Great strides have been made in medical treatments, pharmaceuticals and drug therapies, and patient recordkeeping – many of them by for-profit companies. How has the recent advent of Covid-19 shaped these developments? Last week, Pfizer was the first to announce a Covid-19 vaccine candidate. What new financial opportunities await?

Three panellists convened on November 17, 2020, to discuss the transformation of healthcare, in a webinar sponsored by the Canadian Association of Alternative Strategies & Assets (CAASA). CAASA is a trade association representing alternative investment managers, service providers, and investors. The panel was moderated by Dr. Ted Witek, Health Care Advisor and Scholar, University of Toronto & Dalla Lana School of Public Health.

In terms of the healthcare landscape, “this is the best of times,” because of the tools and breakthroughs. “2020 is the year biotech has come into its own,” said Eden Rahim, Portfolio Manager, NextEdge Capital. “We have gone from discovery to Phase 3 trials in 9 or 10 months,” a previously unheard-of pace, but one necessitated by the pandemic. “This has really put biotech on the map.”

“Industry is showing the capability they’ve been building over the past few years,” said Michael Caldwell, Portfolio Manager, Senior Analyst, Driehaus Capital Management. Many companies in the healthcare sector “were cash-burning entities until now.” Now healthcare is a well-capitalized industry.

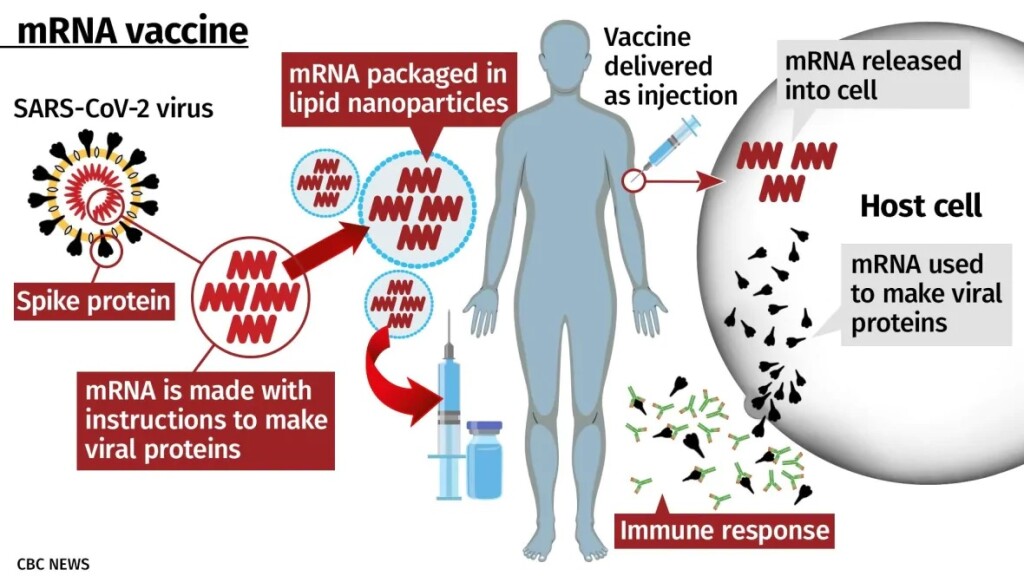

“Governments are thinking of healthcare systems as fundamental to maintain sovereignty,” said Peter van der Velden, Managing General Partner, Lumira Ventures. He noted that just yesterday, the news was announced about a second vaccine candidate from Moderna. That vaccine is mRNA-based.

Sources of capital for healthcare companies

Van der Velden praised the Strategic Innovation Fund but said it should consider “deeper allocation in healthcare.” He noted that “healthcare was outperforming IT funds both on IRR and distributed bases.” IRR refers to the internal rate of return.

“There are latent demands to put capital to work,” Caldwell said. “Capital from government sources has been a game-changer for small companies that can scale their operations faster than they had thought possible.”

“From the public market perspective, shareholders bear all the risk,” said Rahim. “Most drugs fail.” He said that big pharmaceuticals used to spend about 20 percent of expenditures on R&D but that has now dropped to 10 percent. “They now depend on small and medium-sized companies to do the research, and then they acquire the companies.”

Areas of opportunity

In the short term, some healthcare companies are faced with Covid-related restrictions. This can mean interrupting service in person—or figuring out how to adapt. Van der Velden said that healthcare companies want to “do well by doing good.” He gave an example of company that makes cardiac monitors. The monitors must now be serviced by mail, to avoid infecting customers in person.

One area of opportunity is “precision medicine, or melting away tumours,” Caldwell said. “We’re bullish on diagnostics and genomics over the next decade.”

“Breakthroughs have been occurring in the wet sciences,” said Rahim. “Once a pandemic, HIV will be subdued by a vaccine.” He also pointed to work on development of a drug for multiple sclerosis.

Another looming healthcare issue is hepatitis C. Experts warn that many Americans are infected with hepatitis C who may not know it yet. “The pig in a python” of the baby boom generation will be faced with more liver cancer and related conditions.

Missed opportunities

The pathway to success is not always clear. The panellists were able to look back on opportunities that they had passed up. For example, Rahim did not see good returns for diagnostic companies but now, thanks to PCR and how it amplifies tests, “they are knocking the lights out.” Polymerase chain reaction (PCR) is a method used to rapidly make millions of copies of a specific DNA sample.

Caldwell said that earlier, m-RNA-based vaccines did not seem “super high value” because the development times seemed long and the path to de-risking seemed hazy.

“Digital health and remote health availability” did not seem like good investment areas to van der Velden, “but now they’re looking good” due to the distancing required by Covid-19. He had not supported these initiatives, which were not popular with clinicians, “but now they are on board.”

Competition from outside North America

“The change in rules on the Hong Kong Exchange mean that companies have ‘war chests,’” said Caldwell. “I’m impressed by how quickly the Chinese biotech ecosystem has evolved.”

“We have a team member who goes to China regularly,” said van der Velden, “both for due diligence, and to catch wind of opportunities as they arise.”

Rahim noted there is a “frenzy” in the Japanese and Israeli biotech sector. “They have the IP landscape figured out,” he said, whereas IP is not well understood in China. IP refers to intellectual property rules.

Unknowns in pricing

Rahim said the media makes a very big deal about the high price of drugs. He explained that for every “blockbuster” drug that brings in billion-dollar sales, “there are three or four [expensive] failures along the way.”

“People say the current pricing is not sustainable,” said Caldwell.

The panel concluded by summarizing the best areas of opportunity in healthcare: CNS-related, neurology, and diagnostic testing within oncology. ♠

The virus cartoon is drawn by Hilda Bastian and is from the website PLoS Absolutely Maybe.