7. Will blockchain technology affect the drive toward barcodes?

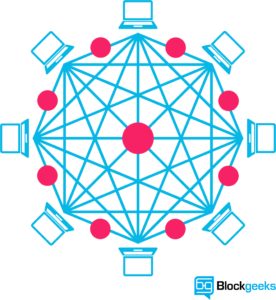

It most definitely should—and in a positive way. The maintenance of a distributed database of identifiers, both for participants and products traded throughout the global financial supply chain is the easiest global blockchain infrastructure application to be developed. A global database of all the world’s participant and product identifiers, maybe a half billion records, is limited in scale, both as to data recorded in its distributed ledger and in its limits of processing speed—seconds required, at the most. Both parameters of speed and scale are well within the boundaries of current blockchain technology. In fact, distributed ledger concepts have been deployed for some time, certainly in the financial industry for market data distribution. It was one of the design concepts we advocated for in our consultations with the FSB and others, an architecture that we carefully detailed in our consultative responses and in our early academic work. See: Final Report on Global Identification Standards for Counterparties and Other Financial Market Participants

8. You make an argument for barcodes reducing infrastructure costs. What kind of cost savings could be expected, and how are they manifested?

We and others have estimated the cost of non-standardized data across the global financial system at $250 billion. Each of the largest financial firms can save $2 billion annually, perhaps double that, if a single distributed ledger is accessed and used for the common identity and reference data needs of all. We and others have estimated that a financial transaction contains 70% static reference data that could be sourced and accessed through such a distributed ledger. Each financial firm would, thereafter, need only their own business process applications and algorithms to do business in their own unique way, removing each firm’s maintenance costs of its own multiple reference databases, mapping processes and redundant data feeds.

9. What can we expect from the FSB’s reviews of the standards initiatives in 2019?

The framework for the global data standards initiatives of the FSB is projected to be finalized in 2019. Thereafter, as further implementation issues arise, we expect further consultations pursuing incremental changes, perhaps game-changing ones.

A comprehensive set of data identification and data element standards is required to achieve the long-sought goal of straight-through-processing and to efficiently aggregate financial transaction data (to analyze any single firm’s enterprise-wide risk and, ultimately, multiple firms’ systemic risk).

Already, the use of the first set of standards under new regulations has proved dysfunctional. Billions of financial transactions directed by regulation to be sent to newly established trade repositories cannot be aggregated due to inconsistent data formats and identity codes. See Central banks and trade repositories derivatives data.

Hierarchical organizational structures, so important for analyzing a single firm’s risk (the Lehman issue), and for systemic risk analysis across multiple firms, is still not in place. Too many permitted exceptions and regulatory lethargy allow legal entities to opt out of signing on to obtain a LEI or to not provide hierarchical ownership information.

Perhaps early assumptions about regulatory compulsion propelling the global data standards initiative needs to be revisited, in light of the collective action problem encountered amongst regulators. Even revisiting the design of the code standards themselves, perhaps using these codes directly for data aggregation should be considered. This later alternative is presented in light of the likely prospect of never completing organizational hierarchies using current codes that do not lead to knowing the ultimate parent at risk (again the Lehman issue). Finally, the FSB may find it necessary to revisit how codes are registered and maintained. Technological advances, such as the technologies of the Blockchain – distributed ledgers, algorithmic authentication and mathematical permissioning require the ultimate owners of an identity (the LEI in this case) to secure their own identity as their private key on the blockchain.

While we have offered approaches to head off these problems before they had been encountered as problems in implementations, we continue to advocate for these changes.

Beyond the completion of the FSB’s data standards initiatives is the Bank for International Settlement’s (BIS’s) data aggregation initiative known as BCBS239 (Principles for effective risk data aggregation and risk reporting). As the title suggests, this initiative will greatly benefit from each financial institution’s adherence to the unique, unambiguous, and universal identity codes of the FSB’s global standards initiative. It will allow aggregation of financial transactions across the many business units of a single financial firm and assist regulators in aggregating these same transactions across multiple firms. ♠️

Suggested Links

- Press Release, 16 August 2018: FSB launches thematic peer review on implementation of the Legal Entity Identifier and invites feedback from stakeholders.

- “Risk, Data, and the Barcodes of Finance” published in the Journal of Financial Transformation April, 2017

- The original proposal to the Securities and Exchange Commission (SEC) by GS1 and Financial InterGroup, which summarizes and incorporates similar proposals to the CFTC and the US Treasury’s Office of Financial Research (OFR), February 14, 2011

- Harmonization of the Unique Transaction Identifier, February 2017

- Bank for International Settlements (BIS), Harmonization of the Unique Product Identifier, September 2017.

- The most recent progress report by the Regulatory Oversight Committee (ROC) “Progress report by the Legal Entity Identifier Regulatory Oversight Committee (LEI ROC) – The Global LEI System and regulatory uses of the LEI”, 30 April 2018

- Rebuilding Financial Industry Infrastructure, Journal of Risk Management in Financial Institutions Volume 11 / Number 1 /Winter 2018

Source for blockchain image: https://blockgeeks.com/