The New Interventionism

Have you noticed that governments are stepping in more often to regulate things? There appears to be renewed interest in industrial policy. In the words of the magazine The Economist, “governments around the world are becoming bossier to the private sector.” Why is this? What will be the overall effect? On January 20, 2022, Sacha Nauta, executive editor of the Economist, posed questions to her colleagues: Jan Piotrowski, business editor, and Don Weinland, China business and finance editor, in order to explore the rise of state interventionism and its potential consequences. Old versus New “There’s been an increase in the […]

“Confront Their Reluctance”

“We believe women need to confront their reluctance to consider a leadership role and work actively to counter it with a more positive response.” This clarion call is issued by two top leaders in the academic and corporate world. Indira Samarasekera was the first woman president of the University of Alberta, and a director of Magna International, TC Energy, and Stelco. Martha Piper was the first woman president of the University of British Columbia, and a director of the Bank of Montreal, Shoppers Drug Mart, and TransAlta Corporation. Although neither was born in Canada, both are officers of the Order […]

COP 26: The End Game

“The first week is usually a disappointment,” said Catherine Brahic, environment editor at the Economist magazine, “but this [second] week, the attendees are pushing ahead the goals. Now we are in the end game.” On November 11, 2021, the Economist magazine sponsored a webinar featuring two panellists: an editor and a science writer. Before an audience of thousands, each gave a firsthand account of what they had been seeing while they attended the 26th United Nations Climate Change conference, commonly referred to as COP 26, in Glasgow, Scotland. “The drafts of the papers have come out—they look simple for starters,” Brahic said, […]

Access to Alternatives

Alternative assets are an important part of modern portfolios—but how can you gain access to them? Do investors and investment advisors know what alternative investment options exist, and what platforms provide them? Do advisors know how to use modern investment platforms to differentiate their offering and provide unique opportunities? How can this type of access on the new platforms enhance the business asset managers? Four panellists convened on October 26, 2021, to discuss these aspects of alternative assets, in a webinar sponsored by the Canadian Association of Alternative Strategies & Assets (CAASA), a trade association representing alternative investment managers, service providers, and investors. The […]

The Decisive Decade

Raging, uncontrollable forest fires. Prolonged heat domes, causing hundreds of deaths. Catastrophic storms. Flash floods. These are just a few of the effects of climate change being felt this year. Are the countries of the world acting quickly enough to prevent irreversible damage? Two months ahead of the upcoming COP26 negotiations in Glasgow, two editors from the magazine the Economist discussed their expectations of this crucial conference in a webinar on September 23, 2021, before an audience of hundreds. Oliver Morton, the Economist’s Briefings senior editor, and Catherine Brahic, Environment editor, discussed the recent findings of the latest Intergovernmental Panel on Climate […]

Starting an Alternative Desk

When a finance company is starting up an alternative fund, the managers may have been isolated from the day-to-day tasks such as trading and execution, fund administration, and cyber security. Where does one begin, and how does one prioritize? “Often the IT is overlooked. Some people think they just need a Bloomberg terminal,” said Robert Strawbridge, Vice President, Head of Canada at Options IT, a global leader in fintech managed services, colocation, and cybersecurity. His firm can step in to help. “We manage the cloud services. We do everything but the trading.” Strawbridge was one of four panellists who convened […]

Update on the Jab

It’s a truism: bad health of the population, bad economy. What then is happening globally in the Covid-19 pandemic? When will things return to normal? The pandemic continues to rage in various parts of the world, affecting both developed and emerging markets. On July 7, 2021, The Economist, a magazine that has been running stories on vaccines and the Covid-19 pandemic each week, sponsored a webinar featuring an editor and correspondent on the pandemic beat. Natasha Lode, health policy editor at the Economist, highlighted some recent issues. She is also host of the Economist’s podcast The Jab, whose tagline reads, […]

Net-Zero Buildings

How do we build our homes and cities for a sustainable future? Climate change is such a huge, complex problem that tackling it can seem overwhelming. Fortunately, many organizations are addressing various parts of this colossal puzzle. One aspect is the “built environment.” Can existing buildings be modified to cope with climate change? Can buildings be redesigned to have net zero effect on the environment? On July 1, 2021, a panel of experts gave their thoughts on matters relating to climate change and buildings, as part of the New York Times Climate Hub series of webinars. This is the “Built […]

WTO: The Jabs and the Jab-Nots

As the covid-19 vaccines continue to be rolled out across the world, and as trade disputes continue to fester, Ngozi Okonjo-Iweala has her work cut out for her as the new director-general of the World Trade Organisation (WTO). With many years’ experience in politics, economics, and vaccine production, she already has a deep understanding of the issues. On June 29, 2021, she spoke with Zanny Minton Beddoes, editor-in-chief of the magazine the Economist, about ending the covid-19 pandemic and the future of globalization. Ngozi described herself as a “trade outsider” when she first began at the World Bank, “which has […]

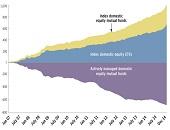

The future of active management

“Active portfolio management is futile,” say some who watch the progression of the financial industry. “Active managers only randomly outperform the stock market as a whole.” Is this true, or have the rumours of its demise been greatly exaggerated? On June 10, 2021, Philip Young, CFA, welcomed a webinar audience on behalf of the CFA Society of Toronto to consider this very question as they listened to Ronald Kahn, Managing Director, and Global Head of Systematic Equity Research at Blackrock, the world’s largest asset manager. He recently co-authored the book Advances in Active Portfolio Management: New Developments in Quantitative Investing. […]