Europe: Is the worst over? Part I.

“The US had one financial crisis in 2008, but Europe has had two crises—2008 and 2011,” said Philippe Ithurbide, Global Head of Research, Analysis, and Strategy at Amundi Asset Management. He was addressing members of the CFA Society Toronto that had gathered in the TMX Group Centre in downtown Toronto on the evening of November 19, 2013 to hear an overview of European market trends. The first half of his talk was a comprehensive quantified description of the financial woes of the euro zone, followed by several proposed solutions and investments strategies in the second half. In the quarters since […]

Essential Mathematics for Economics and Business

Jonny Zivku, Product Manager at Maplesoft, gave a tour of the web-based tutoring and assessment product Maple T.A. on November 12, 2013. To highlight its features, Zivku drew on content that was tailored specifically for Essential Mathematics for Economics and Business by Teresa Bradley. This is one of the leading introductory textbooks on mathematics for students of business and economics, and was recently re-issued in its fourth edition by John Wiley & Sons. Each chapter of the book is structured with an overview, explanation, and applications. Students who do the exercises can check their answers against solutions given at the end of […]

Americans Among Us. Part 2.

When it comes to US-Canada cross-border tax planning, a suggested rule of thumb is “to plan as if the US spouse is the spender and the Canadian spouse is the one saving assets,” said Christine Perry, lawyer at Keel Cotrelle LLP, during the second half of a seminar at the CFA Society Toronto offices on October 29, 2013. Perry identified eight common issues in cross-border tax planning that she encounters. Her list began with wills that are drafted in contemplation of “only” Canadian law, “which I see two or three times a month,” and moved on to issues involving gifts, […]

Americans Among Us. Part 1.

“Know your client” is fundamental to managing issues that might arise in tax and estate planning, according to Christine Perry, lawyer at Keel Cotrelle LLP and specialist on cross-border tax and estate planning solutions for high net worth individuals. She led an afternoon seminar titled “Americans Among Us: US Issue Identification” at the CFA Society Toronto downtown offices on October 29, 2013. “Sometimes a client does not even realize he has to make a US tax filing,” said Perry, citing as an example someone born out of wedlock, not in the US, but whose mother is a US citizen. She […]

Celebrity Gossip for the Finance Nerds

I stumbled on a small piece of paradise when I came across Milevsky’s book, The 7 Most Important Equations for Your Retirement: The Fascinating People and Ideas Behind Planning Your Retirement Income. This book is stuffed with anecdotes about the mathematical geniuses who derived the equations that are central to retirement planning. “Getting an equation named after you isn’t easy. Unlike a building, hospital ward or even a business school, money can’t buy you this sort of fame,” Milevsky writes. “You must own a very sharp set of knives.” In my undergrad days in chemistry, I recall the moment it dawned on […]

Quant Chalkboard: Data, Models & Concepts

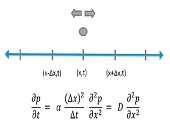

“People are more likely to believe something that comes as data,” said Joe Pimbley, Principal, Maxwell Consulting, “but you shouldn’t necessarily believe the data.” Pimbley, a lead investigator for the examiner appointed by the Lehman Brothers bankruptcy court, addressed financial risk management professionals at a GARP webinar on August 6, 2013. [Ed. Note Click here to read Joe Pimbley – “Why Lehman Brothers Failed When It Did” on Stories.Finance.] Pimbley said that model builders must always look at data with the eyes of a skeptic. With a PhD in physics he is conversant with models devised to predict the “real world” and […]

Volunteer Appreciation Night

National Volunteer Week is a time to recognize the efforts of volunteers across Canada. This year it took place April 21 to 27, 2013 and we dropped by “Volunteer Appreciation Night” hosted by CFA Society Toronto on April 25, 2013 to view some fine magic entertainment by Revel Magic (see magician with flaming business card below), and to hobnob with volunteers. CFA Society Toronto has 17 different committees, plus a board of directors, so there is ample opportunity for community-minded members to find an area to which they can donate their time and talent. Following are interviews with three members of CFAST […]

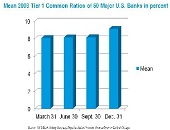

The Fed, Foreign Banks and Basel III: Part 2. Capital Concerns

“Some of the rules are in direct conflict,” said Peter Went, VP, Banking Risk Management Programs, GARP. He was the second speaker at a webinar presented on February 14, 2013 organized by the Global Association of Risk Professionals (GARP) regarding regulatory reform of foreign banking operations (FBOs) in the United States and the implementation of the Basel III framework. The “conflict” refers to rules in the Dodd-Frank Act versus the globally agreed Basel III Accord’s guidelines. Both regulatory attempts apply the G-20 principles on financial regulation (Pittsburgh 2009 summit). The US implementation of the Basel III framework differs from the […]

Libor Fallout: Part 2. Whistling Past the Graveyard

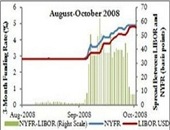

On December 20, 2012, the second presenter at the GARP webinar on the LIBOR scandal was Cliff Rossi, Executive-in-Residence, Center for Financial Policy, University of Maryland. He described the risk implications arising from the Wheatley Review of LIBOR. Rossi noted that some market participants were “still feeling PTSD from the financial crisis of 2008”—and then they got hit with the LIBOR scandal. Rossi succinctly described what went wrong: Low volume in interbank lending in unsecured transactions created an over-reliance on “expert judgement” hence the rate was subject to manipulation. Part of the problem, Rossi said, is that LIBOR reporting was […]

Contingent Capital: The Case for COERCs. Part 1

Contingent convertible bonds, or “cocobonds,” are bonds that convert into equity when the market value of capital falls below a trigger level. A major problem with cocobonds is that “the conversion trigger is based on the capital ratio, which is known to be a poor indicator of financial distress,” said Theo Vermaelen, Professor of Finance at INSEAD. He was the first speaker at the November 29, 2012 webinar held by the Global Association of Risk Professionals (GARP) on the subject of Call Option Enhanced Reverse Convertible (COERC) bonds. Vermaelen referred to a case in point: a Credit Suisse cocobond issued […]