When modelling risk in emerging markets, are you hampered by sparse data?

“Relationships between different asset classes can help measure the sovereign risk in emerging markets,” said Rob Stamicar, Senior Director of Research in Multi-Asset Class Risk Management at Axioma. He was sole presenter at a webinar on December 2, 2014, sponsored by the Global Association of Risk Professionals.

When modelling global multi-asset class portfolios, “aggregation can be challenging,” said Stamicar, because the FX rates must also be taken into consideration—the subject for another day.

His talk focussed on three asset classes: equity, fixed income, and credit portfolios. Infrequent data, illiquid portfolios, and heterogeneous data for the different asset classes are all “known problems” in handling the risk data.

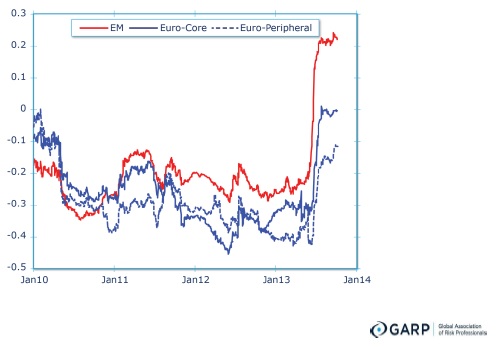

“Correlations have changed over the years due to the debt crisis,” he said. He showed a graph (shown below) of the time-varying correlations of the US dollar with the yield in three different markets (emerging markets, Euro-core and Euro-peripheral).

The sovereign credit default swaps (CDS) market is more sensitive to economic conditions than the yield from corporate bonds. (See graph below.)

Stamicar suggested that the framework for translating credit information from one market to another “could be teased out through the default probability.” In other words, the analyst can extract default probabilities from CDS data and use this to price bonds.

“You can link markets via hazard rates,” he said, where h, the hazard rate, is the instantaneous default probability that gives the survival probability = exp(-h*t) as a function of time t.

There are equations for pricing risky securities, given the default probability as a function of time. Stamicar walked the audience through an example for pricing bonds from CDS data, and showed results for Spain’s sovereign bonds and CDS spreads.

“We can extract the price of securities from equity data using the Merton model,” he said. Since there are many “flavours” of the Merton model, he emphasized it is important to have a clear objective for the model. This will govern whether a risk-neutral or actuarial probability of default should be used.

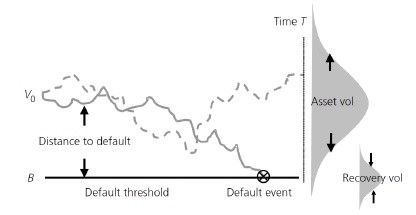

For structural models, Stamicar noted, “the key inputs are asset value and asset volatility—which are unobservable.” In the schematic provided, the asset value and the loss given default can be drawn from distributions of known volatility. ª

Click here to view a summary of the second half of the webinar.