As Fast as You Can

The implementation window for the new Current Expected Credit Loss (CECL) standard may seem plenty big enough, but there are loads of decisions to be made, such as “how will we calculate this?” “Decide on methodology and start implementing as fast as you can,” advised Masha Muzyka, Senior Director, Regulatory and Accounting Solutions at Moody’s Analytics. She was part of a round-table discussion, held on January 10, 2018, about the transition to CECL. The webcast was organized by the Global Association of Risk Professionals (GARP). The new CECL standard will bring significant changes, such as a spike in earnings volatility. […]

Challenges to modelling

Constructing an accurate financial model for the Current Expected Credit Loss (CECL) may present problems to some banks. Possibly a bank is collecting data for annualized charge-off rates. However, that would overlook the question: “how would that inform someone as to the loss rate over the lifetime of the portfolio?” asked Michael Gullette, SVP, Tax and Accounting at the American Bankers Association. The question boils down to whether a bank has enough data of the right kind to see trends and relationships. “And if you have the data, what is the quality?” Gullette said. He was part of a round-table discussion […]

Never too early to start

The “reasonable and supportable” clause of the new Current Expected Credit Loss (CECL) standard “is the most hotly debated part” of the regulation, according to Cristian deRitis, Senior Director, Consumer Credit Analytics at Moody’s Analytics. He was part of a round-table discussion about the transition to CECL that was webcast by the Global Association of Risk Professionals (GARP) on January 10, 2018. CECL is the new credit impairment standard under Financial Accounting Standards Board (FASB). “Auditors are grappling with what ‘reasonable and supportable’ means, too,” he added. For best practice in terms of modelling credit risk, the phrase boils down to whether […]

Lower Bond Trading Costs

As the fixed income market evolves, what are the challenges and general directions of transaction cost analysis (TCA)? How can bond investors spend their money more wisely? “The same kind of conversation we used to have with equity dealers … can now occur with fixed income dealers. That means competition will drive down transaction costs,” said Henry Marigliano, Director at FIS Global Trading. FIS is an international provider of financial services technology. He was the was the first of two panellists discussing fixed income transaction cost analysis at a webinar sponsored by the Global Association of Risk Professionals on December […]

New Dynamics in Energy Sector

How can financial risk be measured and managed in a volatile industry such as the energy sector? What are some of the common industry challenges? Due to low commodity prices and technological changes in the industry, there are new dynamics in the handling of financial risk management in the energy sector. Three speakers addressed specific changes in a webinar sponsored by the Global Association of Risk Professionals on November 29, 2017. “Sometimes the things we think we know, we don’t,” said Gordon Goodman of NRG Energy, the first of three speakers at the webinar. Goodman’s claim to fame is publication […]

Myths of CECL

The time for proper accounting of credit impairment is running out. How prepared is your team? Do you even know what the biggest concern of the auditors will be? This was the call to action voiced by Tom Caragher, Senior Product Manager of Risk and Performance at Fiserv, a US provider of financial services technology on October 26, 2017. He spoke about implementation of current expected credit losses (CECL) at a webinar sponsored by the Global Association of Risk Professionals. (Note that CECL is the impairment standard under Financial Accounting Standards Board (FASB).) “When it comes to CECL, there are many […]

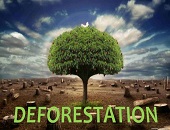

8 Ways to Look at Deforestation Risk

“Forests are the lungs of our land, purifying the air,” wrote Franklin D. Roosevelt. Looking at the economic side, what does the loss of forests mean to global markets? “Deforestation is a risk to the supply chain,” said Gabriel Thoumi, Director Capital Markets at Climate Advisers. “It puts billions of dollars at risk.” He was the first of four presenters at the May 4, 2017, webinar sponsored by the Global Association of Risk Professionals. He began with a summary of the activities of Chain Reaction Research, a group which has been actively assessing the sustainability of the supply chains of […]

Environmental Risk: 5 Lessons Learned

“Deforestation causes severe environmental damage,” said Hilde Jervan, chief advisor of the Council of Ethics of the Government Pension Fund Global (GPFG) of Norway. The scale of deforestation of tropical forests is large, and it is occurring within areas that are ecologically important, thereby aggravating the loss of biodiversity. The GPFG has strong ethical guidelines passed by the Norwegian Parliament in 2004. Jervan discussed these in light of the actual example of tropical deforestation. She was the second of four presenters at the May 4, 2017, webinar on Supply Chain Risk due to Deforestation sponsored by the Global Association of […]

A Moving Target

When it comes to changing the Dodd-Frank Act (DFA), the new Trump administration “may find repeal and replace is not really a good strategy,” said Tim McTaggart, partner at Stinson Leonard Street, LLP. He was the second of two presenters during the webinar on planned changes to the Dodd-Frank Act, April 27, 2017, timed to coincide with the 100th day since Donald Trump became U.S. president. The webinar was sponsored by the Global Association of Risk Professionals. The changes could involve a reconfiguration or readjustment of the regulatory process, coupled with “some really interesting personnel appointments,” McTaggart said. It’s a […]

The First 100 Days

In the first 100 days of the Trump presidency, has financial risk increased, decreased, or stayed the same? “One of the key platforms of the Trump administration was a promise to dismantle the Dodd-Frank Act,” said Candice Nonas, managing consultant at Resources Global Professionals. “What will be the impact of repeal on consumer protection?” She was one of two presenters during the one-hour webinar sponsored by the Global Association of Risk Professionals on April 27, 2017, which is the 100th day since Donald Trump became U.S. president. Nonas noted that the Dodd-Frank Act is actually an amalgam of several pieces […]