Covid Vaccines

“Be careful what you wish for,” the adage goes, “it might come true.” After a year of an ever-broadening pandemic, vaccines have arrived, and thus begins a new round of planning and negotiating. As the first covid-19 vaccines are rolled out across the world, the magazine the Economist assembled a panel on January 14, 2021, to reflect on the challenges. An audience of thousands tuned in as three seasoned journalists discussed global issues related to vaccine development, the risks of misinformation, and the expected impact of an uneven distribution process of vaccines. The panel moderator was Helen Joyce, executive editor for […]

Transforming Healthcare

Great strides have been made in medical treatments, pharmaceuticals and drug therapies, and patient recordkeeping – many of them by for-profit companies. How has the recent advent of Covid-19 shaped these developments? Last week, Pfizer was the first to announce a Covid-19 vaccine candidate. What new financial opportunities await? Three panellists convened on November 17, 2020, to discuss the transformation of healthcare, in a webinar sponsored by the Canadian Association of Alternative Strategies & Assets (CAASA). CAASA is a trade association representing alternative investment managers, service providers, and investors. The panel was moderated by Dr. Ted Witek, Health Care Advisor […]

Impact of Covid-19: Economics

How is the world grappling with the Covid-19 Pandemic, especially in the realm of economics? The magazine the Economist presented a webinar on July 30, 2020, titled “The Inside Story: The Impact of Covid-19.” Helen Joyce, executive editor for events at the Economist, interviewed a science writer and an economics editor. This is part two of a two-part summary of that webinar. The second panellist was Henry Cur, an economics editor. He said the economic crisis precipitated by the pandemic is markedly different from “garden variety recessions.” “The scale of unemployment is greater than the 2008 downturn,” he said, “and […]

New World Order 2

From state-owned enterprises to the Covid-19 pandemic, issues in China affect the Canadian investment environment and capital flow decisions. Given China’s ascendance in the global economy, what is the best strategy to ride the wave upward, too? What are potential danger areas? The following is the second half of a report on the webinar “New World Order: How China’s Rising Affects Investment Strategy” held on June 15, 2020, and sponsored by the CFA Society Toronto. Three panellists were interviewed by Tanya Lai, Managing Director, Public Equities, of the Investment Management Company of Ontario (IMCO). Lai noted there was increased scrutiny […]

New World Order 1

From trade wars to 5G technology, issues in China are having an impact on the Canadian investment environment and capital flow decisions. What effect will China’s ascendance have on the global economy? What is the best strategy to ride the wave upward? What are potential danger areas? On June 15, 2020, Herbert Zhang, the chair of the institutional asset management committee of the CFA Society Toronto, welcomed three panellists at the webinar titled, “New World Order: How China’s Rising Affects Investment Strategy.” The panellists shared their thoughts on how investors should view US-China trade tensions and deal with the associated […]

Shadow Banking in China

Shadow banking has enjoyed extraordinary growth over the past decade, especially in the emerging markets of China. The implications were discussed in the webinar “Shadow Banking: Standing at the Precipice?” sponsored by the Global Association of Risk Professionals (GARP) on August 6, 2019. Cindy Li, a Greater China analyst of the Federal Reserve Bank of San Francisco, was the second of two speakers at the one-hour GARP webinar. She said the shadow banking system in China has evolved to a fairly large group of powerful competitors, but that has led to “a build-up of risk” as China’s economic growth slows down. First, […]

Standing at the Precipice?

What is shadow banking, and are the associated risks being properly mitigated? A summary of issues can be found in the webinar “Shadow Banking: Standing at the Precipice?” sponsored by the Global Association of Risk Professionals (GARP) on August 6, 2019. Fabio Natalucci, Deputy Director, Monetary and Capital Markets Department of the International Monetary Fund (IMF), was the first of two speakers at the one-hour webinar. He began by explaining that the shadow banking system prefers to be thought of in “less sinister” terms as “non-bank financial intermediaries” that provide services similar to, but outside of, the regular banking system. He described […]

Managing Artificial Intelligence Risk

“The potential consequences of artificial intelligence are profound,” said Daniel Wagner, founder and CEO, Country Risk Solutions. “We’re just at the beginning of the runway. How resources are utilized will change significantly.” AI will affect all areas of life, and it is possible new forms of digital authoritarianism may arise. Wagner was one of two speakers at a webinar titled “Artificial Intelligence: Running the Race and Managing the Risks,” sponsored by the Global Association of Risk Professionals (GARP) on October 16, 2018. Wagner and Keith Furst co-authored the new book AI Supremacy: Winning in the Era of Machine Learning. His presentation summarized […]

Mega-Platforms, Mega Risk

There’s a world of difference between innovation and disruption. “Think of innovation as doing more, in the same old way,” said Haydn Shaughnessy, innovation specialist and author of Platform Disruption Wave: How the Platform Economy is Changing the World. He presented a GARP webinar on “The Rise of Mega-Platforms and the Risks to Banking” on May 25, 2016. In the first part of his talk, he described mega-platforms. He referred to the thesis of The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail by Clayton Christensen. This book argues that successful companies get so caught up in meeting […]

When Data Is Sparse. Part 2

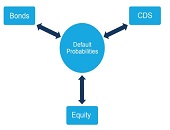

It’s difficult to model sovereign credit risk for emerging markets using structural models such as the Merton model because “calibration is always an issue,” said Rob Stamicar, Senior Director of Research in Multi-Asset Class Risk Management at Axioma, continuing a theme during the second half of his webinar on December 2, 2014. During the first half, he showed how the probability of default can be used as a common link among the asset classes of interest (bonds, swaps, and equities). In the second half, he focused more on sovereign credit risk. Calculation of sovereign risk could be done directly, “but […]