practice at Deloitte. On January 24, 2019, Amri was the second of two panellists who discussed early results of a joint survey by SAS and the Global Association […]

Operationalizing A.I.

How pervasive is the use of artificial intelligence in the field of financial risk management? What are the key challenges in AI implementation over the next two to three years? These issues were examined in early 2019 via the webinar, Operationalizing AI and Risk in Banking, sponsored by the Global Association of Risk Professionals (GARP). “We found exceptionally high rates of AI usage among survey respondents,” said Katherine Taylor, Senior Data Scientist at the software company SAS. On January 24, 2019, Taylor was the first of two panellists who presented a “sneak peek” at a joint survey by SAS and […]

Not Just the Modelling

The estimation and reporting of credit impairment at banks has led to a brand-new set of guidelines around the current expected credit loss (CECL). What’s a beleaguered banker to do? “For an effective CECL transition, preparation is key,” said Samrah Kazmi, Advisory Industry Consultant for Risk Solutions at SAS. She was the third and final speaker at a webinar titled “CECL: Managing Through the Implementation Headwinds” sponsored by the Global Association of Risk Professionals (GARP) on September 12, 2018. “Most banks think CECL is just about the modelling,” she said, “but it’s also data, systems, and processes.” Begin by identifying the stakeholders, she advised, […]