Robo-Advisors

What does the client want to see on the landing page of an automated wealth management website? Four panellists at the digital wealth management (a.k.a. robo-advisor) session of the Financial Technology conference held on June 17, 2016, had theories on how to connect with clients. The session was part of a one-day conference organized by the CFA Society Toronto and was held at the Toronto Board of Trade. Three of the panellists showed screen shots from their companies’ websites and spoke about underlying philosophies on client usage; the fourth panellist works for a company that provides “back end”, namely, the […]

Catch a Falling Knife. Part 1

Who is taking advantage of the downturn in crude oil prices? “Most E&P assets are no longer economic to drill at today’s commodity prices,” said Curtis Flood, Vice President at the investment banking firm Evercore. He was the first of two speakers at a webinar “Catch a Falling Knife: Financial Repercussions of Current Crude Oil Prices” sponsored by the Global Association of Risk Professionals on June 7, 2016. (E&P refers to exploration & production, also known as the upstream petroleum industry.) The downturn in oil & gas prices is “the result of simple economics” caused by the “shale revolution” leading […]

Investing in Emotional Assets

When Morty discovered my vacation plans this year included Cremona, that put a bee in his bonnet. Did I know it was the home of the famous Stradivarius workshop? Was I going there to check out violins? Yes and no, I said. My preference was to cycle along the Po valley and sip espresso near the Zodiac Tower. “Maybe you should think twice about your visit,” Morty said. “I happen to have it on good authority that beautiful collectibles can be a solid component of your portfolio.” “Please Morty, don’t make wild-eyed guesses about other people’s money,” I said. Especially […]

Fama-French 2. Three is Now Five?

Fama and French, originators of the three-factor model for asset pricing, are working to understand the fourth factor –and a fifth factor, too, said Marlena Lee, PhD, VP of Dimensional Fund Advisors. She should know; she has worked closely with Nobel laureate Gene Fama and was his former teaching assistant at the University of Chicago Booth School of Business. Lee spoke at the CFA Society Toronto on June 19, 2014, about the evolution of asset pricing. Part 1 summarizes her comments on the dimension of profitability. Could there be another component? As early as 1993 Jegadeesh and Titman had proposed […]

Fama-French Model 1. Three is Now Four

Does the Fama-French three-factor model adequately capture all information available in describing stock returns? According to Marlena Lee, PhD, VP of Dimensional Fund Advisors, the three-factor model is lacking one or two important components. Lee visited the Toronto offices of the CFA Society Toronto on the afternoon of June 19, 2014, to speak to over twenty financial experts about the evolution of asset pricing. Lee was a funny and forthcoming lecturer. After her flight from the States up to Toronto, she said the suspicious Canada Border Services officer asked: “This CFA Society… what does ‘CFA’ stand for?” She momentarily blanked: […]

8 Things About a Winning Team

“Our firm is kind of like a teaching hospital,” said Kim Shannon, President, Founder and CIO of Sionna Investment Managers. The second part of her presentation to the CFA Society Toronto at the National Club on March 5, 2014, described what she looks for in her employees, and how the team works. Below are eight insights on selecting and retaining top talent. Grow their own – Shannon noticed early on that the most successful investment firms grew their own talent, namely, they hired junior employees and trained them over a period of years for senior positions. Greed is not good – […]

The Value Proposition

“I believe financial statements are as much marketing documents as statements of fact,” said Kim Shannon, President, Founder and Chief Investment Officer of Sionna Investment Managers. She was addressing a crowd of analysts and financial managers at a breakfast meeting organized by the CFA Society Toronto on March 5, 2014, in the historic National Club. The first part of Shannon’s presentation tied in directly with her new book, The Value Proposition. Shannon wrote 80 pages of the first draft, and then stopped while she established the company and guided it through the next decade (which included the 2008 financial crisis). Years […]

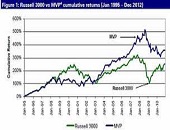

A Low Volatility Equity Strategy

Despite conventional wisdom, “the returns on more volatile equities have not exceeded the historical returns on less volatile equities,” said Grant Wang, Senior Vice-President and Head of Research at Highstreet Asset Management in London, Canada. He was the first of two speakers at the GARP Toronto Chapter meeting held at First Canadian Place at King & Bay, Toronto on the evening of January 30, 2014. Wang began with a brief survey of the increased volatility in equity markets over the past several years: the 2001 tech bubble, the 2008 housing crash, and the 2011 European debt crisis. “VIX has posed […]