Robo-Advisors

What does the client want to see on the landing page of an automated wealth management website? Four panellists at the digital wealth management (a.k.a. robo-advisor) session of the Financial Technology conference held on June 17, 2016, had theories on how to connect with clients. The session was part of a one-day conference organized by the CFA Society Toronto and was held at the Toronto Board of Trade. Three of the panellists showed screen shots from their companies’ websites and spoke about underlying philosophies on client usage; the fourth panellist works for a company that provides “back end”, namely, the […]

Mega-Platforms, Mega Risk

There’s a world of difference between innovation and disruption. “Think of innovation as doing more, in the same old way,” said Haydn Shaughnessy, innovation specialist and author of Platform Disruption Wave: How the Platform Economy is Changing the World. He presented a GARP webinar on “The Rise of Mega-Platforms and the Risks to Banking” on May 25, 2016. In the first part of his talk, he described mega-platforms. He referred to the thesis of The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail by Clayton Christensen. This book argues that successful companies get so caught up in meeting […]

The Dawn of the Mega-Platform

Disruption of the financial sector is just on the horizon, says Haydn Shaughnessy, author and innovation specialist. He presented a webinar on “The Rise of Mega-Platforms and the Risks to Banking” to the Global Association of Risk Professionals (GARP) on May 25, 2016. His books include The Elastic Enterprise, Shift, and (most recently) Platform Disruption Wave. “What are the consequences of the disintegration of industry structures?” Shaughnessy asked. Most people see innovation as trying to get more of something that’s desirable, he said, but they might not understand clearly where they are headed. In short, what is the “big picture” […]

Fast Turnaround of Complex Math

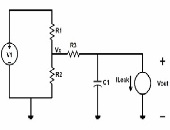

Imagine you are driving your brand-new mini-van, the latest Drake album cranked on high, the windshield wipers at top tempo, and the heater keeping things toasty. You go to switch the headlights to high-beam—and you are suddenly hit by the unmistakable odour of melting circuits…. Not a happy situation. It’s one that automotive designers the world over try to avoid by extensive testing of many different usage scenarios. Problem-solving tools have dramatically changed the way engineers advance their knowledge, for financial, automotive, chemical, and other sectors. Many products and technologies we take for granted—such as the electronic circuitry in a […]

Worst Case Analysis Made Easy

Can symbolic computing improve real-world design? Definitely yes, according to the product development team at the automotive firm Delphi. “Each time the circuits were changed, the electrical equations changed. We turned to symbolic computing so that we could quickly deal with design changes,” said Michael G. McDermott, Senior Development Engineer at Delphi. He was the second speaker in a webinar on May 25, 2016, titled “How Far Can Your Math Knowledge Go?” Lights, heating, movies for kids in the back to watch… Over time, vehicles have come to have more and more elaborate electronics. These can lead to unpredictable stresses […]

The Case for Symbolic Computing

Should you care about symbolic computing? If your work involves concepts that are expressed in math, and if you want to reduce errors and routine work, then Samir Khan says, yes, you should. Khan, Product Manager at Maplesoft, was the first speaker in a webinar on May 25, 2016, titled “How Far Can Your Math Knowledge Go?” “Symbolic computing allows you to automatically derive system equations using well-defined rules,” said Khan. “It allows you to mechanize your work with equations, such as the routine manipulations that are done in algebra.” The traditional design process means the designer (or engineer or […]

Platform of the Future

What will be the ideal modelling platform of future bankers? It will need to contain key functionalities in model execution, scenario management, and a “risk engine” that will deliver answers for multiple horizons at the loan level. Furthermore, it should implement the most advanced modelling suites, reduce the quants’ time to develop models, and contain simulation capabilities for stress testing and beyond. This bold vision of the future was presented by Martim Rocha, Advisory Business Solution Manager at SAS. He was the second of two presenters at the February 25, 2016, webinar offered by the Global Association of Risk Professionals […]

Integrated Data and Modelling

How can today’s bankers prepare for tomorrow’s challenges? Consider the financial models built using available data. Data collection and financial modelling used to be conducted in each different silos of the bank, with credit separate from market, which was separate from treasury and other groups). Then data became “managed” and modelling was moved to “platforms” which did not mix well between the various silos. A few brave souls began to integrate the data management for different groups of the bank. Other brave souls tried to integrate the modelling. This was the phase of integration achieved through batch calculations. Now, the […]

Harnessing Your Risks

Before your company undertakes economic risks, what systems should be firmly in place? “Good risk management allows us to take risks we wouldn’t normally do,” said Brenda Boultwood , Senior Vice President of GRC Solutions at MetricStream. (GRC is the acronym for governance, risk management and compliance.) She was the second of two panellists at the webinar titled Explore Your Opportunity Landscape by Harnessing Your Risks, sponsored by the Global Association of Risk Professionals on November 18, 2015. A company needs superior risk intelligence in order to understand the risks they plan to harness. Technology can be leveraged to capitalize […]

Topology Can Streamline Modelling

How can software systematize and optimize the routine tasks in building financial risk models? “We use topology to inform feature selection, and then we examine a range of models,” said Mukund Ramachandran, Data Scientist at Ayasdi. He was the third of three panellists at the October 27, 2015, webinar on Effective Risk Models Using Machine Intelligence sponsored by the Global Association of Risk Professionals. In the course of evaluating potential models, several statistical tests are applied. “Machine intelligence considers the entire high dimensional space jointly,” he said. Machine learning is capable of applying hundreds of algorithms and different combinations, “but […]