Investors continue to ask for more investment strategies that target environment and sustainability. When it comes to capability to manage financial risks due to climate change, how far along are firms in addressing the issues?

The second annual global survey of climate risk management at financial firms, sponsored by the Global Association of Risk Professionals (GARP), was presented in a webinar on September 22, 2020. The report is co-authored by Jo Paisley, Co-President, and Maxine Nelson, Senior Vice President at GARP.

Paisley began by taking a quick poll of the audience, chiefly GARP members. “Why are you interested in the results of the survey?” Two-thirds cited personal interest in climate change. One-fifth said investors at their firms were asking about it. One-third said the regulatory pressure made them take notice and another one-third said senior management at their firms were asking about climate risk. The audience was clearly motivated to hear the results.

Maxine Nelson provided context for the concern over climate risk. “Climate risk was deemed the top risk for 2020 by the World Economic Forum,” she said. Climate risk must be considered a severe issue because it is far-reaching, has tipping points and non-linear behavior, and in many ways, is irreversible. “The magnitude and nature of the future impacts will be determined by actions taken today.”

However, there are many opportunities. She quoted an Organisation for Economic Co-operation and Development (OECD) study that showed investing $1.8 trillion globally in climate adaptation over the next decade could generate $7.1 trillion in total net benefits. The investment payoff will be greatest for “making new structures resilient.”

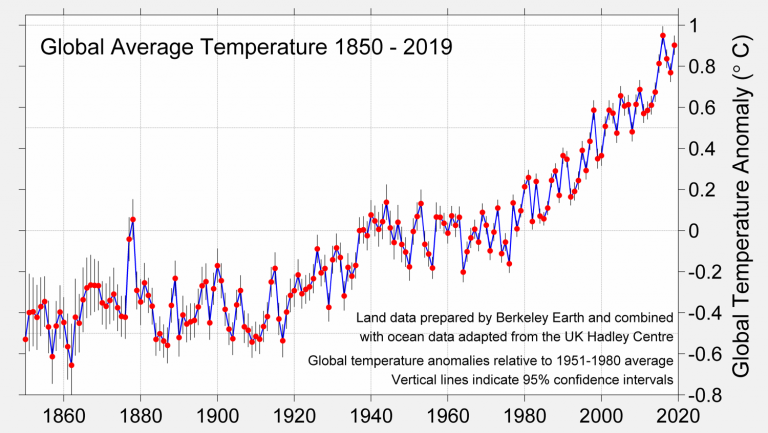

The chief problem is that man-made greenhouse gas (GHG) emissions are creating global warming on an accelerated scale. “There’s been a huge rise in carbon dioxide levels,” she said, “and that is correlated with rising temperature.”

Climate change is leading to physical risks (arising from more severe storms, wildfires, etc.) and transition risks (arising from adjustment to low-carbon economy).

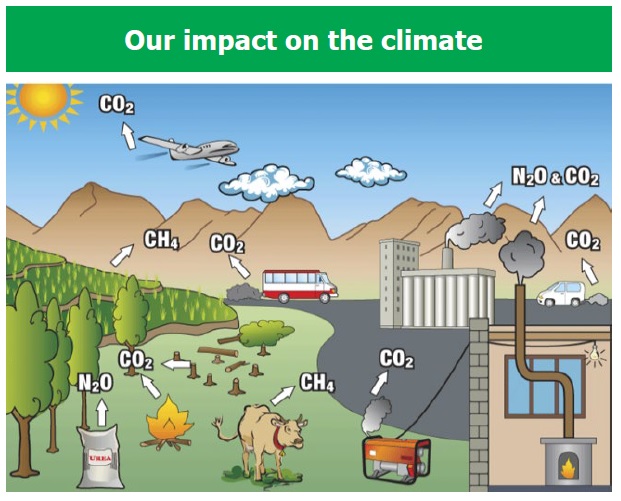

Nelson encouraged the audience to think of climate risk from two different perspectives: our impact on the climate (such as the carbon footprint) and the climate’s impact on us (such as flooding our homes during hurricanes).

“The main risk for financial institutions is on the counterparties in their portfolios,” she said. “The bank needs to understand how a company affects the environment. That will give some idea of the transition risk.”

