Modeling Sovereign Risk. Part 1: Emerging Markets

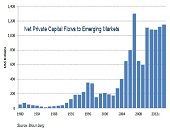

“Country-specific factors such as government debt and the sovereign credit rating change slowly but global aggregates such as the risk appetite change quickly, thus leading to confusion the part of observers,” said Michael Rosenberg, Foreign Exchange Consultant, Bloomberg and author of Currency Forecasting: A Guide to Fundamental and Technical Models of Exchange Rate Determination. He was the first of two speakers to address a GARP webinar audience on September 12, 2013. Much of Rosenberg’s talk focused on the sovereign credit risk of emerging markets (EM), because the accelerating flow of net private capital into EM from 1980-2014 has been unprecedented. […]

Foreign Asset Income Trusts

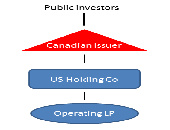

“Income trusts should be viewed as a story in capital markets innovation,” said Jon Northup of Goodmans LLP. He was speaking at a luncheon at the National Club in Toronto, sponsored by the Chartered Financial Analysts (CFA) Society Toronto on March 5, 2013. The introduction of SIFT (Specified Investment Flow-Through) rules by the Canadian government in October 2006, “effectively eliminated Canadian income trusts,” Northup said. There are two exceptions: (1) a trust that does not involve Canadian real estate, immovable or resource properties used in carrying on a business and (2) a trust that qualifies as a REIT (real estate […]

The Fed, Foreign Banks and Basel III: Part 1. A Long Hard Look

Foreign banking operations (FBOs) in the United States are about to face a whole new set of regulations that may dampen their enthusiasm for US-based operations, according to a February 14, 2013 webinar organized by the Global Association of Risk Professionals (GARP). “The Fed observed over time that US branches were increasingly used to fund the home office operations,” said Charles Horn, partner at Morrison Foerster, who was the first speaker at the panel. Other concerns of the Federal Reserve Board are the increased complexity of FBOs, and “the availability of home country financial resources for branch offices.” The goal, […]

Global Outlook for Crude Oil: FUD = Fear, Uncertainty, Doubt

In July 2008, Brent crude oil prices reached $148 per barrel “and we saw a lot of pushback from the market but nowadays when I mention $150, there is no pushback,” said Christian O’Neill, senior analyst at Bloomberg Industries during a GARP webinar October 11, 2012. He proceeded to walk the audience through the key factors affecting current supply and demand of this vital commodity. O’Neill’s presentation showed that oil leveraged energy and petroleum (E&P) stocks have strongly outperformed the S&P 500 in the period since March 2009. “Energy has been the beta sector of the market,” said O’Neill, because […]

Implications of the Euro Zone Crisis

When it comes to financial debt in the Euro Zone, “deleveraging has barely begun,” said Daniel Wagner, author and risk consultant. “It’s a long and winding road.” On August 7, 2012, Daniel Wagner, CEO of Country Risk Solutions, a US-based cross-border risk management consulting firm, addressed a Global Association of Risk Professionals (GARP) audience about the Eurozone crisis. Wagner, author of Political Risk Insurance Guide, and Managing Country Risk, published in 2012, spoke on a range of related topics. Wagner’s talk was far-ranging and comprehensive (78 slides in 45 minutes). He spoke about the impact of debt: in particular, the effect […]