“Tons of Models, Tons of Variables”

With so many economic variables, and such a wide choice of parameters, do you feel overwhelmed by the task of producing the best financial model possible? Is there a systematic approach to exploring models? “Ever since the 2008 financial crisis, there’s been a focus on stress testing,” which requires robust financial models, said Roderick Powell, Director of Market and Treasury Risk at the consulting company KPMG. He was the first of three panellists at the October 27, 2015, webinar on Effective Risk Models Using Machine Intelligence sponsored by the Global Association of Risk Professionals. “Building those models is a time-consuming, […]

3 Steps to Liquidity Compliance

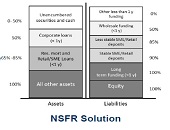

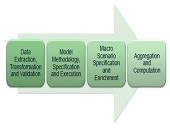

Are you scrambling to adjust to new reporting expectations for liquidity risk? Getting good data is key, but “you have to get it right and on time,” said Pierre Mesnard, Director Solutions Specialist at Moody’s Analytics. He was the third of three presenters on liquidity risk compliance at a webinar on June 25, 2015, sponsored by the Global Association of Risk Professionals. Once you have the data, there are three steps to delivering integrated liquidity compliance and business management, said Mesnard. First, you must ensure all financial instruments at your bank can be adequately modelled in order to generate realistic […]

Liquidity: A Change in Governance

Have you noticed that financial risk managers talk and think differently about liquidity risk, compared to pre-crisis days? The 2007-08 financial crisis was a watershed in the evolution of liquidity management, according to Nicolas Kunghehian, Director Solutions Specialist at Moody’s Analytics. He was the second of three presenters on liquidity risk compliance at a webinar on June 25, 2015, sponsored by the Global Association of Risk Professionals. “Before the crisis, there was only one team dedicated to monitoring and managing liquidity,” Kunghehian said. Liquidity risk was assumed to be small, and the Treasury department was chiefly fine-tuning the profit and […]

An Opportunity To Get Things Right

When it comes to forecasting liquidity risk, does your bank follow best practices? It might be tough to do so, because of a “data conundrum,” said Gudni Adalsteinsson, author of The Liquidity Risk Management Guide – from Policy to Pitfalls. Banks carry out a “retrospective analysis” on data that is “not forward looking.” Adalsteinsson, Head of Global Liquidity, Group Treasury at Legal & General Group Plc, was the first of three presenters on liquidity risk compliance, at a webinar on June 25, 2015, sponsored by the Global Association of Risk Professionals. He praised the Basel III regulation on liquidity risk. […]

Four Lessons from Stress Testing Exercise

“It very quickly became apparent that this was not a one- or two-month exercise,” said Charyn Faenza, Vice President, Manager of Corporate Business Intelligence Systems at First National Bank, the largest subsidiary of the largest subsidiary of FNB Corporation. She was the second of two presenters at the May 19, 2015, webinar on Stress Testing Modeling sponsored by the Global Association of Risk Professionals. Faenza was referring to her bank’s experience as an example of a “DFAST 10-50” bank that is required to conduct an annual stress test. She drew four important lessons from the exercise. Good Modeling Requires Good […]

“Not Only The What But The How”

When it comes to financial data for stress testing, there’s a good news-bad news aspect. The good news may be that a bank did not suffer severe financial stress but the bad news is that it will be harder for the bank to model “bad events” if it does not have such data. And banks “will get written up if [the regulators] don’t believe their bad events,” said Tara Heusé Skinner, Manager at SAS Risk Research & Quantitative Solutions, and co-author of The Bank Executive’s Guide to Enterprise Risk Management. She was the first presenter of two at the May […]

When Data Is Sparse. Part 2

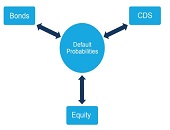

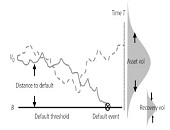

It’s difficult to model sovereign credit risk for emerging markets using structural models such as the Merton model because “calibration is always an issue,” said Rob Stamicar, Senior Director of Research in Multi-Asset Class Risk Management at Axioma, continuing a theme during the second half of his webinar on December 2, 2014. During the first half, he showed how the probability of default can be used as a common link among the asset classes of interest (bonds, swaps, and equities). In the second half, he focused more on sovereign credit risk. Calculation of sovereign risk could be done directly, “but […]

When Data Is Sparse. Part 1

When modelling risk in emerging markets, are you hampered by sparse data? “Relationships between different asset classes can help measure the sovereign risk in emerging markets,” said Rob Stamicar, Senior Director of Research in Multi-Asset Class Risk Management at Axioma. He was sole presenter at a webinar on December 2, 2014, sponsored by the Global Association of Risk Professionals. When modelling global multi-asset class portfolios, “aggregation can be challenging,” said Stamicar, because the FX rates must also be taken into consideration—the subject for another day. His talk focussed on three asset classes: equity, fixed income, and credit portfolios. Infrequent data, […]

Public vs Private Banks in India and China

“Public sector banks perform worse than private banks In India whereas there is no significant performance difference for the two sectors in China,” said Dr. Rajan Singenellore, Global Head of the Default Risk and Valuation Group at Bloomberg. He gave an overview of operational performance and credit risk trends in Banking in Emerging Markets, and was the third of three webinar panellists on November 20, 2014, organized by the Global Association of Risk Professionals. For both countries, Singenellore compared government-owned banks with private sector banks. The terminology is different: India has public sector undertakings (PSU) banks whereas China has state-owned […]

“Expect More Niche Customer Targeting”

In India and China, “large state-owned banks often have a significant constraint on their ability to manage liabilities,” said Professor Moorad Choudhry from the Department of Mathematical Sciences at Brunel University and author of Principles of Banking. He was the second of three panellists at the webinar Banking in Emerging Markets held on November 20, 2014, organized by the Global Association of Risk Professionals, and his role was to describe “operational realities.” The 2018 advent of new Basel III rules for capital and liquidity requires 100 percent compliance with new rules on the liquidity coverage ratio (LCR) and the net […]