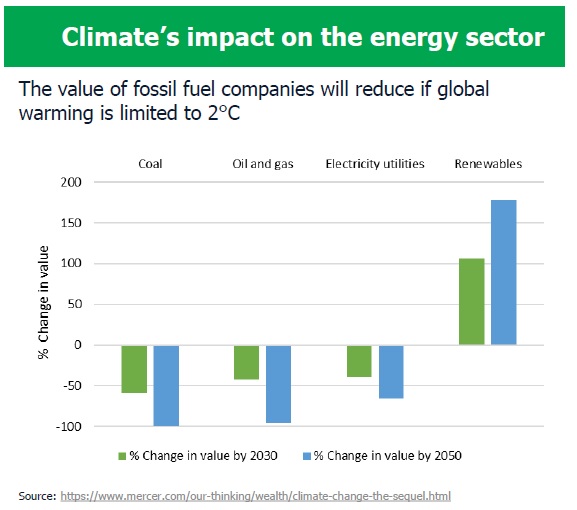

Consider the energy sector, infamous for its consumption of fossil fuels. Over the next few years, the value of coal will trend toward zero, whereas the value of renewable sources of energy will continue to move upward.

Transition risk arises in four different ways:

Policy and Legal Risk – For example, carbon pricing mechanisms that are implemented to reduce GHG emissions can increase costs.

Technology Risk – For example, research and development expenditure for new technologies.

Market Risk – For example, consumer behavior may change as customers become more aware of environmental impacts. Note: this is the economic perspective of markets, not the usual “stock market risk” of financial institutions.

Reputational Risk – For example, damage to brand value and loss of customer base due to negative public sentiment about climate change. (Or conversely, a rise in brand value for “green” companies.)

Physical risks can be either chronic or acute, and each of these types can be direct or indirect.

Direct acute risk – For example, property damage claims increase as frequency of flood events rises.

Indirect acute risk – For example, lower property values due to increasing flood risk.

Direct chronic risk – For example, rising temperatures create more flood plains.

Indirect chronic risk – For example, higher construction costs for building infrastructure designed to withstand higher sea levels.

Nelson said each type of industry sector must be looked at by the financial institutions planning to do future business with it. The climate risk, say, of the food industry, suffers greater physical risk due to changes to the growing season and water scarcity. It suffers transition risk as consumers change their consumption of such products, once they find out the food product exacerbates climate change.

Jo Paisley spoke about how financial institutions are dealing with climate risk. “Climate risk is for long duration, much longer than financial markets operate.”

Changes to climate will be disruptive. “We are seeing increased regulatory risk because of the impact of climate on financial stability.”

“Our survey covered 43 banks and 28 other financial institutions from around the world,” Paisley said, “representing about $42 trillion (USD) of financial assets.”

“Board engagement has strengthened further this year,” she noted. “Most firms have or want a strategic approach to climate risk, but most respondents felt the strategies were not resilient beyond five years.”

On the positive side, she said there are barriers and challenges that are expected to “ease” such as the availability of reliable models and data sources. Also, the regulatory uncertainty will start to clear up, and most organizations will start to have “internal alignment on climate risk strategy.”

Nelson said that the survey showed climate risk was not seen as one of the principal risks (such as credit risk or operational risk), but instead spanned a variety of other risks, such as counterparty risk. “Counterparty due diligence must include climate risk assessment,” she said, but currently only about 50 percent of counterparties assess GHG emissions. The majority of firms believe climate risk is not fully included in market prices.

Paisley summarized the top-level takeaways:

- Everything starts with the board.

- Firms see more opportunities than risks.

- A late and disorderly transition to a good climate risk strategy will be costly.

“There’s an urgent need to build capability and awareness,” she concluded. ♠️

Click here to access the PDF version of the GARP report, Second Annual Global Survey of Climate Risk Management at Financial Firms: Mapping out the Continuing Journey, 2020. Several figures in this blog are reproduced from the report, permission pending.

The photo of the “farmer in the desert” above is from the Guardian Weekly article “Growing food in the desert: is this the solution to the world’s food crisis?”