How well positioned are you for the job market in a softening economic environment? Possessing the chartered financial analyst designation, known as the CFA charter, sends a strong signal to potential employers, said Chris Polson, President of the CFA Society Toronto, which is part of the global CFA Institute. He was speaking at the webinar “Capital Markets Compensation Trends” on August 11, 2015, sponsored by CFA Society Toronto.

The goals of the webinar were twofold: to recap the value underlying the charterholder designation, and whether this was reflected in the remuneration of Canadian charterholders, as shown by the results of the member survey conducted in April-May 2015.

“Generally speaking, employers are looking for signals that you have the ability and desire to do the job—and that’s where the CFA program comes in,” Polson said. The third signal, whether you have the personality to fit in with the team, will be assessed during the interview process—but first, entry must be gained, and that’s where the CFA designation helps.

To become a charterholder, applicants must fulfill four requirements:

1. Complete the CFA Program (comprised of three six-hour examinations);

2. Have four years (48 months) of qualified work experience;

3. Become a member of CFA Institute;

4. Adhere to the CFA Institute Code of Ethics and Standards of Professional Conduct.

The rigorous set of exams covers the Candidate Body of Knowledge (CBOK), and The CBOK includes a broad range of topics relating to investment management, financial analysis, stocks, bonds and derivatives. The typical CFA candidate requires hundreds of hours of intensive study. For any given level of exam, pass rates are as low as 32 percent. Only one in five of those who attempt the CFA program ultimately attain charterholder status, Polson pointed out.

The financial crisis of 2007-08 was a blow to the financial sector and the reputation of financial professionals. Still, the value of charterholder status appears to have held strong. Mark Carney, the former Governor of the Bank of Canada said, “To reform and monitor the financial system, or to conduct market operations, public authorities must acquire specialized knowhow. The Bank of Canada values the expertise and experience of its CFA charterholders.”

David MacDonald, VP at Environics Research Group presented the results of the 2015 compensation survey. The twelve CFA Societies in Canada sent e-mail to their members, inviting them to complete an online survey. Of the 2606 e-mail respondents, 83 percent are male. The respondent profile was: average age 40 years; average years of experience is 15; and 39 percent hold an MBA or other masters designation in addition to the CFA. Nearly half (48 percent) belong to the Toronto Society. Forty-one percent work at companies that employ more than 5000 employees.

The average compensation in 2014 was $280,454, a 20 percent increase from $233,780 in 2013. The survey results noted that, “Mean total compensation is significantly higher than median compensation ($147,550), indicating a small proportion of CFA charterholders receive very high compensation. The top 25 percent of charterholders have compensation of at least $275,000, rising to over $10 million.”

When the aggregate compensation is broken down by years of professional experience, a picture emerges that strongly favours experience. (See Figure 1.) The base salary rises from nearly $69,000 for those with least experience, to nearly $205,000 for those with 30-34 years of experience. The commissions / sales bonuses climbed more steeply: from nearly $15,000 to nearly $137,000 for the same experience categories.

Total compensation is highest for equity portfolio managers ($619,559), executives such as CEO/CAO/COOs/CIOs ($518,072), and multi-asset portfolio managers ($496,374). Compensation is lower for portfolio analysts ($99,075), buy-side risk analysts ($144,060), persons working in compliance/regulatory areas ($147,958), and those working in marketing and product development ($154,883).

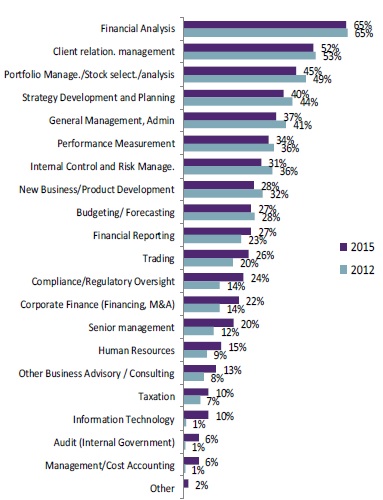

The responsibilities charterholders as they fulfill their roles are varied, and “include financial analysis (65%), client relationship management (52%), portfolio management/stock selection (45%), strategy development and planning (40%), general management/administration (37%), performance management (34%) and internal control and risk management (31%).” The proportions of responsibilities are changing over time. Figure 2 compares 2015 and 2012 survey results for job responsibilities.

Of the 53 percent of respondents who personally manage assets, they manage “an average of $4.2 billion, up from $3.5 billion in 2012.”

Note that no independent corroboration of survey findings was carried out. The results of estimates of hours worked, duties, and compensation received, etc., were all self-reported.

As Polson outlined, becoming a charterholder is an arduous process. As MacDonald reported, the compensation is favourable. In the words of Corey Ruttan, former SVP and CFO of Petrobank Energy & Resources, “Job candidates carrying the CFA designation arrive with strong financial breadth, ethical integrity and professionalism. These qualities provide a valuable advantage for any organization hiring these recruits.” In terms of the compensation paid, the CFA designation appears to be well worth the trouble to attain. ª

Figures 1 and 2 are from the presentation by David MacDonald, prepared by Environics Research Group