Measuring the ROI of GRC. Part 2: Solutions to “Absorb Regulatory Demands”

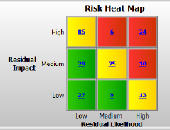

An unprecedented amount of new regulations “has led to risk assessment fatigue,” said John Kelly, Market Segment Manager in Business Analytics at IBM. He was the second of two speakers who addressed a GARP webinar audience on March 28, 2013 on the topic of the return on investment (ROI) on governance, risk assessment, and compliance (GRC). Most of the presentation referred to the study “Guidebook: Understanding the Financial Value of GRC Management” released in October 2012 by Nucleus Research that was talked about by Hyoun Park in the first part of the presentation. When it comes to regulation, there is […]

Measuring the ROI of GRC. Part 1: “Your Mileage May Vary”

When looking at the return on investment (ROI), “it’s not about getting the highest number—it’s what is most defensible,” said Hyoun Park, Principal Analyst at Nucleus Research. Park was speaking on March 28, 2013 to a webinar audience on the topic of how to quantitatively measure the ROI on governance, risk assessment, and compliance (GRC). The two-speaker panel, convened by the Global Association of Risk Professionals (GARP), based their remarks on a study released in October 2012 by Nucleus Research (cover shown here). The report states “this research was conducted in context of the usage of IBM OpenPages, a software […]

The Fed, Foreign Banks and Basel III: Part 3. Necessary Complexity?

As the US moves to adopt Basel III, there are regulatory initiatives that are expected to be implemented, said Peter Went, VP, Banking Risk Management Programs, GARP, on February 14, 2013. The Basel Committee has several proposals that are issued for consultation and discussion, including ones that affect liquidity rules, the securitization framework, trading book review, and consistency of risk-weighted assets. Went was the second speaker at a webinar organized by the Global Association of Risk Professionals (GARP) regarding regulatory reform of foreign banking operations (FBOs) in the United States and the implementation of the Basel III framework. (This continues […]

The Fed, Foreign Banks and Basel III: Part 2. Capital Concerns

“Some of the rules are in direct conflict,” said Peter Went, VP, Banking Risk Management Programs, GARP. He was the second speaker at a webinar presented on February 14, 2013 organized by the Global Association of Risk Professionals (GARP) regarding regulatory reform of foreign banking operations (FBOs) in the United States and the implementation of the Basel III framework. The “conflict” refers to rules in the Dodd-Frank Act versus the globally agreed Basel III Accord’s guidelines. Both regulatory attempts apply the G-20 principles on financial regulation (Pittsburgh 2009 summit). The US implementation of the Basel III framework differs from the […]

The Fed, Foreign Banks and Basel III: Part 1. A Long Hard Look

Foreign banking operations (FBOs) in the United States are about to face a whole new set of regulations that may dampen their enthusiasm for US-based operations, according to a February 14, 2013 webinar organized by the Global Association of Risk Professionals (GARP). “The Fed observed over time that US branches were increasingly used to fund the home office operations,” said Charles Horn, partner at Morrison Foerster, who was the first speaker at the panel. Other concerns of the Federal Reserve Board are the increased complexity of FBOs, and “the availability of home country financial resources for branch offices.” The goal, […]

Managing Model Risk: Part 3. Collective Hubris

There are more things in heaven and earth, Horatio, Than are dreamt of in your philosophy. – Wm. Shakespeare, Hamlet, Act 1, Scene 5. “We are building the language in which to discuss model risk,” said Boris Deychman, Director of Model, Market and Operational Risk Management at RBS Citizens Financial Group. He drew an analogy with the world of wine experts, who have developed specific vocabulary to talk about aroma and taste. “They don’t say just: this tastes like wine.” Deychman was the third and final speaker of a panel invited by the Global Association of Risk Professionals to discuss […]

Managing Model Risk: Part 2. The Impact of Basel III

“More consideration must be made for regulatory capital changes that focus on small but potentially devastating risks or risk factors,” said Peter Went, VP, Banking Risk Management Programs at GARP. He was speaking about Basel III and its impact on modelling regulatory capital at a webinar on January 29, 2013, organized by the Global Association of Risk Professionals to discuss model risk management. Went mentioned three developments in the Basel III that directly impact capital models and model risk in regulatory capital determination. First, Basel III introduces a risk-invariant leverage ratio of 3 percent in recognition that models may be […]

Managing Model Risk: Part 1. “Models are Always Wrong”

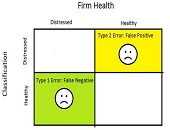

“Models are always wrong,” said Joe Pimbley, Principal at Maxwell Consulting, via webinar on January 29, 2013. He was the first of a panel of three speakers invited by the Global Association of Risk Professionals to discuss model risk, what it is, and how to assess and validate it after the financial crisis. Models are always wrong, Pimbley clarified, because they are only simplifications. “Wrongness” he defined as some type of error or omission that materially impacts the results as understood by the user. A model can be wrong because the meaning of the result differs from that understood by […]

Libor Fallout: Part 3. A Muted Valuation Effect

On December 20, 2012, the third presenter at the GARP webinar on the LIBOR scandal was Robert Maxim, director of Complex Asset Solutions at Duff & Phelps. He spoke about the valuation implications of incorrect LIBOR rates. The cash flow of many financial instruments is indexed to LIBOR, he said, for big companies as well as small, and even for individual consumers such as those holding private student loans. Maxim considered an interest rate swap example in which the floating leg is tied to LIBOR. The valuation is always computed on the difference between the fixed and floating leg. “The […]