Climate change is bringing on events, such as hurricanes and wildfires, of greater severity and frequency than ever before. How does insurance help communities rebuild? What economic barriers arise during recovery? Is insurance the best way to provide disaster relief?

These are some of the questions tackled by Carolyn Kousky of the Environmental Defense Fund (EDF) in her recent book and research. She is a co-editor of A Blueprint for Coastal Adaptation and author of Understanding Disaster Insurance: New Tools for a More Resilient Future.

On October 19, 2023, Carolyn Kousky, Associate VP, Economics and Policy Analysis at EDF, gave a presentation on her findings, which are based on unique survey data of residents impacted by four hurricanes in the U.S. Her webinar was part of the series of talks, titled the Virtual Seminar on Climate Economics, sponsored by the Federal Reserve Bank of San Francisco (FRBSF).

“Disasters are negative financial shocks,” she said, “when expenditures increase and incomes can decline.” The online survey conducted by EDF found that 40 to 50 percent of households had “income disruption” due to the disaster—just when they were hit by increased costs for everything from home damage (nearly 90 percent) to additional pet care expenses (over 20 percent).

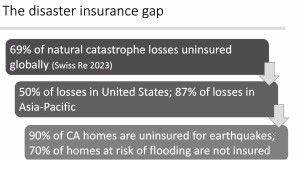

“How do households fund recovery?” Her research (link below) found that only 55 percent of households had insurance and only 21 percent had flood insurance. Thus, many people were turning to friends and family (29 percent), credit cards (19), or charity and related sources (10). Only 19 percent received a Federal Emergency Management Agency (FEMA) grant and 7 percent received a federal disaster loan.

“We observed clusters of the similar responses that we identified as two funding strategies. The first group all used insurance plus other sources of funds. The second group was without insurance and they drew on friends and family,” Kousky said.

Lack of insurance is significant in widening economic inequality, as several recent studies show.

In Kousky’s survey, she reported, “Households with insurance are 85 percent less likely to report high financial burdens three weeks after the disaster.” By contrast, one year later, 82 percent of the non-insured group reports a high financial burden.

There are substitutes and complements for insurance, she noted, such as FEMA grants, Small Business Administration (SBA) loans, bank loans, and employer loans. The households with insurance “are more likely to make use of other sources, such as credit cards” and other funding instead of drawing on funding from family and friends.

She summarized other economists who have studied the non-insurance sources of funding recovery, such as personal savings. One quarter of consumers have no emergency savings. Savings are less likely to exist for Blacks and Hispanics. For federal aid, areas with lower average income are less likely to get awards and when they do, awards tend to be lower amounts.

One interesting tactic was found among flooded, better-off households. They could open new credit cards at promotional 0-percent interest rates, spend on those cards, and pay off the credit balances before promotional rates expired.

Insurance Spillover

Her extensive review of the literature boils down to the “haves and have-nots” during recovery. “Some households are uninsured, have lower incomes, have smaller savings, are more likely to be denied disaster loans, and have trouble accessing fair payments from disaster aid,” she said.

“Greater take-up of insurance in certain communities means these communities have greater resilience to rebuild,” Kousky said. She looked at an inclusive disaster insurance system, which would make “appropriate and affordable insurance available to those currently unserved or underserved by the market.”

She identified four barriers to inclusivity:

- Affordability

- Limitations in coverage, e.g., a hidden sub-limit for frozen pipes

- Certain post-disaster needs not covered, e.g., renters get evicted while landlords repair the storm damage and must find new accommodation at higher rent.

- Indirect discrimination and differential impact may persist in certain parts of the insurance value chain.

“While we need policy reform, we need more investment in improving disaster response overall.”

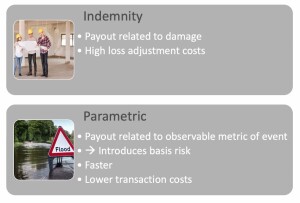

She contrasted indemnity vs parametric insurance payouts. Indemnity insurance is an agreement where one party guarantees compensation for losses or damages incurred by another, after inspection of losses. Parametric insurance is non-traditional insurance that offers pre-specified payouts based on the parameters of the trigger event.

“Parametric insurance still requires insurable interest and proof of loss,” she noted, “but the transaction costs are lower and most importantly, the delay time for payout is much smaller.” The problem with delays is that people fall behind on bills, healthcare, and so on.

In the final part of her presentation, Kousky went over details of the NYC Civic Innovations Pilot that looked into how to improve the post-flood resilience of communities. ♠️

Click here to download the research paper this webinar was based on.

Click here to find out about the FRBSF Climate Seminar Series.