“Analysts in capital markets get pummeled with vast quantities of information,” said Jeff Hasmann, “sometimes receiving as many as twenty newsfeeds per day. How are they to make sense of it all?” Hasmann was the first of three panelists speaking at the Global Association of Risk Professionals (GARP) webinar, “Modernizing Financial Risk Management: The Changing Technology Paradigm” on May 22, 2012.

There is a push to modernize financial risk management from both above and below. Besides handling information overload, Hasmann noted there are several reasons to modernize: evolving regulations, improvements in efficiency to be gained, and needs for standardization.

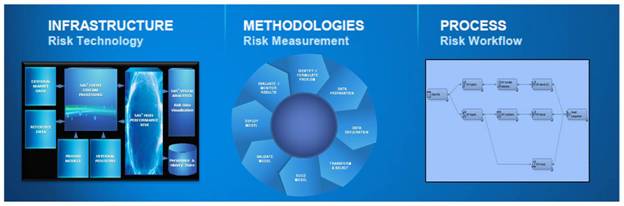

Hasmann, a senior consultant at SAS, said modernization is occurring on three fronts: infrastructure, methodologies, and process. In terms of infrastructure, institutions are focusing on improving their data management capabilities. One tool to accomplish this is complex event processing (CEP). CEP engines can execute millions of R/W operations and can process streaming data in milliseconds.

New methodologies for measuring risk are now possible because fast data processing can now be combined with ‘in-memory’ analytics so that risk measures on large portfolios can be delivered on an intraday basis.

As a final step, workflow engines can then be used to automate the distribution of this information to decision-makers.

All this is possible because hardware for risk management is advancing at a highly accelerated pace. “More banks are using GPUs, and highly engineered CPUs, to enable fast data processing and fast risk calculations,” Hasmann noted in answer to an audience question about new directions in technology. “As well, more financial institutions are considering solid state drives instead of traditional drives, to optimize I/O. In order to utilize the benefits of these new technologies, the software that runs on them must be designed in a manner that is capable of using the speedy hardware.”

“Financial institutions don’t want to do analysis on stale data,” said Hasmann. With new hardware, and appropriately designed software, risk can now be analyzed on an intraday basis, and in some cases, in near real-time.

Question: does modernizing financial risk management merely mean making it faster? That led naturally to the next two panellists of the day.ª

The webinar presentation slides can be found at: http://www.garp.org/risk-news-and-resources/webcasts/on-demand-webcasts.aspx?page=1

The research paper it’s based on can be found by asking for it at SAS from the page at: http://www.sas.com/whitepapers/indexByIndustry.html#sid=0450.0000.0000

The latter is a white paper by risk expert Myron S.Scholes, PhD and Nobel Laureate, along with Tom Kimner, head of the Risk Practice at SAS. The paper explains how organizations can use advanced analytics to measure exposure and risk across all risk types and books of business, and distribute incentives for consistent optimization of risk-adjusted returns.