“Currently, there’s a large gap between models and the standardized approach. [The members of the Basel Committee] are trying to bring these back into line,” said Patricia Jackson, Head of Financial Regulatory Advice at EY (formerly known as Ernst & Young). She was the second of two speakers at a GARP-sponsored webinar on recently proposed changes to the trading book capital requirements.

Strengthening the boundary between the banking book and the trading book “could have a significant impact,” Jackson said, because it will be harder to move positions. The change was made “to reduce arbitrage opportunities for placement with respect to the boundary.”

The proposed changes prescribe a variety of liquidity horizons, because the financial crisis proved some positions were illiquid for years. Thus, the trading book must allow for longer regulatory horizons.

Jackson emphasized that it was “extremely important” that firms give feedback to the quantitative impact study (QIS) that will assess the proposed changes. She went on to provide a summary of the major impacts expected.

There will “most likely” be an increase in required capital overall. The methodology of the standardized approach will become “more complex.” Supervisory oversight will be increased, and will become more granular.

There are expanded disclosure and transparency requirements. “Banks must disclose standardized results, information on desk structures, and results of back-testing,” she noted.

The changes will all add up to increased operational complexity.

These are significant effects, and that is why it is so important for those firms affected to have input to the QIS. Yet, she pointed out there are major “implementation challenges,” which will be exacerbated by the very tight timeframe for the QIS. (For the defined regulatory portfolio, that deadline is April 2014; for the total trading book, it is October 2014.)

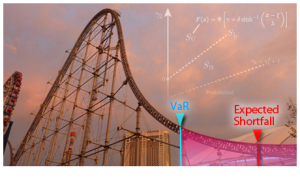

In part, it’s difficult to prepare for the QIS because the new measure, expected shortfall, is different than the old measure, value at risk (VaR), that was previously used. Jackson contrasted the pros and cons of expected shortfall. On the plus side, it’s a more conservative estimate, and it’s more sensitive to the entire distribution of the tail, and is calculated with a rolling time period. On the minus side, it is “more opaque” and “less easily back-tested” than VaR.

Methodology changes and four additional time horizons may be tricky to implement at some firms, in part because they have new data requirements as well, Jackson said.

Methodology changes and four additional time horizons may be tricky to implement at some firms, in part because they have new data requirements as well, Jackson said.

The revised standardized approach “must decompose into cash flows” and the firm must be able to allocate notional positions.

Jackson said most EY clients were expecting an increase of between 100 to 200 percent in capital requirements. Pro-cyclicality will be intensified. She predicted a retreat from illiquid holdings.

There could be surprising effects from the mandatory disclosure, as the industry begins to fixate on the standardized approach. There will be less incentive to develop models. “This would drive business decisions that would optimize standardized capital,” which is not a true reflection of the risk to capital. And ultimately that could lead to poor business decisions. ª

Click here to go the first presentation. ª

The webinar presentation slides can be found at: http://event.on24.com/r.htm?e=733545&s=1&k=E508DFF3B1FABD225A5E6F3144E9764B