Risk Models From Governance to Validation: Part 1. Don’t Forget the Story

The best practices of risk models–and model building–boil down to one thing: “we can’t forget the story behind it,” said Peter Went, VP, Banking Risk Management Programs at GARP. He was the first of three speakers at a GARP webinar on risk models held June 11, 2013. “There must always be a qualitative story expressible in quantitative terms.” And, vice versa, since any model reduces the complexities of the real world into snippets of mathematical relationships, the opposite must hold true. Went, a trained econometrist, described three main types of models. Fundamental models are based on rules relating basic variables […]

Ain’t Misbehavin’. Part 2: What Makes a Good Committee?

“Good committees make good decisions,” said Arnold Wood, guest speaker at the CFA Society Toronto on June 3, 2013. On the TV show Who Wants to Be a Millionaire, whenever the contestant turns to the crowd for help with an answer, the crowd is right 91 percent of the time, said Wood, who is president and CEO of Martingale Investments and a specialist in behavioural finance. The first part of his talk described common errors in individual thinking. But what makes a good committee? The composition of committees can be tricky. Too often, there is an appearance of diversity but […]

Ain’t Misbehavin’. Part 1: Overconfidence and Illusion

“It’s not our ability that makes us, it’s our choices.” With this quotation from Harry Potter, Arnold Wood, President and CEO of Martingale Investments proceeded to show how, in case after case, a good grasp of behavioural finance could explain the workings of the typical investment committee. Wood was speaking to a few dozen charterholders at a luncheon sponsored by the CFA Society Toronto at the historic National Club in Toronto on June 3, 2013. Wood wove his commentary around three themes: key habitual errors of decision-making, the composition of committees, and the behaviour of the chair of the investment […]

Financial Shenanigans: Forensic Accounting in Practice

There are ample opportunities for financial shenanigans in North American companies, according to Howard Schilit, founder of Schilit Forensics LLC and author of the classic Financial Shenanigans: How to Detect Accounting Gimmicks & Fraud in Financial Reports, first published in 1993 and now in its third edition. He led a mid-day seminar on characteristics of poor accounting practices at the CFA Society Toronto downtown offices on May 30, 2013. “Financial shenanigans are not necessarily illegal,” explained Schilit, but they are practices that “are not nice to perpetrate on someone” and could, if unchecked, slip into criminality. Given the extensive subject […]

Risk Intelligence for Value Creation: Part 2. The New Efficient Frontier

“Risk intelligence is the new efficient frontier,” said Philippe Carrel, author of The Handbook of Risk Management: Implementing a Post-Crisis Corporate Culture (2010) [Cover shown]. He was the second of two speakers on May 28, 2013 at a webinar organized by the Global Association of Risk Professionals (GARP). He went on to explain the connection between risk-adjusted performance and the elaborate information network that is “risk intelligence.” “Balancing shareholder’s value with risk exposure depends on a firm’s assessment of its aggregate sensitivity to risk and its ability to act on it,” Carrel said. “A firm builds its corporate memory as […]

Risk Intelligence for Value Creation: Part 1. The Levers in the Cockpit

The strategic focus of financial executives and institutional investors must be risk intelligence, not just risk management, according to Leo Tilman, President of Tilman & Company, author, and adjunct professor of finance at Columbia University. He was the first speaker on May 28, 2013 at a webinar organized by the Global Association of Risk Professionals (GARP). In the words of Peter Drucker, institutional investors must understand “the future that has already happened.” Tilman said investors need to have a vision for growth and relevance in the low growth, low return environment post-2007. “Does a firm have a holistic framework for […]

How New Regulations Are Breaking Down Silos. Part 3: Interconnection Needed

The biggest hurdle to breaking down silos “is organizational in nature,” according to Amit Gupta, Partner in Risk Management Practice at the consulting firm Accenture. “The heads of Risk, Finance, Operations are all different people and this introduces a level of complexity.” However, “organizational interconnection at high levels is starting to happen.” Gupta was the third panellist to weigh in at the GARP webinar on May 21, 2013 on how new financial regulations (Dodd-Frank and Basel III) are breaking down silos in risk management. Regulators are pushing for greater consistency in reporting. As an example, Gupta pointed to new requirements […]

How New Regulations Are Breaking Down Silos. Part 2: Look at Economics

An institution “needs to have a strong cross-risk function which coordinates all parties in order to influence the recovery plan,” said Dr. Andrea Burgtorf, Head of Stress Testing, Risk Analytics and Instruments at Deutsche Bank. She was speaking at the GARP webinar on May 21, 2013 about the effect of new regulations on risk management. As part of the Basel III mandate to develop a Recovery and Resolution Plan, a bank must include analysis of all critical economic functions, and this, said Burgtorf, “forces a bank to examine what are its core and non-core businesses, and to decide which governance […]

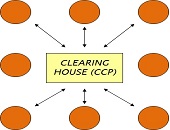

How New Regulations Are Breaking Down Silos. Part 1: Stress Testing

“Financial regulators have introduced stress testing as a means to cut across silos,” said Dan Travers, VP of Product Management, Adaptiv at SunGard and the opening speaker at a GARP webinar on May 21, 2013. Historically, he noted, financial risk has been treated as a set of separate units (or silos) across the main types of risk: credit, market, operational, and liquidity risk, the latter connected to asset-liability management (ALM). The new reporting demands of Basel III and Dodd-Frank serve to break down silos, Travers said, with such things as incremental risk charge being reported as capital percentage for the […]

Evolution of the OTC Swaps Markets. Part 2: Lessons Learned

The scramble to meet the Phase 1 deadline of new regulations on swaps “was a significant learning experience,” said Bis Chatterjee, Global Head of E-Trading, Credit Markets at Citi. He was the second speaker in a webinar panel organized by the Global Association of Risk Professionals (GARP) on May 14, 2013. The deadline that came into effect March 11, 2013 pertained to the Dodd-Frank Act governing over-the-counter (OTC) swaps. (Two more phases will follow; see Part 1 for details.) There were challenges first of all, Chatterjee said, in the self-identification of market participants in Phase 1. Second, even if you […]