Data Science 1. Trading Analytics

At the end of the day, what do you produce? If you are a knowledge worker, your “product” could be something as intangible and significant as decisions. That is the thinking behind the “decision factories” discussed in Roger Martin’s seminal Harvard Business Review article. If we labour in decision factories, then we are decision engineers, and our chief raw material is data, according to Nima Safaian, team lead for Trading Analytics at Cenovus Energy. “We need the capacity to produce many good decisions,” he said at the webinar on August 2, 2016, sponsored by the Global Association of Risk Professionals […]

Fast Turnaround of Complex Math

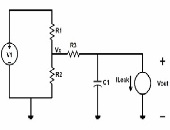

Imagine you are driving your brand-new mini-van, the latest Drake album cranked on high, the windshield wipers at top tempo, and the heater keeping things toasty. You go to switch the headlights to high-beam—and you are suddenly hit by the unmistakable odour of melting circuits…. Not a happy situation. It’s one that automotive designers the world over try to avoid by extensive testing of many different usage scenarios. Problem-solving tools have dramatically changed the way engineers advance their knowledge, for financial, automotive, chemical, and other sectors. Many products and technologies we take for granted—such as the electronic circuitry in a […]

Worst Case Analysis Made Easy

Can symbolic computing improve real-world design? Definitely yes, according to the product development team at the automotive firm Delphi. “Each time the circuits were changed, the electrical equations changed. We turned to symbolic computing so that we could quickly deal with design changes,” said Michael G. McDermott, Senior Development Engineer at Delphi. He was the second speaker in a webinar on May 25, 2016, titled “How Far Can Your Math Knowledge Go?” Lights, heating, movies for kids in the back to watch… Over time, vehicles have come to have more and more elaborate electronics. These can lead to unpredictable stresses […]

The Case for Symbolic Computing

Should you care about symbolic computing? If your work involves concepts that are expressed in math, and if you want to reduce errors and routine work, then Samir Khan says, yes, you should. Khan, Product Manager at Maplesoft, was the first speaker in a webinar on May 25, 2016, titled “How Far Can Your Math Knowledge Go?” “Symbolic computing allows you to automatically derive system equations using well-defined rules,” said Khan. “It allows you to mechanize your work with equations, such as the routine manipulations that are done in algebra.” The traditional design process means the designer (or engineer or […]

War, Kidnapping, Data Theft

War, kidnapping, and data theft: Is it some fiction pot-boiler that’s come over the transom? No, it’s the chapter on how the gross domestic product (GDP) came into being in Germany. Today’s excerpt comes from pages 117-8 of the book The Power of a Single Number: A Political History of GDP by Philipp Lepenies, translated by Jeremy Gaines (Columbia University Press, 2016). “[John Kenneth] Galbraith was surprised by the results of his calculations and surveys because they, for the first time, provided a clear picture of the Nazi economy. Because no set of tools comparable to gross national product calculation existed on […]

Platform of the Future

What will be the ideal modelling platform of future bankers? It will need to contain key functionalities in model execution, scenario management, and a “risk engine” that will deliver answers for multiple horizons at the loan level. Furthermore, it should implement the most advanced modelling suites, reduce the quants’ time to develop models, and contain simulation capabilities for stress testing and beyond. This bold vision of the future was presented by Martim Rocha, Advisory Business Solution Manager at SAS. He was the second of two presenters at the February 25, 2016, webinar offered by the Global Association of Risk Professionals […]

Integrated Data and Modelling

How can today’s bankers prepare for tomorrow’s challenges? Consider the financial models built using available data. Data collection and financial modelling used to be conducted in each different silos of the bank, with credit separate from market, which was separate from treasury and other groups). Then data became “managed” and modelling was moved to “platforms” which did not mix well between the various silos. A few brave souls began to integrate the data management for different groups of the bank. Other brave souls tried to integrate the modelling. This was the phase of integration achieved through batch calculations. Now, the […]

Lagging in Technology Solutions

When it comes to new regulatory requirements for advanced models in financial stress testing, are banks meeting expectations? Over the past two years, relatively good progress has been made in financial models and managing data for stress testing, said Tom Kimner, Director of Global Risk Operations at SAS, “but less progress has been made in technology and reporting.” He was the second of two panellists at a webinar on September 22, 2015, sponsored by the Global Association of Risk Professionals (GARP). He was presenting the findings from a survey report, “Stress Testing: A View from the Trenches,” that was jointly […]

Rising to the Challenge

What kinds of financial institutions are scrambling to comply with new regulatory requirements for financial stress testing? In 2015, the Global Association of Risk Professionals (GARP) conducted its first industry survey to see how banking institutions worldwide were coping with more stringent regulations. They produced a report, “Stress Testing: A View from the Trenches,” and on September 22, 2015, two panellists presented their findings during a webinar to members of GARP. “Institutions on the whole are purposefully addressing the challenges,” said Jeff Kutler, Editor-in-Chief of Risk Intelligence at GARP. “There has been significant progress in data, modeling, and scenario management.” […]

Conference Call Tones. Part 2

Click here to visit Part 1. Interview with S. McKay Price, continued. Q: In the introduction to your paper on textual analysis of conference call tones, you describe a 2012 conference call in which David Einhorn grilled the management team of Herbalife, thereby causing the shares to fall 20 percent in price. Did you run the transcript of this conference call through your call tone algorithm, and if so, was it the most negative sample in the set? 2012 was not in our sample period so we did not specifically create tone measures for that Herbalife call. Although I suppose […]