Embrace the Alternative

In the world of finance, investors are constantly searching for new sources of information that could help them generate alpha. Many of them have recently turned to alternative data. But what, exactly, is alternative data? And why should investors (and those seeking a career in finance) care about it? On February 17, 2021, the Professional Development Committee at CFA Society Toronto convened a panel discussion to demystify the alternative data industry. Alexandra Zvarich, representing the committee, questioned the panellists about insights they could share, and how to prepare for a career in this area. “We worked with alternative data before […]

From Ideas to Action

Climate change will reshape how financial organizations and investors think about climate-related events. But how will we deal with climate change risk? How will financial organizations respond to increasing demands for transparency, measurement, and action? On February 2, 2021, the Institutional Asset Management Committee of the CFA Society of Toronto convened a webinar with three seasoned experts who discussed how best to move into a world of green initiatives. The session was opened by Brandon Gill, Senior Portfolio Manager, Capital Markets Group, External Public Investments and Credit at OPTrust, the pension trust fund of the Ontario Public Service Employees Union. […]

Find the Needle

With the Covid-19 pandemic still posing challenges to the economy and national health, many financial institutions are making changes to their recruiting mandates. How can they continue to attract the best candidates? How can they mitigate the restrictions of the pandemic when “in person” visits are at the heart of recruitment? “Recruitment is the proverbial case of finding the needle in a haystack,” said Bill Vlaad, President and CEO, Vlaad and Company. “Our job is not to go through hay, but to find the needle.” He was speaking at a webinar on December 17, 2020. The CFA Society Toronto convened […]

The Achilles Heel of Banking

After last decade’s financial crisis, regulators introduced several new measures to reduce systemic risk in the financial system. How are the new safeguards working? What are the implications for future balance sheet structure? The CFA Society Toronto convened a panel of three experts on November 25, 2020, to discuss the new regulatory capital and liquidity frameworks and how they are reshaping the way Canadian banks approach the market. The webinar, including a Q&A session, was moderated by Nigel D’Souza, Investment Analyst, Veritas Investment Research. “There’s no doubt the financial crisis changed balance sheets,” said Bruce Choy, Managing Director (Former Risk […]

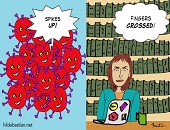

Transforming Healthcare

Great strides have been made in medical treatments, pharmaceuticals and drug therapies, and patient recordkeeping – many of them by for-profit companies. How has the recent advent of Covid-19 shaped these developments? Last week, Pfizer was the first to announce a Covid-19 vaccine candidate. What new financial opportunities await? Three panellists convened on November 17, 2020, to discuss the transformation of healthcare, in a webinar sponsored by the Canadian Association of Alternative Strategies & Assets (CAASA). CAASA is a trade association representing alternative investment managers, service providers, and investors. The panel was moderated by Dr. Ted Witek, Health Care Advisor […]

Ethical Decision Making

Why do well-meaning people engage in unethical behavior? Given that a healthy financial market depends on trust, and that trust is earned through ethical behaviour, ethics are fundamental to ensuring the integrity of finance professionals. A panel of two experts in ethical decision making from the CFA Institute—Jon Stokes, Director, and Paul Johnson, Manager and Special Investigator—spoke live to an audience of about 700 on October 21, 2020 in celebration of Global Ethics Day 2020. A survey of 3500 retail investors showed which industry sectors they ranked as “highly trustworthy.” Medicine was at the top of the list, with 68 […]

ESG disclosures: apples vs oranges

When it comes to environmental, social, and governance (ESG) funds, do you feel like we are still comparing apples with oranges? Isn’t it time for a global voluntary standard? “There’s been an explosion of interest in ESG investing, but the inconsistency in ESG-related disclosures could lead to an erosion of trust in the industry,” said Deborah Kidd, who is a director with the Global Industry Standards (GIPS). She was the first of two panelists who presented a consultation paper on “ESG Disclosure Standards for Investment Products” at a webinar titled “Improving Transparency and Comparability of Investment Products with ESG-related Features” […]

Psychology of Money

In 2009, award-winning journalist Morgan Housel was awash in information about the 2008 financial collapse. Yet, try as he might, he could not find the answer to the question: “Why did people behave the way they did?” This is what led him to start formulating notes for what became a blog, and eventually a book titled The Psychology of Money: Timeless lessons on wealth, greed, and happiness (Harriman House, 2020). The book was launched on September 8. “What is a person’s relationship with greed and fear? The psychological side of investing is the most important side,” Housel said, “because if you […]

Quality in the time of Covid

There’s a wide range of “quality factor” investing out there. How can the investor distinguish between the variety of methods? More importantly, how can the investor select the best factor method for given economic conditions? To answer this question, a recent paper compared the variety of methods, and examined how each method performed under different market conditions. The paper, “What is Quality?”, by Jason Hsu, Vitali Kalesnik, and Engin Kose, won the Graham & Dodd 2020 award for the best paper published in the Financial Analysts Journal in 2019. To celebrate the achievement, the journal invited the authors of the […]

Private Equity in “the new normal”

From pandemic to protectionism, global events and trends are having an impact on the private equity (PE) markets. From a Canadian perspective, what effect are these issues having on the alignment between PE investors and PE fund managers? In Toronto on July 9, 2020, Helen Pham welcomed three panellists to the webinar titled, “Private Market Trends: Improving Alignment Between Investors and Managers.” The webinar was organized by the institutional asset management committee of the CFA Society Toronto. The panellists shared their thoughts on how investors should view effects of the global pandemic on private equity markets and the associated risks […]