Commercial Credit Analytics 1: Under-utilized Tools

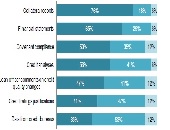

“There is a surprising under-utilization of common tools,” said David O’Connell, Senior Analyst, Aite Group, a financial services consulting group, during a webinar organized by the Global Association of Risk Professionals on February 20, 2014. He was referring to a survey by Aite Group of about twenty North American commercial loan underwriting professionals (responses as at quarter end Q3 2012). O’Connell characterized the under-utilization as “surprising” because loan underwriting is such an important part of banking. O’Connell was formerly a loan underwriting and loans officer, and was clearly familiar with the details of commercial lending and its role in “Banking […]

Trading Book Capital: Repercussions of a Revised Framework

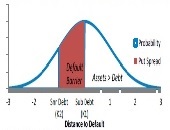

“Currently, there’s a large gap between models and the standardized approach. [The members of the Basel Committee] are trying to bring these back into line,” said Patricia Jackson, Head of Financial Regulatory Advice at EY (formerly known as Ernst & Young). She was the second of two speakers at a GARP-sponsored webinar on recently proposed changes to the trading book capital requirements. Strengthening the boundary between the banking book and the trading book “could have a significant impact,” Jackson said, because it will be harder to move positions. The change was made “to reduce arbitrage opportunities for placement with respect […]

Trading Book Capital: A Revised Framework

The proposed changes to trading book capital requirements are “a regulatory trade-off among the objectives of simplicity, risk sensitivity, and comparability,” said Mark Levonian, Managing Director and Global Head at Promontory Financial Group, and the first of two speakers at a webinar sponsored by the Global Association of Risk Professionals held February 11, 2014. Levonian acted as “tour guide” for the Basel Committee’s recently proposed changes to the trading book capital requirements. Highlights of the changes are: the revised standardized approach, more rigorous testing, and replacement of the value at risk (VaR) measurement with expected shortfall. “The perception from the […]

Stress Testing, Part 2: Data, the River

A common theme throughout contemporary financial stress testing is “data, the risky river,” said David O’Connell, Senior Analyst, Aite Group, a financial services consulting group. He was the second of two speakers to address issues around data in stress testing in a webinar organized by GARP on January 28, 2014. The recent financial crisis has permanently altered the relationship between the central bank and all other financial institutions, said O’Connell. The central bank is now looking at them as potential customers for a line of credit, and thus must carry out due diligence including asking for proof that the financial […]

Stress Testing, Part 1: The Data Mountain

Demands by regulators for increased frequency of reporting and more granularity of data in financial stress testing “are creating a data mountain,” said Jon Asprey, VP Strategic Consulting, Trillium Software. He was the first of two speakers to address the issue of data in stress testing in a webinar organized by the Global Association of Risk Professionals on January 28, 2014. He contrasted the new demands with early (pre-financial crisis) days of Basel reporting, when the summary level was sufficient. The data mountain has a significant impact on financial institutions, creating “the month-end panic,” Asprey said, since reporting at most […]

Eye on Credit Markets. Part 2: Spreads Hit Floor

“The central bank stimulus has been significant—what will happen as it’s withdrawn?” asked Seth Rooder, Global Credit Derivatives Product Manager at Bloomberg. He was the second of two speakers to consider the effects of tapering in a GARP webinar presentation on November 21, 2013. A key question is: “when will the Fed taper?” Rooder said not soon, because with unemployment still above 6.5 percent, Vice-Chair of the Fed Janet Yellen will have unwillingness to taper. Currently, the Fed is pumping money into the system by buying $40 billion in mortgage-backed securities and $45 billion in Treasury bills per month. He […]

Eye on Credit Markets. Part 1: Little Beta, Lots of Alpha

“How will the credit markets perform if the Federal Reserve Board chooses to taper over the next year or so?” asked Sivan Mahadevan, Head of U.S. Credit Strategy and Global Credit Derivatives Strategy at Morgan Stanley. He posed this question to members of the Global Association of Risk Professionals on November 21, 2013. Here, “tapering” refers to a gradual lessening of asset purchases. As the first of two speakers in a webinar presentation, Mahadevan summarized the credit markets to date: “little beta, lots of alpha.” Investment grade assets have had a good rally this year. “The higher yields go, the […]

Credit Workflow Optimization: A Practical Approach

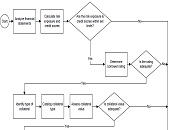

“How can an institution practically approach credit workflow when it might not be streamlined? How can we optimize existing processes?” These questions were posed by Justin Huhn, Credit Assessment & Origination Practice Leader at Moody’s Analytics Enterprise during a webinar arranged by the Global Association of Risk Professionals on September 24, 2013. Huhn noted that, as of Q1 2013, there were over seven thousand insured commercial banks and savings institutions in the US excluding foreign branches. These financial institutions tend to develop silos of expertise. Workflow optimization is of pressing concern to many. In 2008 the American Bankers Association estimated […]

Risk Data Aggregation & Risk Reporting. Part 2

“Not everything that can be counted counts,” said Mike Donovan, VP, Strategic Risk Analytics & Credit Portfolio Management at Canadian Imperial Bank of Commerce (CIBC). He was the second speaker to address the September 19, 2013 evening meeting of the Toronto chapter of GARP regarding the set of Principles for Effective Risk Data Aggregation & Risk Reporting released by the Basel Committee in January 2013. CIBC, like other Canadian banks, is adapting to the heightened risk management data requirements and building the foundation for future sustainable growth. Donovan used the opening quote by Einstein to remind the audience that big […]

Risk Data Aggregation & Risk Reporting. Part 1

During the throes of the last financial crisis, banks and regulators alike “struggled” to get good quality information. “The infrastructure was not there,” said James Dennison, CFA, Managing Director, Operational Risk Division, Office of the Superintendent of Financial Institutions (OSFI). To enhance banks’ risk management infrastructure, the Basel Committee on Banking Supervision (BCBS) released a set of Principles for Effective Risk Data Aggregation & Risk Reporting in January 2013. Dennison was first to speak on the evening of September 19, 2013 at the Toronto chapter meeting of the Global Association of Risk Professionals (GARP). It was convened at First Canadian Place to allow […]