Global Challenges in Chemicals & Energy: Standardizing & Accelerating R&D

“The iPhone of experimental chemistry” standardizes and simplifies experimental chemistry in a paradigm-shifting manner, according to Michael Schneider, SVP of Chemspeed Technologies, and the holder and author of more than 30 publications and patents. He was delivering a presentation on March 19, 2013, through a webinar organized by Chemical & Engineering News (C&EN). “The iPhone of experimental chemistry” is based on a sleek desk-sized compartment that apportions chemicals in ”1-2-5” money analogously staggered (but in mmoles instead of cents) , ready-to-apply formats. It dramatically simplifies the experimental work in a multitude of “applications” in traditional experimental lab work and/or as […]

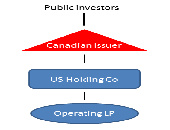

Foreign Asset Income Trusts

“Income trusts should be viewed as a story in capital markets innovation,” said Jon Northup of Goodmans LLP. He was speaking at a luncheon at the National Club in Toronto, sponsored by the Chartered Financial Analysts (CFA) Society Toronto on March 5, 2013. The introduction of SIFT (Specified Investment Flow-Through) rules by the Canadian government in October 2006, “effectively eliminated Canadian income trusts,” Northup said. There are two exceptions: (1) a trust that does not involve Canadian real estate, immovable or resource properties used in carrying on a business and (2) a trust that qualifies as a REIT (real estate […]

The Fed, Foreign Banks and Basel III: Part 3. Necessary Complexity?

As the US moves to adopt Basel III, there are regulatory initiatives that are expected to be implemented, said Peter Went, VP, Banking Risk Management Programs, GARP, on February 14, 2013. The Basel Committee has several proposals that are issued for consultation and discussion, including ones that affect liquidity rules, the securitization framework, trading book review, and consistency of risk-weighted assets. Went was the second speaker at a webinar organized by the Global Association of Risk Professionals (GARP) regarding regulatory reform of foreign banking operations (FBOs) in the United States and the implementation of the Basel III framework. (This continues […]

The Fed, Foreign Banks and Basel III: Part 1. A Long Hard Look

Foreign banking operations (FBOs) in the United States are about to face a whole new set of regulations that may dampen their enthusiasm for US-based operations, according to a February 14, 2013 webinar organized by the Global Association of Risk Professionals (GARP). “The Fed observed over time that US branches were increasingly used to fund the home office operations,” said Charles Horn, partner at Morrison Foerster, who was the first speaker at the panel. Other concerns of the Federal Reserve Board are the increased complexity of FBOs, and “the availability of home country financial resources for branch offices.” The goal, […]

US Implementation of Basel III. Part 2: The GPS for the Journey

On July 24, 2012, Peter Went, VP Banking Risk Management Programs at GARP, summarized the changing landscape of Basel III from a US perspective. First he outlined the deadlines and proposed changes; Part 1 of this posting covers these for the standardized approach. Financial institutions adhering to the advanced approach, Went said, must follow the Basel III counterparty credit risk rules. In some cases, correlations between asset values must be increased. A distinction will be made between securitization and resecuritization. [Ed. Note: To this, we say, “high time.” See, for example, Hull & White’s award-winning article in Financial Analysts Journal, […]

US Implementation of Basel III. Part 1: A Long and Winding Journey

The long and winding US route to Basel implementation has been more difficult and circuitous than the route for European banks. Peter Went, VP Banking Risk Management Programs at GARP, delivered a webinar update on the Basel III leg of the journey on July 24, 2012. First, Went summarized the deadlines. Several sequential proposals have been issued by the US prudential agencies: the OCC, FRB, and the FDIC, with an expected implementation date beginning January 1, 2013, and a series of milestones thereafter. [Note: by mid-December 2012, the implementation dates for most of the Basel III proposals have been delayed […]