Risk Units & Risk Accounting

“In the absence of a standardized and universally accepted method of calculating exposure to risk, are accuracy, integrity and timeliness achievable?” asked Peter Hughes, Managing Director, Financial InterGroup (UK). He was the fourth of four panellists to present at the GARP webinar on risk data aggregation held July 22, 2014. Hughes was speaking with reference to the Basel Committee on Banking Supervision (BCBS) article 239, which spells out principles of accuracy, integrity, and timeliness for risk data. There’s a mixed bag of methods used to identify and quantify exposure to risk, Hughes noted. Quantitative modelling, accounting methods, key risk indicators, […]

A Day in the Life: Risk Managers

Financial risk management is a stimulating and worthwhile livelihood, according to four panellists who convened on May 14, 2014, to describe their careers in the industry. A rainy afternoon did not discourage an audience of about sixty risk professionals and students from attending the meeting of the Toronto Chapter of the Global Association of Risk Professionals which was held in the new KPMG offices on Bay Street. Xiaobo Wang, Director of Credit Risk Audit at Scotiabank, acted as the evening’s moderator. He posed several questions to four panellists: the nature of their work, what is a “typical day,” and how […]

Model Risk 1. After the Crisis

The potential sources of error in constructing a model “is the key point in determining how to handle model risk,” said Suresh Gopalakrishnan, Principal, Business Information Management, at Capgemini Financial Services. He was the first of two speakers on the topic of model risk management (MRM) in the post-financial crisis regulatory regime, and was speaking at a webinar organized by the Global Association of Risk Professionals on April 24, 2014. Model risk is very wide-ranging. “What about inadequacies in models?” he asked. “Do they cover black swan events? What about aggregate risk? Is model risk in fact part of operational […]

OTC Market 2. A New Paradigm

“How will errors be handled? That’s the biggest area of discussion with SEFs,” said Bis Chatterjee, Global Head of E-Trading and New Business Development, Credit Markets, at Citigroup Global. SEF refers to a Swap Execution Facility. He was the second of two speakers at a GARP-sponsored webinar, about changes to the over-the-counter (OTC) credit default swaps (CDS) market, held on April 15, 2014. “The market had less time than it would have liked to review various rules of the new guideline,” Chatterjee said, referring to the flurry of market response to the new regulations brought in by the US Commodities Futures […]

Risk Volunteers: Two Profiles

While attending the Toronto chapter of the Global Association of Risk Professionals meetings, we at TextMedic notice a few dedicated volunteers doing everything from handing out name badges to introducing guest speakers. Of course, that’s just the tip of the iceberg—these folks also do a lot of unseen labour such as holding organizational meetings and composing e-mail broadcasts and twisting arms of reticent (and busy) subject matter experts. Thanks to the local chapter, TextMedic has reported in the past on live events about things like pension plan risk, a low volatility equity strategy, and risk data aggregation and reporting. Since National […]

A Successful Operational Risk Program 2. Purpose

“The purpose of the framework is to provide business value,” said Philippa Girling, Commercial Business Chief Risk Officer at Capital One and author of Operational Risk Management: A Complete Guide to a Successful Operational Risk Framework. She was the second of two presenters at a GARP-sponsored webinar on April 8, 2014 that attracted about 2,000 registrants. “Good governance drives good behaviour,” said Girling, noting that the standards of Basel II have now become the de facto standard. Operational risk is “about anything that can go wrong” that’s not market or credit risk. “People make mistakes, systems fail, policies fail” plus […]

A Successful Operational Risk Program 1. Framework

“A clear strategic direction of your company should help formulate clear business objectives, understood by all stakeholders, including employees,” said Brenda Boultwood, SVP, Industry Solutions at MetricStream. An operational risk may be seen as something, together with credit or market risks, which impedes “achieving those business objectives” and includes IT risk, HR risk, and reputation risk. MetricStream is a provider of Governance, Risk, Compliance (GRC) management software and consulting. Boultwood was the first of two presenters at a GARP-sponsored webinar on April 8, 2014 that attracted about 2,000 registrants. Operational risk has evolved from conceptual to strategic, and is now […]

Trading Book Capital: Repercussions of a Revised Framework

“Currently, there’s a large gap between models and the standardized approach. [The members of the Basel Committee] are trying to bring these back into line,” said Patricia Jackson, Head of Financial Regulatory Advice at EY (formerly known as Ernst & Young). She was the second of two speakers at a GARP-sponsored webinar on recently proposed changes to the trading book capital requirements. Strengthening the boundary between the banking book and the trading book “could have a significant impact,” Jackson said, because it will be harder to move positions. The change was made “to reduce arbitrage opportunities for placement with respect […]

Basel, the Big Picture: Tackling Risk Aggregation & Reporting. Part 1

“It’s a quality piece of work that lays out the road ahead,” said Donna Howe, professor of finance at Brandeis International Business School. She was the first of two speakers at a webinar to discuss the 2013 Basel paper, Principles for Effective Aggregation and Reporting of Risk Data. The webinar was sponsored by the Global Association of Risk Professionals. Besides governance, Howe noted the 14 principles described in the paper expressed four main themes: completeness, accuracy, timeliness, and adaptability. Completeness of risk reporting is necessary, but “it becomes very easy to lose the nuance” when the data are too numerous […]

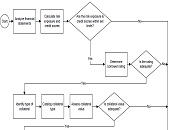

Credit Workflow Optimization: A Practical Approach

“How can an institution practically approach credit workflow when it might not be streamlined? How can we optimize existing processes?” These questions were posed by Justin Huhn, Credit Assessment & Origination Practice Leader at Moody’s Analytics Enterprise during a webinar arranged by the Global Association of Risk Professionals on September 24, 2013. Huhn noted that, as of Q1 2013, there were over seven thousand insured commercial banks and savings institutions in the US excluding foreign branches. These financial institutions tend to develop silos of expertise. Workflow optimization is of pressing concern to many. In 2008 the American Bankers Association estimated […]