Most Valuable Skill for Risk Managers?

In terms of marketable expertise for financial risk managers, what counts more: quantitative skills, or the ability to communicate and interpret the results of calculations? “The biggest surprise of our in-depth study is that communication ranked above quant skills,” said Christopher Donohue, Managing Director of Research and Educational Programs at the Global Association of Risk Professionals. On June 30, 2015, he reported on the results of the 2015 Job Task Analysis of GARP members. Survey Design The goal of the survey and analysis was to identify knowledge and skills necessary to support competent performance of tasks and responsibilities that are […]

Al Rosen: Latest Trends in Financial Deception

“Canada is changing. There’s a return to yield games” and manipulation of operating cash flow, said Al Rosen on October 25, 2012. He was addressing about 40 people at a CFA Society Toronto luncheon seminar on the topic “Latest Trends in Financial Deception.” Rosen is co-founder of Accountability Research Corporation (ARC), the investment research arm of Rosen & Associates Limited, a forensic accounting firm, and co-author of Swindlers: Cons & Cheats and How To Protect Your Investments From Them published by Madison Commerce Press in 2010. Rosen does not like the loose guidelines of the International Financial Reporting Standards (IFRS) in Canada. He paraphrased it thus: […]

Implications of the Euro Zone Crisis

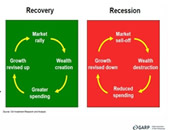

When it comes to financial debt in the Euro Zone, “deleveraging has barely begun,” said Daniel Wagner, author and risk consultant. “It’s a long and winding road.” On August 7, 2012, Daniel Wagner, CEO of Country Risk Solutions, a US-based cross-border risk management consulting firm, addressed a Global Association of Risk Professionals (GARP) audience about the Eurozone crisis. Wagner, author of Political Risk Insurance Guide, and Managing Country Risk, published in 2012, spoke on a range of related topics. Wagner’s talk was far-ranging and comprehensive (78 slides in 45 minutes). He spoke about the impact of debt: in particular, the effect […]

Zombie Banks Part 2. A Call for Change

Given the current high coolness quotient of anything “zombie,” a webinar about “zombie banks” is guaranteed to pique the interest of even the non-bankers out there. (Kudos to the non-financial types who made it through Part 1 and the discussion of interest rates.) But really, “zombie” is nothing more than a highly picturesque way to refer to something that is kept in motion or presumed viable long after it normally would have expired. “Zombie yogurt,” anyone?To recap Yalman Onaran’s definition in Part 1 of this posting, a zombie bank is a financial institution that continues to exist “even though the […]

“We Need to Fix the Plumbing”

Allan Grody is a man with a mission. The fall-out from the financial meltdown has shone a light on many things that need fixing within the financial system, and of these, Grody is focusing on one especially leaky, corroded pipe. Grody, president of Financial Intergroup, was addressing a GARP (Global Association of Risk Professionals) audience as the third of three panelists on “Modernizing Financial Risk Management: The Changing Technology Paradigm” on May 22, 2012. Early in his presentation, Grody showed a complex summation diagram. Titled “Need to Fix the Plumbing,” it was a kind of map, one that deserves a place […]

Real-Time Risk Analytics, SAS Style

“Analysts in capital markets get pummeled with vast quantities of information,” said Jeff Hasmann, “sometimes receiving as many as twenty newsfeeds per day. How are they to make sense of it all?” Hasmann was the first of three panelists speaking at the Global Association of Risk Professionals (GARP) webinar, “Modernizing Financial Risk Management: The Changing Technology Paradigm” on May 22, 2012. There is a push to modernize financial risk management from both above and below. Besides handling information overload, Hasmann noted there are several reasons to modernize: evolving regulations, improvements in efficiency to be gained, and needs for standardization. Hasmann, […]