Cyber Risks: 5 Core Capabilities

Integration of cybersecurity into an organization’s risk management framework is “still in the hunter-gatherer state,” said Yo Delmar, VP, Governance Risk & Compliance (GRC) at MetricStream. She was the second of two presenters at the December 16, 2014, webinar on cybersecurity organized by the Global Association of Risk Professionals. Cyber risks are currently incorporated into existing risk management and governance processes in an ad hoc fashion that is “unorganized and fragmented,” Delmar said. “There is quite a bit of work to do to get to a rationalized state” that would permit management of such risks. “Most companies have the vision […]

Public vs Private Banks in India and China

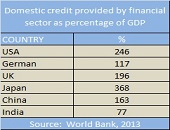

“Public sector banks perform worse than private banks In India whereas there is no significant performance difference for the two sectors in China,” said Dr. Rajan Singenellore, Global Head of the Default Risk and Valuation Group at Bloomberg. He gave an overview of operational performance and credit risk trends in Banking in Emerging Markets, and was the third of three webinar panellists on November 20, 2014, organized by the Global Association of Risk Professionals. For both countries, Singenellore compared government-owned banks with private sector banks. The terminology is different: India has public sector undertakings (PSU) banks whereas China has state-owned […]

“Expect More Niche Customer Targeting”

In India and China, “large state-owned banks often have a significant constraint on their ability to manage liabilities,” said Professor Moorad Choudhry from the Department of Mathematical Sciences at Brunel University and author of Principles of Banking. He was the second of three panellists at the webinar Banking in Emerging Markets held on November 20, 2014, organized by the Global Association of Risk Professionals, and his role was to describe “operational realities.” The 2018 advent of new Basel III rules for capital and liquidity requires 100 percent compliance with new rules on the liquidity coverage ratio (LCR) and the net […]

“Lending Will Be Marketing Gimmick”

What will be the effect of Basel III on banks in emerging markets? “Commercial banks will become less interested in providing loans,” said Dr. Michael C. S. Wong, the first panellist in a webinar on Banking in Emerging Markets held November 20, 2014, and sponsored by the Global Association of Risk Professionals. He is Associate Professor of Finance at City University of Hong Kong, and Chairman at CTRISKS Rating. Wong summarized the challenges of the new Basel III regulatory regime, with its tougher capitalization and liquidity requirements. A global systemically important bank (G-SIB) will have additional capital and cash-holding requirements, he said, […]

Tracking the Elusive Black Swan

Enterprise risk management (ERM) requires a “robust framework design and collaborative approach to capture a black swan event before its occurrence,” said Brenda Boultwood, Senior Vice President of Industry Solutions at MetricStream. She was the second of two speakers at the GARP-sponsored webinar on Black Swans and Reputational Risk held on August 26, 2014. Black swan events are “close to impossible to estimate impact and likelihood,” such as the Japan 2011 tsunami, or Hurricane Katrina. The complexity of these types of risk “requires that we focus on what is most important” in strategic risk management, said Boultwood, naming four principal areas: […]

Risk Units & Risk Accounting

“In the absence of a standardized and universally accepted method of calculating exposure to risk, are accuracy, integrity and timeliness achievable?” asked Peter Hughes, Managing Director, Financial InterGroup (UK). He was the fourth of four panellists to present at the GARP webinar on risk data aggregation held July 22, 2014. Hughes was speaking with reference to the Basel Committee on Banking Supervision (BCBS) article 239, which spells out principles of accuracy, integrity, and timeliness for risk data. There’s a mixed bag of methods used to identify and quantify exposure to risk, Hughes noted. Quantitative modelling, accounting methods, key risk indicators, […]

A Day in the Life: Risk Managers

Financial risk management is a stimulating and worthwhile livelihood, according to four panellists who convened on May 14, 2014, to describe their careers in the industry. A rainy afternoon did not discourage an audience of about sixty risk professionals and students from attending the meeting of the Toronto Chapter of the Global Association of Risk Professionals which was held in the new KPMG offices on Bay Street. Xiaobo Wang, Director of Credit Risk Audit at Scotiabank, acted as the evening’s moderator. He posed several questions to four panellists: the nature of their work, what is a “typical day,” and how […]

Model Risk 1. After the Crisis

The potential sources of error in constructing a model “is the key point in determining how to handle model risk,” said Suresh Gopalakrishnan, Principal, Business Information Management, at Capgemini Financial Services. He was the first of two speakers on the topic of model risk management (MRM) in the post-financial crisis regulatory regime, and was speaking at a webinar organized by the Global Association of Risk Professionals on April 24, 2014. Model risk is very wide-ranging. “What about inadequacies in models?” he asked. “Do they cover black swan events? What about aggregate risk? Is model risk in fact part of operational […]

OTC Market 2. A New Paradigm

“How will errors be handled? That’s the biggest area of discussion with SEFs,” said Bis Chatterjee, Global Head of E-Trading and New Business Development, Credit Markets, at Citigroup Global. SEF refers to a Swap Execution Facility. He was the second of two speakers at a GARP-sponsored webinar, about changes to the over-the-counter (OTC) credit default swaps (CDS) market, held on April 15, 2014. “The market had less time than it would have liked to review various rules of the new guideline,” Chatterjee said, referring to the flurry of market response to the new regulations brought in by the US Commodities Futures […]