Selecting environmental, social, and governance (ESG) funds is a way that ordinary citizens can invest in an ethical way. But what does the increased interest in ESG investing shown by institutional and private wealth clients really mean? Is it paying off? Are we at a watershed moment for structural change in the way investors allocate resources?

The move to consider ESG investing came some years ago with scandals such as Enron, and continues with more scandals such as Volkswagen’s Dieselgate and Facebook’s meddlings, said Pedro Matos, a professor of finance at University of Virginia and the author of the CFA Institute Research Foundation publication, “ESG and Responsible Institutional Investing Around the World: A Critical Review.”

His review explored the substantial body of research on ESG investing. He presented some highlights of his findings in a webinar on August 4, 2020, hosted by the Chartered Financial Analysts (CFA) Institute.

Investors are integrating ESG considerations into portfolios and engaging with companies to make them more sustainable. ESG funds are to be found at the Big Three investment firms: StateStreet, Vanguard, and Blackrock. “Stewardship teams on these funds are small,” he noted. “They might be crowding out more vocal funds.”

“Of all the forces that drive ESG investing, the most active is climate risk,” Manos said. There is real concern that oil and gas may become stranded assets. “Large investors are also worried about regulatory risk.”

“Institutional investors such as pension funds are now the largest holders of shares in public companies,” he said, “holding about three quarters of market capitalization in the U.S.” and about 50 percent of market cap in Canada.

Manos contrasted Friedman versus Freeman. Milton Friedman said, “There is … only one social responsibility of business–to use its resources and engage in activities designed to increase its profits” whereas R. Edward Freeman said, “organizations must take multiple stakeholder groups into account.”

There’s no consistent evidence that socially responsible investing (SRI) strategies have produced enhanced returns.

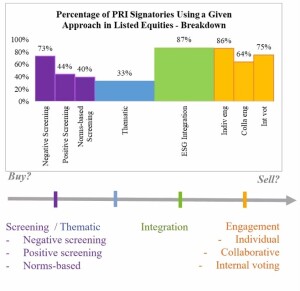

Do investors have the data and metrics they need for ESG integration? He noted there is “mystery” around how ESG is actually incorporated by businesses. The United Nations Environment Programme (UNEP) is coordinating the UN’s environmental activities in response to climate change – such as the Montreal Protocol. UNEP has a Finance Initiative that contains the Principles for Responsible Investment (PRI) that ESG funds should adhere to.

“European institutional investors lead the list of signatories to PRI,” he said. However, U.S. signatories are not “walking the ESG talk.”

He noted there are still “data quality issues.” Since ESG adherence is self-reporting, “there’s a tendency to greenwash.” A couple years ago, the Wall Street Journal ran the article, “Why it’s so hard to be an ethical investor.”

“Academic research is skeptical about ESG investing,” Manos said. “It’s a healthy dose of skepticism.”

Furthermore, ESG contains three dimensions. The Covid-19 pandemic has highlighted the “S” or social dimension. “Does this mean the ‘E’ and ‘G’ lose momentum?” he asked. Investment research firm Morningstar reports that ESG funds have outperformed in the last quarter, “perhaps due to holding fewer energy stocks.”

He posed the question: “Are ESG factors correlated with positive equity returns?” Governance showed correlation back in the 1980s and 1990s – i.e., firms with good governance had higher returns. Now, environmental risk is showing that “carbon risk is not properly priced in the economy.”

“The social dimension has been under-researched. We don’t know yet whether companies with a more diverse C-suite outperform,” he said. “The sample size is too small, with only about 20 female CEOs in the top 500 companies.”

When it comes to climate change, investors tend to have a shorter time frame than Mother Earth. “Most investors think we won’t hit the 2-degree target [of the Montreal Protocol]” but “the largest investors are not directly affected. There’s a lack of alignment.”

This becomes one more area where short-termism in financial behaviour leads to poor outcomes. ♠️

Click here to read the review article on ESG investing by Professor Matos.