Madoff Scandal: Three Books, Three Perspectives

The Madoff scandal has spawned a sub-genre of work. In the Toronto Public Library system, there are about twenty entries (books, e-books, DVDs) as of September 2012. It’s already a crowded arena. The books range from those written by victims (The Bag Lady Papers : The Priceless Experience Of Losing It All by Alexandra Penney, 2010) to those written by family (The End Of Normal : A Wife’s Anguish, A Widow’s New Life by Stephanie Madoff Mack, 2011) to those written by persons involved with hunting him down (No One Would Listen, by Harry Markopolos, 2010). Only one mistress has […]

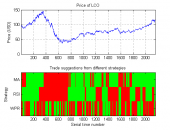

Automated Trading with MATLAB

Stuart Kozola, product manager for computational finance at MathWorks, demonstrated examples of trading systems using MATLAB during a webinar on August 21, 2012. In the first half he discussed how to develop an automated trading decision engine. This meant identifying a successful trading rule, extending the trading rule set, and automating the trading rule selection. In the second half of the webinar he showed implementation of the automated trading, with a caveat that these would require testing prior to integration and execution in the real-life scenario. The worked problem involved Brent oil futures. The first challenge was to identify profitable […]

Executive Compensation: Insights for Investors

If you pick the right people and give them the opportunity to spread their wings and put compensation as a carrier behind it you almost don’t have to manage them. – Jack Welch Catherine McCall and Damian Yu, both principals at Hugessen Consulting , provided a lively overview of issues in executive compensation to an afternoon audience at the CFA Society Toronto offices on August 20, 2012. The duo first outlined the current governance and market environment of compensation, then gave helpful pointers for deciphering management information, and concluded with “hot topics” in the area. Executive compensation deserves the attention […]

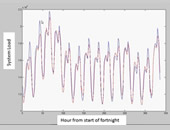

Tree Bagger & Tree Booster: MatLab for Data-Driven Fitting

Let’s say you want to create a predictive model without assuming an analytical form to the model. How would you go about it? On August 14, 2012, Richard Willey, Technical Marketing Manager at MathWorks, demonstrated via webinar how input data could be fit using machine-learning approaches. The emphasis here is data-driven, as opposed to model-driven, fitting. “A limitation of regression techniques is that the user must specify a functional form,” said Willey, and the choice of that model is usually based on the domain model. Typically the data points are fit with high-order polynomials or Fourier series. Or, the user might run the data […]

Implications of the Euro Zone Crisis

When it comes to financial debt in the Euro Zone, “deleveraging has barely begun,” said Daniel Wagner, author and risk consultant. “It’s a long and winding road.” On August 7, 2012, Daniel Wagner, CEO of Country Risk Solutions, a US-based cross-border risk management consulting firm, addressed a Global Association of Risk Professionals (GARP) audience about the Eurozone crisis. Wagner, author of Political Risk Insurance Guide, and Managing Country Risk, published in 2012, spoke on a range of related topics. Wagner’s talk was far-ranging and comprehensive (78 slides in 45 minutes). He spoke about the impact of debt: in particular, the effect […]

Zombie Banks Part 2. A Call for Change

Given the current high coolness quotient of anything “zombie,” a webinar about “zombie banks” is guaranteed to pique the interest of even the non-bankers out there. (Kudos to the non-financial types who made it through Part 1 and the discussion of interest rates.) But really, “zombie” is nothing more than a highly picturesque way to refer to something that is kept in motion or presumed viable long after it normally would have expired. “Zombie yogurt,” anyone?To recap Yalman Onaran’s definition in Part 1 of this posting, a zombie bank is a financial institution that continues to exist “even though the […]

“We Need to Fix the Plumbing”

Allan Grody is a man with a mission. The fall-out from the financial meltdown has shone a light on many things that need fixing within the financial system, and of these, Grody is focusing on one especially leaky, corroded pipe. Grody, president of Financial Intergroup, was addressing a GARP (Global Association of Risk Professionals) audience as the third of three panelists on “Modernizing Financial Risk Management: The Changing Technology Paradigm” on May 22, 2012. Early in his presentation, Grody showed a complex summation diagram. Titled “Need to Fix the Plumbing,” it was a kind of map, one that deserves a place […]

Real-Time Risk Analytics, SAS Style

“Analysts in capital markets get pummeled with vast quantities of information,” said Jeff Hasmann, “sometimes receiving as many as twenty newsfeeds per day. How are they to make sense of it all?” Hasmann was the first of three panelists speaking at the Global Association of Risk Professionals (GARP) webinar, “Modernizing Financial Risk Management: The Changing Technology Paradigm” on May 22, 2012. There is a push to modernize financial risk management from both above and below. Besides handling information overload, Hasmann noted there are several reasons to modernize: evolving regulations, improvements in efficiency to be gained, and needs for standardization. Hasmann, […]

Joost Driessen Discusses Liquidity Effects in Bonds

Put away the crossword and the sudoku: it’s the “credit spread puzzle” that’s occupying some leading financial minds. On May 3, 2012, Prof. Joost Driessen of Tilburg University spoke to a Global Association of Risk Professionals (GARP) webinar audience about recent work done by his research group to solve this puzzle. The term “credit spread puzzle” refers to the fact that credit spreads are much higher than can be justified by historical default losses. A typical example Driessen cited was a long-term AA bond that had an expected default loss of 0.06% yet whose average credit spread, calculated using real-life data, was 1.18%. More […]

Uncontrolled Risk

Uncontrolled Risk: The Lessons of Lehman Brothers and How Systemic Risk Can Still Bring Down the World Financial System by Mark T. Williams 220 pp., not including 27 pp of Appendix, Notes, and Index (Reprinted from The Analyst, March 2011 issue.) On September 15, 2008, the 158-year-old investment bank, Lehman Brothers, filed for bankruptcy, thereby unleashing a horde of systemic risk effects that continue to bedevil the financial system. In this recently-published investigation into how the collapse of one iconic institution contaminated an entire sector, Mark T. Williams draws some sobering lessons. In the 1990s, author Mark T. Williams worked […]