Basel III and Beyond: Part 2. Real-Time Counterparty Risk

“Implementing the CVA is a journey with great expectations,” said James Zante, Product Manager for Integrated Market and Credit Risk at IBM Risk Analytics. He was the second of two speakers on the topic of counterparty risk assessment. He presented a real-life case to a GARP webinar audience on June 27, 2013. CVA refers to a new capital charge, the credit valuation adjustment brought in as part of the Basel III regulations. The CVA plays an important role in the optimization of credit capital, said Zante. At one extreme, the trades cleared through the clearinghouse may be considered “risk free,” […]

Basel III and Beyond: Part 1. Optimization with On-Demand Risk Insights

“The capital consumption of credit counterparty risk has become an issue for banks,” said Rita Gnutti, Head of Internal Model Market and Counterparty Risk at Intesa Sanpaolo. She was the first of two speakers addressing the impact of regulatory developments on counterparty risk assessment. She spoke to a webinar audience arranged by the Global Association of Risk Professionals on June 27, 2013. Gnutti first outlined the new Basel III regulatory framework of credit counterparty risk (CCR), then she described its calculation using internal model methodology (IMM), and third she described the computing and back-testing of CCR carried out by her […]

Basel III and Beyond: Capital Management and Funding Strategies

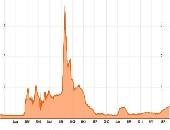

“Banking profitability will remain below pre-financial crisis levels for the near term,” said Mario Onorato, Senior Director, Balance Sheet and Capital Management at IBM and Visiting Professor at Cass Business School in London, UK. He was addressing a June 25, 2013 webinar organized by the Global Association of Risk Professionals (GARP) on the effects of Basel III. Banks have potential funding problems due to mismatched maturity periods, among other challenges. Onorato cited a Goldman Sachs report that forecasts a 1 percent decline year-over-year in revenue for banks in North America. There were comparable dismal reports by Citi and UBS about […]

How New Regulations Are Breaking Down Silos. Part 3: Interconnection Needed

The biggest hurdle to breaking down silos “is organizational in nature,” according to Amit Gupta, Partner in Risk Management Practice at the consulting firm Accenture. “The heads of Risk, Finance, Operations are all different people and this introduces a level of complexity.” However, “organizational interconnection at high levels is starting to happen.” Gupta was the third panellist to weigh in at the GARP webinar on May 21, 2013 on how new financial regulations (Dodd-Frank and Basel III) are breaking down silos in risk management. Regulators are pushing for greater consistency in reporting. As an example, Gupta pointed to new requirements […]

How New Regulations Are Breaking Down Silos. Part 2: Look at Economics

An institution “needs to have a strong cross-risk function which coordinates all parties in order to influence the recovery plan,” said Dr. Andrea Burgtorf, Head of Stress Testing, Risk Analytics and Instruments at Deutsche Bank. She was speaking at the GARP webinar on May 21, 2013 about the effect of new regulations on risk management. As part of the Basel III mandate to develop a Recovery and Resolution Plan, a bank must include analysis of all critical economic functions, and this, said Burgtorf, “forces a bank to examine what are its core and non-core businesses, and to decide which governance […]

How New Regulations Are Breaking Down Silos. Part 1: Stress Testing

“Financial regulators have introduced stress testing as a means to cut across silos,” said Dan Travers, VP of Product Management, Adaptiv at SunGard and the opening speaker at a GARP webinar on May 21, 2013. Historically, he noted, financial risk has been treated as a set of separate units (or silos) across the main types of risk: credit, market, operational, and liquidity risk, the latter connected to asset-liability management (ALM). The new reporting demands of Basel III and Dodd-Frank serve to break down silos, Travers said, with such things as incremental risk charge being reported as capital percentage for the […]

Stress Testing: Part 2. The Next Generation

There are five key considerations for the “next generation” of financial stress testing, said Tom Kimner, Head of Americas Risk Practice & Global Risk Products at SAS. He was addressing a webinar audience on May 7, 2013 as the second speaker in a panel organized by the Global Association of Risk Professionals (GARP). Modern stress testing must be measured against the key considerations of performance, efficiency, completeness, transparency, and compliance. The goal of turning stress testing into an “early warning system seemed futuristic only a few years ago,” admitted Kimner at the outset of his talk. He contrasted the world […]

Stress Testing: Part 1. Balance Numbers and Narrative

“Uncertainty is a fundamental part of business. Major shifts occur without warning, triggered by a single event, or combination of unrelated, contemporaneous events,” said Sanjiv Talwar, Managing Director, Risk Capital & Stress Testing at Bank of Montreal. He was addressing a webinar audience on May 7, 2013 as the first speaker in a panel organized by the Global Association of Risk Professionals (GARP). He summarized the categorization of uncertainty by Courtney et al. in “Strategy Under Uncertainty”, Harvard Business Review. There is a variety of tools available to help manage the uncertainty, Talwar noted: option evaluation, game theory, pattern recognition, […]

The Fed, Foreign Banks and Basel III: Part 3. Necessary Complexity?

As the US moves to adopt Basel III, there are regulatory initiatives that are expected to be implemented, said Peter Went, VP, Banking Risk Management Programs, GARP. The Basel Committee has several proposals that are issued for consultation and discussion, including ones that affect liquidity rules, the securitization framework, trading book review, and consistency of risk-weighted assets. Went was the second speaker at a webinar on February 14, 2013, organized by the Global Association of Risk Professionals (GARP) regarding regulatory reform of foreign banking operations (FBOs) in the United States and the implementation of the Basel III framework. (This continues […]

The Fed, Foreign Banks and Basel III: Part 2. Capital Concerns

“Some of the rules are in direct conflict,” said Peter Went, VP, Banking Risk Management Programs, GARP. He was the second speaker at a webinar presented on February 14, 2013 organized by the Global Association of Risk Professionals (GARP) regarding regulatory reform of foreign banking operations (FBOs) in the United States and the implementation of the Basel III framework. The “conflict” refers to rules in the Dodd-Frank Act versus the globally agreed Basel III Accord’s guidelines. Both regulatory attempts apply the G-20 principles on financial regulation (Pittsburgh 2009 summit). The US implementation of the Basel III framework differs from the […]