Risk Intelligence for Value Creation: Part 2. The New Efficient Frontier

“Risk intelligence is the new efficient frontier,” said Philippe Carrel, author of The Handbook of Risk Management: Implementing a Post-Crisis Corporate Culture (2010) [Cover shown]. He was the second of two speakers on May 28, 2013 at a webinar organized by the Global Association of Risk Professionals (GARP). He went on to explain the connection between risk-adjusted performance and the elaborate information network that is “risk intelligence.” “Balancing shareholder’s value with risk exposure depends on a firm’s assessment of its aggregate sensitivity to risk and its ability to act on it,” Carrel said. “A firm builds its corporate memory as […]

Risk Intelligence for Value Creation: Part 1. The Levers in the Cockpit

The strategic focus of financial executives and institutional investors must be risk intelligence, not just risk management, according to Leo Tilman, President of Tilman & Company, author, and adjunct professor of finance at Columbia University. He was the first speaker on May 28, 2013 at a webinar organized by the Global Association of Risk Professionals (GARP). In the words of Peter Drucker, institutional investors must understand “the future that has already happened.” Tilman said investors need to have a vision for growth and relevance in the low growth, low return environment post-2007. “Does a firm have a holistic framework for […]

How New Regulations Are Breaking Down Silos. Part 1: Stress Testing

“Financial regulators have introduced stress testing as a means to cut across silos,” said Dan Travers, VP of Product Management, Adaptiv at SunGard and the opening speaker at a GARP webinar on May 21, 2013. Historically, he noted, financial risk has been treated as a set of separate units (or silos) across the main types of risk: credit, market, operational, and liquidity risk, the latter connected to asset-liability management (ALM). The new reporting demands of Basel III and Dodd-Frank serve to break down silos, Travers said, with such things as incremental risk charge being reported as capital percentage for the […]

Evolution of the OTC Swaps Markets. Part 2: Lessons Learned

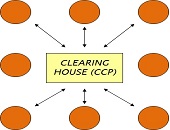

The scramble to meet the Phase 1 deadline of new regulations on swaps “was a significant learning experience,” said Bis Chatterjee, Global Head of E-Trading, Credit Markets at Citi. He was the second speaker in a webinar panel organized by the Global Association of Risk Professionals (GARP) on May 14, 2013. The deadline that came into effect March 11, 2013 pertained to the Dodd-Frank Act governing over-the-counter (OTC) swaps. (Two more phases will follow; see Part 1 for details.) There were challenges first of all, Chatterjee said, in the self-identification of market participants in Phase 1. Second, even if you […]

Spotting Signs of Poor Corporate Governance. Part 2: ESG Management

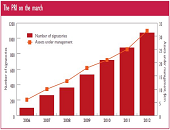

Corporate governance is only one part of an overall phenomenon known as “ESG management,” or how a company handles environmental, social, and corporate governance (ESG) issues. “Research shows that companies that disclose more ESG information are more likely to enjoy a lower cost of capital,” said Max Zehrt, Senior Manager at Sustainalytics. He was addressing a noon-hour seminar of financial analysts and portfolio managers on the subject of corporate governance on May 8, 2013 at the offices of the CFA Society Toronto. His talk was the second part of a two-speaker panel moderated by Toby Heaps of Corporate Knights. Zehrt was […]

Measuring the ROI of GRC. Part 1: “Your Mileage May Vary”

When looking at the return on investment (ROI), “it’s not about getting the highest number—it’s what is most defensible,” said Hyoun Park, Principal Analyst at Nucleus Research. Park was speaking on March 28, 2013 to a webinar audience on the topic of how to quantitatively measure the ROI on governance, risk assessment, and compliance (GRC). The two-speaker panel, convened by the Global Association of Risk Professionals (GARP), based their remarks on a study released in October 2012 by Nucleus Research (cover shown here). The report states “this research was conducted in context of the usage of IBM OpenPages, a software […]

Managing Model Risk: Part 3. Collective Hubris

There are more things in heaven and earth, Horatio, Than are dreamt of in your philosophy. – Wm. Shakespeare, Hamlet, Act 1, Scene 5. “We are building the language in which to discuss model risk,” said Boris Deychman, Director of Model, Market and Operational Risk Management at RBS Citizens Financial Group. He drew an analogy with the world of wine experts, who have developed specific vocabulary to talk about aroma and taste. “They don’t say just: this tastes like wine.” Deychman was the third and final speaker of a panel invited by the Global Association of Risk Professionals to discuss […]

Risk-Adjusted Performance Measurement. Part 1: Mind the Expectations

“The guiding principles for risk control,” said Carl Bacon, CIPM, Chairman of Statpro, and former Director of Risk Control and Performance at F&C Investment Management Ltd, “are integration and confidence in data.” Bacon was in Toronto on September 17, 2012 to deliver a one-day workshop on risk-adjusted performance measurement to about a dozen members of the CFA Society Toronto as part of the Society’s continuing education program. He is the author of Practical Portfolio Performance Measurement & Attribution, which went into its second edition in 2008. Performance measurement is the calculation of portfolio return for purposes of comparison against a […]

Uncontrolled Risk

Uncontrolled Risk: The Lessons of Lehman Brothers and How Systemic Risk Can Still Bring Down the World Financial System by Mark T. Williams 220 pp., not including 27 pp of Appendix, Notes, and Index (Reprinted from The Analyst, March 2011 issue.) On September 15, 2008, the 158-year-old investment bank, Lehman Brothers, filed for bankruptcy, thereby unleashing a horde of systemic risk effects that continue to bedevil the financial system. In this recently-published investigation into how the collapse of one iconic institution contaminated an entire sector, Mark T. Williams draws some sobering lessons. In the 1990s, author Mark T. Williams worked […]