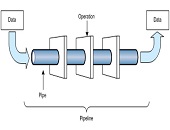

The Data Pipeline

The new guidelines on credit impairment at U.S. banks regulate the estimation and reporting of the current expected credit loss (CECL). But what are they really about? “CECL is all about setting up a data pipeline,” said Krish Ray, CECL Implementation Lead at SAS. He was the second of three speakers at a webinar panel titled “CECL: Managing Through the Implementation Headwinds” sponsored by the Global Association of Risk Professionals (GARP) on September 12, 2018. Ray categorized the key challenges of CECL implementation as: models, data, business, governance, and sustainability. Smaller banks might lack modelling expertise and “may have to turn to vendor models.” […]

Shifting Energy Markets

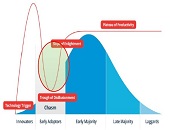

How are strategic priorities in energy markets shifting? What are the risk management implications? “Geopolitical risks have worsened and technological innovation is causing more disruption,” said Medy Agami, senior partner and vice-chairman at Ben-Roz and Associates and co-founder of the consulting firm Opimas. He was the sole presenter of the webinar “Energy Market Strategy and Risk Playbook: How to prosper amid a wave of disruptive innovation, geopolitical uncertainty, market volatility & exponentially growing risk landscape in 2018 & beyond” sponsored by the Global Association of Risk Professionals (GARP) on August 7, 2018. “There are five main forces acting on fundamentally shifting markets,” […]

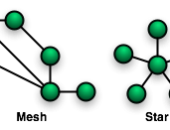

Central Clearing Design

If you had to design a central clearinghouse for transactions in financial markets, what size of guarantees should be offered? And what percentage fees should be charged? “The central clearing modifies the market,” said Andreea Minca, “because the old network structure [of one-to-one] is changing to a new ‘star’ structure.” Minca is Assistant Professor at the School of Operations Research and Information Engineering at Cornell University and was the sole presenter at the December 6, 2016, webinar on systemic risk and central clearing design to members of the Global Association of Risk Professionals (GARP). Under new US legislation, all over-the-counter […]

Data Science 2. The Roadmap

“The core concept for data science is hypothesis testing,” said Nima Safaian, team lead for Trading Analytics at Cenovus Energy. The data scientist must identify trends, generate hypotheses, and test, test test. The scientist’s bent toward hypothesis testing should be even stronger than their math skills. Safaian was speaking at the Data Science webinar on August 2, 2016, sponsored by the Global Association of Risk Professionals (GARP). “Attitude is everything,” Safaian said. “Think like a startup. Have an agile mindset,” he urged, referring to the books The Lean Startup by Eric Ries and The Lean Enterprise by Humble, Molesky, and […]

Data Science 1. Trading Analytics

At the end of the day, what do you produce? If you are a knowledge worker, your “product” could be something as intangible and significant as decisions. That is the thinking behind the “decision factories” discussed in Roger Martin’s seminal Harvard Business Review article. If we labour in decision factories, then we are decision engineers, and our chief raw material is data, according to Nima Safaian, team lead for Trading Analytics at Cenovus Energy. “We need the capacity to produce many good decisions,” he said at the webinar on August 2, 2016, sponsored by the Global Association of Risk Professionals […]

Platform of the Future

What will be the ideal modelling platform of future bankers? It will need to contain key functionalities in model execution, scenario management, and a “risk engine” that will deliver answers for multiple horizons at the loan level. Furthermore, it should implement the most advanced modelling suites, reduce the quants’ time to develop models, and contain simulation capabilities for stress testing and beyond. This bold vision of the future was presented by Martim Rocha, Advisory Business Solution Manager at SAS. He was the second of two presenters at the February 25, 2016, webinar offered by the Global Association of Risk Professionals […]

Integrated Data and Modelling

How can today’s bankers prepare for tomorrow’s challenges? Consider the financial models built using available data. Data collection and financial modelling used to be conducted in each different silos of the bank, with credit separate from market, which was separate from treasury and other groups). Then data became “managed” and modelling was moved to “platforms” which did not mix well between the various silos. A few brave souls began to integrate the data management for different groups of the bank. Other brave souls tried to integrate the modelling. This was the phase of integration achieved through batch calculations. Now, the […]

The Latest & Greatest

Although the next round of changes to accounting standards will not come into effect until 2018, alert financial analysts should already be asking companies about how they plan to address them, according to Canada’s top accountant. “Pay attention now, because companies do have the option to adopt” and some, such as Canadian banks, are adopting IFRS 9 early, said Linda Mezon, Chair of the Accounting Standards Board (AcSB). She was speaking at a webinar on January 21, 2016, to members of CFA Society Toronto and CPA Canada on the recent developments in accounting standards and emerging trends impacting financial statements. […]

Topology Can Streamline Modelling

How can software systematize and optimize the routine tasks in building financial risk models? “We use topology to inform feature selection, and then we examine a range of models,” said Mukund Ramachandran, Data Scientist at Ayasdi. He was the third of three panellists at the October 27, 2015, webinar on Effective Risk Models Using Machine Intelligence sponsored by the Global Association of Risk Professionals. In the course of evaluating potential models, several statistical tests are applied. “Machine intelligence considers the entire high dimensional space jointly,” he said. Machine learning is capable of applying hundreds of algorithms and different combinations, “but […]

Machine Intelligence + Business Intuition

Given the exponential growth in data complexity, how can you, the risk manager, quickly determine the most salient economic factors to include in calculating a bank’s risk exposure? Nowadays, modelling risk is all about “speed, accuracy, and defensibility,” said Patrick Rogers, Head of Marketing at the software company Ayasdi. Risk models must be developed “in a relatively short time window and must be statistically valid.” Since risk models must be defensible to business owners and industry regulators, and simple to explain, the ordinary “black box” machine learning would fall flat, Rogers said. He was the second of three panellists at […]