Financial Shenanigans: Forensic Accounting in Practice

There are ample opportunities for financial shenanigans in North American companies, according to Howard Schilit, founder of Schilit Forensics LLC and author of the classic Financial Shenanigans: How to Detect Accounting Gimmicks & Fraud in Financial Reports, first published in 1993 and now in its third edition. He led a mid-day seminar on characteristics of poor accounting practices at the CFA Society Toronto downtown offices on May 30, 2013. “Financial shenanigans are not necessarily illegal,” explained Schilit, but they are practices that “are not nice to perpetrate on someone” and could, if unchecked, slip into criminality. Given the extensive subject […]

Risk Intelligence for Value Creation: Part 2. The New Efficient Frontier

“Risk intelligence is the new efficient frontier,” said Philippe Carrel, author of The Handbook of Risk Management: Implementing a Post-Crisis Corporate Culture (2010) [Cover shown]. He was the second of two speakers on May 28, 2013 at a webinar organized by the Global Association of Risk Professionals (GARP). He went on to explain the connection between risk-adjusted performance and the elaborate information network that is “risk intelligence.” “Balancing shareholder’s value with risk exposure depends on a firm’s assessment of its aggregate sensitivity to risk and its ability to act on it,” Carrel said. “A firm builds its corporate memory as […]

Risk Intelligence for Value Creation: Part 1. The Levers in the Cockpit

The strategic focus of financial executives and institutional investors must be risk intelligence, not just risk management, according to Leo Tilman, President of Tilman & Company, author, and adjunct professor of finance at Columbia University. He was the first speaker on May 28, 2013 at a webinar organized by the Global Association of Risk Professionals (GARP). In the words of Peter Drucker, institutional investors must understand “the future that has already happened.” Tilman said investors need to have a vision for growth and relevance in the low growth, low return environment post-2007. “Does a firm have a holistic framework for […]

How New Regulations Are Breaking Down Silos. Part 3: Interconnection Needed

The biggest hurdle to breaking down silos “is organizational in nature,” according to Amit Gupta, Partner in Risk Management Practice at the consulting firm Accenture. “The heads of Risk, Finance, Operations are all different people and this introduces a level of complexity.” However, “organizational interconnection at high levels is starting to happen.” Gupta was the third panellist to weigh in at the GARP webinar on May 21, 2013 on how new financial regulations (Dodd-Frank and Basel III) are breaking down silos in risk management. Regulators are pushing for greater consistency in reporting. As an example, Gupta pointed to new requirements […]

How New Regulations Are Breaking Down Silos. Part 2: Look at Economics

An institution “needs to have a strong cross-risk function which coordinates all parties in order to influence the recovery plan,” said Dr. Andrea Burgtorf, Head of Stress Testing, Risk Analytics and Instruments at Deutsche Bank. She was speaking at the GARP webinar on May 21, 2013 about the effect of new regulations on risk management. As part of the Basel III mandate to develop a Recovery and Resolution Plan, a bank must include analysis of all critical economic functions, and this, said Burgtorf, “forces a bank to examine what are its core and non-core businesses, and to decide which governance […]

How New Regulations Are Breaking Down Silos. Part 1: Stress Testing

“Financial regulators have introduced stress testing as a means to cut across silos,” said Dan Travers, VP of Product Management, Adaptiv at SunGard and the opening speaker at a GARP webinar on May 21, 2013. Historically, he noted, financial risk has been treated as a set of separate units (or silos) across the main types of risk: credit, market, operational, and liquidity risk, the latter connected to asset-liability management (ALM). The new reporting demands of Basel III and Dodd-Frank serve to break down silos, Travers said, with such things as incremental risk charge being reported as capital percentage for the […]

Evolution of the OTC Swaps Markets. Part 2: Lessons Learned

The scramble to meet the Phase 1 deadline of new regulations on swaps “was a significant learning experience,” said Bis Chatterjee, Global Head of E-Trading, Credit Markets at Citi. He was the second speaker in a webinar panel organized by the Global Association of Risk Professionals (GARP) on May 14, 2013. The deadline that came into effect March 11, 2013 pertained to the Dodd-Frank Act governing over-the-counter (OTC) swaps. (Two more phases will follow; see Part 1 for details.) There were challenges first of all, Chatterjee said, in the self-identification of market participants in Phase 1. Second, even if you […]

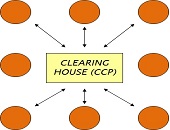

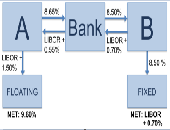

Evolution of the OTC Swaps Markets. Part 1: “Futurization” of Swaps

Recent reforms to the swaps market can be thought of as “the futurization of swaps,” said Nathan Jenner, COO Fixed Income E-Trading at Bloomberg. He was addressing a webinar audience on May 14, 2013 as the first speaker in a panel organized by the Global Association of Risk Professionals (GARP) on the evolution of the market for over-the-counter (OTC) swaps. Five years ago, “derivatives were perceived as a catalyst in precipitating” the financial crisis of 2007-08, said Jenner. For example, it wasn’t immediately apparent who were all the counterparties to the AIG swaps. Pricing was “murky,” he said, and risk […]

Spotting Signs of Poor Corporate Governance. Part 2: ESG Management

Corporate governance is only one part of an overall phenomenon known as “ESG management,” or how a company handles environmental, social, and corporate governance (ESG) issues. “Research shows that companies that disclose more ESG information are more likely to enjoy a lower cost of capital,” said Max Zehrt, Senior Manager at Sustainalytics. He was addressing a noon-hour seminar of financial analysts and portfolio managers on the subject of corporate governance on May 8, 2013 at the offices of the CFA Society Toronto. His talk was the second part of a two-speaker panel moderated by Toby Heaps of Corporate Knights. Zehrt was […]

Spotting Signs of Poor Corporate Governance. Part 1: “Ask the Tough Questions”

“Good governance practices are important for the sound financial growth of a corporation—the board directs and protects,” said Stephen Kibsey, VP Equity Risk Management at Caisse de dépôt et placement du Québec. On May 8, 2013 he addressed a noon-hour seminar of financial analysts and portfolio managers through remote link on the subject of corporate governance at the offices of the CFA Society Toronto. His talk was the first part of a two-speaker panel moderated by Toby Heaps, co-founder and president of Corporate Knights. Kibsey pointed out that concern over matters like environment, social and governance (ESG) issues within a […]