A Successful Operational Risk Program 2. Purpose

“The purpose of the framework is to provide business value,” said Philippa Girling, Commercial Business Chief Risk Officer at Capital One and author of Operational Risk Management: A Complete Guide to a Successful Operational Risk Framework. She was the second of two presenters at a GARP-sponsored webinar on April 8, 2014 that attracted about 2,000 registrants. “Good governance drives good behaviour,” said Girling, noting that the standards of Basel II have now become the de facto standard. Operational risk is “about anything that can go wrong” that’s not market or credit risk. “People make mistakes, systems fail, policies fail” plus […]

Volcker Rule Implementation 2. Proprietary Trading

The provisions of the Volcker Rule mean that banks are “turning their attention to difficult decisions that must be made,” said Anna Pinedo, Partner at Morrison & Foerster and the second of two speakers during a GARP webinar on April 1, 2014. The Volcker Rule defines proprietary trading as a bank “engaging as principal for” its own “trading account” in a “purchase or sale of one or more financial instruments,” including derivatives, noted Pinedo. Pinedo reviewed the financial instruments that must be assessed for compliance with the new rule. “A lot of our clients itemized and inventoried products to determine […]

Volcker Rule Implementation 1. Assess Yourself

“The Volcker Rule is a negative rule, namely, you are guilty until you prove yourself innocent,” said Robert Lendino, Associate General Counsel at BB&T, and the first of two speakers during a webinar hosted by GARP on April 1, 2014. “And the proof must be furnished by the bank’s compliance group.” The Volcker Rule, drafted in the aftermath of the 2008 financial crisis and approved December 10, 2013, prohibits banking entities from engaging in proprietary trading, and from having ownership in, or acting as sponsors to, certain commodity pools, hedge funds, and private equity funds. [Note: for readability the remainder […]

Fixing Broken Windows 4. Reducing Exposure To Investigations

“Staff training on policies and procedures is critical,” said Luke Cadigan, “to reduce exposure to insider trading investigations.” Cadigan, a partner in the Government Enforcement Group at law firm K&L Gates, was the final speaker in a four-part webinar on “Fixing Broken Windows” organized by GARP on March 11, 2014. Cadigan emphasized the message of the past three speakers, namely, that the Securities and Exchange Commission has become much more focussed on catching financial wrongdoing—from the lowest levels up. Investigations take time and effort and can be costly, thus, firms “want to convince the SEC staff there’s nothing there they […]

Fixing Broken Windows 3. Operation Perfect Hedge

The past seven years of Operation Perfect Hedge have been a “whirlwind,” said David Chaves, Securities Program Coordinator of the Federal Bureau of Investigation. He was the third speaker in the four-part webinar panel on March 11, 2014, “Fixing the Financial Industry’s Broken Windows,” sponsored by GARP. The undercover operation was born in 2007, amid the confluence of several factors that produced the financial crisis. At the time, there were a couple of “pump and dump” schemes but the FBI “couldn’t put anyone in,” Chaves said. Two individuals were identified by the Securities and Exchange Commission through market analysis. “Those […]

Fixing Broken Windows 2: How to be there when you’re not really there

“With only 4200 employees, the SEC must rely on force multipliers”, said Valerie Szczepanik, Assistant Director of the Asset Management Unit, Division of Enforcement, Securities and Exchange Commission. She was the second of four panellists at the GARP webinar “Fixing the Financial Industry’s Broken Windows” held on March 11, 2014. SEC Chair Mary Jo White has emphasized the SEC must be everywhere and appear to be everywhere, said Szczepanik, who outlined six factors helping the SEC carry out its mission in the face of increasing complexity in the financial world. The SEC is increasing its collaboration with other regulators and […]

Fixing Broken Windows 1. Game Changers and Whistleblowers

There is renewed focus on “pursuing small violations to prevent a culture where laws are not viewed as toothless guidelines,” said Amy Poster, Director for Risk and Regulatory Advisory Services at C & A Consulting LLC. She was the opening speaker in a four-part webinar panel titled “Fixing the Financial Industry’s Broken Windows” sponsored by GARP on March 11, 2014. Poster opened with a quote from a speech by Mary Jo White, Securities and Exchange Commission Chair: “The theory is that when a window is broken and someone fixes it – it is a sign that disorder will not be […]

Commercial Credit Analytics 2: A Missed Opportunity

Many banks are wasting the loans data they capture, according to David O’Connell, Senior Analyst, Aite Group, a financial services consulting group. This posting summarizes the second half of his webinar organized by the Global Association of Risk Professionals on February 20, 2014. O’Connell contrasted marketing teams with underwriting teams. Marketing teams use predictive analytics to decide which customers are most likely to respond to certain campaigns. They are very forward-thinking in devising the “customer next best action,” he said. O’Connell encouraged the credit and underwriting teams to have a similar outlook—to also make use of predictive analytics to determine “borrower […]

Commercial Credit Analytics 1: Under-utilized Tools

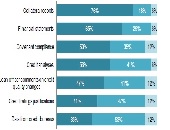

“There is a surprising under-utilization of common tools,” said David O’Connell, Senior Analyst, Aite Group, a financial services consulting group, during a webinar organized by the Global Association of Risk Professionals on February 20, 2014. He was referring to a survey by Aite Group of about twenty North American commercial loan underwriting professionals (responses as at quarter end Q3 2012). O’Connell characterized the under-utilization as “surprising” because loan underwriting is such an important part of banking. O’Connell was formerly a loan underwriting and loans officer, and was clearly familiar with the details of commercial lending and its role in “Banking […]

Trading Book Capital: Repercussions of a Revised Framework

“Currently, there’s a large gap between models and the standardized approach. [The members of the Basel Committee] are trying to bring these back into line,” said Patricia Jackson, Head of Financial Regulatory Advice at EY (formerly known as Ernst & Young). She was the second of two speakers at a GARP-sponsored webinar on recently proposed changes to the trading book capital requirements. Strengthening the boundary between the banking book and the trading book “could have a significant impact,” Jackson said, because it will be harder to move positions. The change was made “to reduce arbitrage opportunities for placement with respect […]