Climate Risk Survey

Investors continue to ask for more investment strategies that target environment and sustainability. When it comes to capability to manage financial risks due to climate change, how far along are firms in addressing the issues? The second annual global survey of climate risk management at financial firms, sponsored by the Global Association of Risk Professionals (GARP), was presented in a webinar on September 22, 2020. The report is co-authored by Jo Paisley, Co-President, and Maxine Nelson, Senior Vice President at GARP. Paisley began by taking a quick poll of the audience, chiefly GARP members. “Why are you interested in the […]

ESG disclosures: apples vs oranges

When it comes to environmental, social, and governance (ESG) funds, do you feel like we are still comparing apples with oranges? Isn’t it time for a global voluntary standard? “There’s been an explosion of interest in ESG investing, but the inconsistency in ESG-related disclosures could lead to an erosion of trust in the industry,” said Deborah Kidd, who is a director with the Global Industry Standards (GIPS). She was the first of two panelists who presented a consultation paper on “ESG Disclosure Standards for Investment Products” at a webinar titled “Improving Transparency and Comparability of Investment Products with ESG-related Features” […]

Psychology of Money

In 2009, award-winning journalist Morgan Housel was awash in information about the 2008 financial collapse. Yet, try as he might, he could not find the answer to the question: “Why did people behave the way they did?” This is what led him to start formulating notes for what became a blog, and eventually a book titled The Psychology of Money: Timeless lessons on wealth, greed, and happiness (Harriman House, 2020). The book was launched on September 8. “What is a person’s relationship with greed and fear? The psychological side of investing is the most important side,” Housel said, “because if you […]

Investing in the greater good

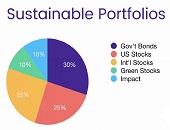

Every day, more investors are converting their portfolios to socially responsible investing (SRI). But does being a socially responsible investor mean you will take a hit on performance? “Over the last five years, responsible investments have done at least as well as the traditional portfolio,” said Tim Nash, a fee-for-service financial planner who spoke at the webinar “Investing in the Greater Good” on August 18, 2020, sponsored by Questrade. Nash is the founder of Good Investing and blogs as The Sustainable Economist. He is also the lead researcher for Ethical Markets Green Transition Scoreboard research report, which details more than […]

Quality in the time of Covid

There’s a wide range of “quality factor” investing out there. How can the investor distinguish between the variety of methods? More importantly, how can the investor select the best factor method for given economic conditions? To answer this question, a recent paper compared the variety of methods, and examined how each method performed under different market conditions. The paper, “What is Quality?”, by Jason Hsu, Vitali Kalesnik, and Engin Kose, won the Graham & Dodd 2020 award for the best paper published in the Financial Analysts Journal in 2019. To celebrate the achievement, the journal invited the authors of the […]

Private Equity in “the new normal”

From pandemic to protectionism, global events and trends are having an impact on the private equity (PE) markets. From a Canadian perspective, what effect are these issues having on the alignment between PE investors and PE fund managers? In Toronto on July 9, 2020, Helen Pham welcomed three panellists to the webinar titled, “Private Market Trends: Improving Alignment Between Investors and Managers.” The webinar was organized by the institutional asset management committee of the CFA Society Toronto. The panellists shared their thoughts on how investors should view effects of the global pandemic on private equity markets and the associated risks […]

A Tale of Two Funds

There are helpful and unhelpful models for determining risk-based profit attribution, according to Michael B. Miller, founder and CEO, Northstar Risk. This is part 2 of his explanation about how to attribute financial performance, given at a webinar sponsored by the Global Association of Risk Professionals on June 20, 2018. Miller gave an example of two funds. Fund A contains both long and short assets, is market neutral and generates positive alpha. Fund B is a macro fund that is market dependent and whose manager is correct 54 percent of the time. The returns of Funds A and B look very […]

Risk-Based Profit Attribution

“Even the best portfolio managers have bad years due to macroeconomic factors beyond their control,” said Michael B. Miller, founder and CEO, Northstar Risk, to an audience of financial risk professionals. This is Part 1 of his talk about how to attribute performance for financial management at a webinar sponsored by the Global Association of Risk Professionals on June 20, 2018. “We tend to view measurement of risk and performance as separate tasks, but performance can only be fully understood by taking risk into account,” Miller said. Performance is always evaluated relative to something else, such as “the market”—which commonly taken […]

Robo-Advisors

What does the client want to see on the landing page of an automated wealth management website? Four panellists at the digital wealth management (a.k.a. robo-advisor) session of the Financial Technology conference held on June 17, 2016, had theories on how to connect with clients. The session was part of a one-day conference organized by the CFA Society Toronto and was held at the Toronto Board of Trade. Three of the panellists showed screen shots from their companies’ websites and spoke about underlying philosophies on client usage; the fourth panellist works for a company that provides “back end”, namely, the […]

Catch a Falling Knife. Part 1

Who is taking advantage of the downturn in crude oil prices? “Most E&P assets are no longer economic to drill at today’s commodity prices,” said Curtis Flood, Vice President at the investment banking firm Evercore. He was the first of two speakers at a webinar “Catch a Falling Knife: Financial Repercussions of Current Crude Oil Prices” sponsored by the Global Association of Risk Professionals on June 7, 2016. (E&P refers to exploration & production, also known as the upstream petroleum industry.) The downturn in oil & gas prices is “the result of simple economics” caused by the “shale revolution” leading […]